Eternal Hospitality Group (TSE:3193) EPS Surge Reinforces Bullish Growth Narrative Despite Margin Slippage

Eternal Hospitality GroupLtd (TSE:3193) opened Q1 2026 with revenue of about ¥12.6 billion and Basic EPS of ¥66.52, while net income excluding extraordinary items came in at ¥767.22 million, setting a solid headline for its latest update. The company has seen revenue move from roughly ¥11.0 billion in Q4 2024 to ¥12.6 billion in Q1 2026, with Basic EPS stepping up from ¥35.63 to ¥66.52 over the same stretch as net income excluding extraordinary items climbed from ¥412 million to ¥767.22 million. For investors, the story now turns to how much of that earnings power is sticking, with margins doing the quiet work behind the scenes.

See our full analysis for Eternal Hospitality GroupLtd.With the latest numbers on the table, the next step is to see how this earnings print lines up with the dominant narratives around Eternal Hospitality GroupLtd, and where the data might push back on those storylines.

Curious how numbers become stories that shape markets? Explore Community Narratives

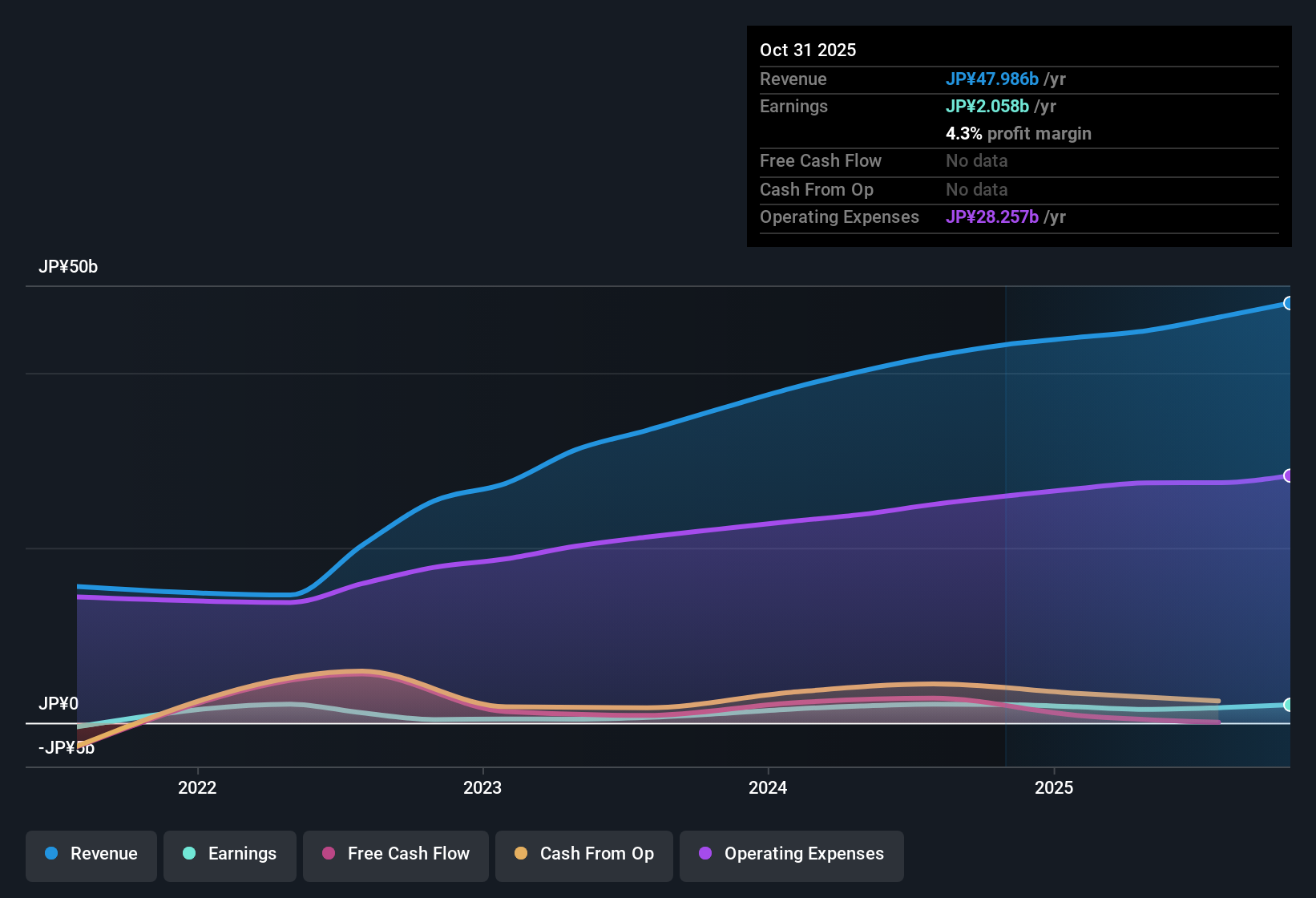

TTM revenue nears ¥48.0 billion

- On a trailing twelve month basis, revenue reached about ¥47,985.8 million, up from roughly ¥46,356.0 million at the prior TTM snapshot, while TTM net income excluding extraordinary items moved from about ¥1,720.0 million to ¥2,058.3 million over the same comparison.

- What is striking for a generally bullish angle is how this steady TTM step up in revenue and net income contrasts with the note that one year earnings growth was negative versus the strong five year average of about 32.5 percent per year, suggesting:

- The larger revenue base near ¥48.0 billion supports the idea of an expanding platform, even if the most recent year did not match the earlier earnings growth pace.

- Forecasts calling for roughly 10.7 percent annual revenue growth and about 9.5 percent annual earnings growth build off this higher TTM level, which helps the bullish case focus on scale rather than a single soft comparison year.

Margins slip from 4.8 percent to 4.3 percent

- Net profit margin over the last year stood at 4.3 percent, down from 4.8 percent the prior year, even as quarterly net income excluding extraordinary items in Q1 2026 rose to ¥767.2 million from ¥603.0 million in Q4 2025.

- Bears highlight this margin compression as a sign that growth may be getting harder to convert into profit, yet the combination of rising TTM net income from about ¥1,720.0 million to ¥2,058.3 million and the latest quarterly net income increase suggests:

- The recent dip in net margin comes alongside higher absolute profits, so the bearish focus on thinner margins does not mean earnings are falling in yen terms.

- With margins still positive and earnings forecast to grow roughly 9.5 percent annually, the bearish concern about profit quality rests more on efficiency trends than on an outright decline in profitability.

P/E at 17.8x vs DCF fair value gap

- The shares trade at ¥3,175 with a P/E of 17.8 times, below the Japan hospitality industry average of 22.9 times and peer average of 25.6 times, while the quoted DCF fair value stands at ¥778.32, materially below the current price.

- Consensus style valuation thinking sees a tension here, because relative multiples suggest the stock is cheaper than its hospitality peers even as the DCF fair value implies a large gap to intrinsic value, which means:

- Investors focused on comparables can point to the discount versus the 22.9 times and 25.6 times P/E benchmarks as support for a value angle at the current ¥3,175 price.

- Those who prioritise discounted cash flow work will instead note the spread between market price and the ¥778.32 DCF fair value, framing the stock as expensively priced against that intrinsic yardstick despite the low headline P/E.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Eternal Hospitality GroupLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Eternal Hospitality GroupLtd combines solid top line growth with sliding margins and a valuation tug of war, leaving uncertainty around how durable its earnings power really is.

If that mix of margin pressure and valuation tension feels uncomfortable, use our these 908 undervalued stocks based on cash flows today to zero in on companies where pricing better reflects underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com