Is Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990) Fairly Valued After Its 175% Year-To-Date Share Price Surge?

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990) has quietly been on a strong run this year, with the stock up around 175% year to date and roughly 150% over the past year.

See our latest analysis for Sichuan Kelun-Biotech Biopharmaceutical.

That kind of year to date share price return, combined with a 1 year total shareholder return of roughly 150 percent, signals that sentiment has swung sharply toward Kelun Biotech as investors price in faster growth and a lower perceived risk profile.

If Kelun Biotech has caught your eye, it is also worth exploring other innovative names among healthcare stocks to see how the market is rewarding different pipelines and balance sheets in this space.

With revenue and earnings both growing rapidly but the stock already trading closer to analyst targets, investors face a key question: Is Kelun Biotech still trading at a discount, or is future growth already priced in?

Price to Book of 19.4x: Is it justified?

On a price to book basis, Sichuan Kelun Biotech looks expensive at the last close of HK$460, even compared to an already richly valued biotech peer group.

The price to book ratio compares the company’s market value to its net assets on the balance sheet, a common yardstick for early stage and asset intensive biopharma names. For Kelun Biotech, a 19.4x multiple suggests investors are paying a substantial premium over the company’s accounting equity, effectively front loading expectations of future drug approvals and commercial success.

Relative to the broader Hong Kong Biotechs industry average of 4.9x, Kelun Biotech is trading at nearly four times the sector norm, pointing to a valuation that bakes in materially higher growth and profitability than the typical local peer. Yet when set against a closer peer set, its 19.4x price to book comes in below the 37.2x average, implying that within its high growth subset the market is not assigning the most aggressive premium, despite the strong pipeline and forecast improvements in returns.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 19.4x (ABOUT RIGHT)

However, risks remain, particularly ongoing losses and lofty expectations for its oncology pipeline. Clinical or regulatory setbacks could quickly unwind recent optimism.

Find out about the key risks to this Sichuan Kelun-Biotech Biopharmaceutical narrative.

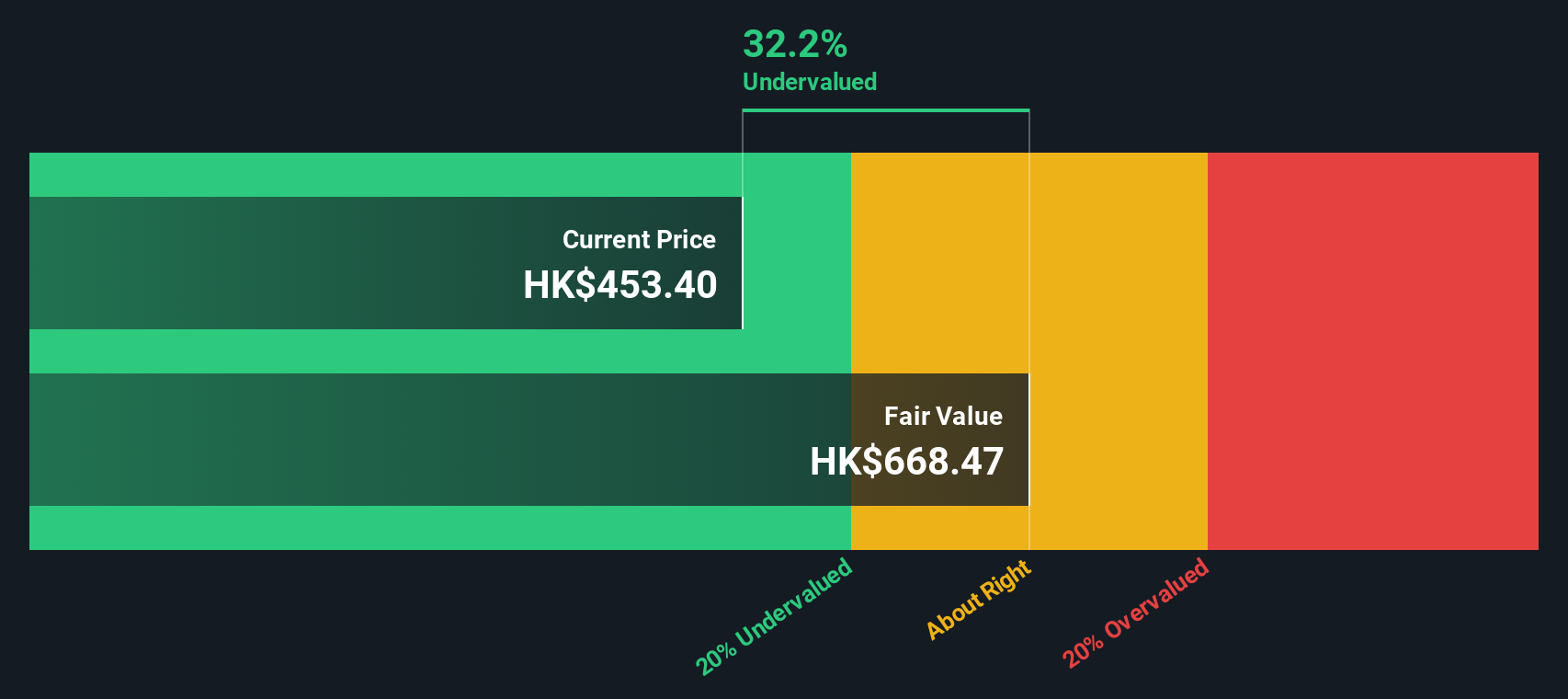

Another View: Discounted Cash Flow Signals Upside

While the 19.4x price to book multiple implies Kelun Biotech is fairly valued versus high growth peers, our DCF model presents a different perspective, with fair value at around HK$658.7 per share, roughly 30 percent above the current price. Could the market still be underestimating the long term cash generation from its pipeline?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sichuan Kelun-Biotech Biopharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sichuan Kelun-Biotech Biopharmaceutical Narrative

If you would rather trust your own process and dig through the data directly, you can construct a complete, personalised narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sichuan Kelun-Biotech Biopharmaceutical.

Ready for more high conviction ideas?

Before momentum fades, equip yourself with a wider watchlist of opportunities using the Simply Wall Street Screener, so you are not reacting after markets move.

- Capture potential multi baggers early by scanning these 3575 penny stocks with strong financials that pair tiny market caps with improving fundamentals and strengthening balance sheets.

- Ride structural growth by targeting these 30 healthcare AI stocks shaping the future of diagnostics, treatment, and operational efficiency across global health systems.

- Lock in reliable income streams by focusing on these 15 dividend stocks with yields > 3% that offer attractive yields with the financial strength to sustain payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com