Ateam Holdings (TSE:3662) One-Off ¥491M Gain Clouds Earnings Narrative After Q1 2026 Results

Ateam Holdings (TSE:3662) opened fiscal Q1 2026 with revenue of ¥5.5 billion and basic EPS of ¥15.9, alongside net income of ¥295 million that sets a clear reference point against last year’s run rate. Looking back over recent quarters, the company has seen revenue move between ¥5.7 billion and ¥6.4 billion while basic EPS ranged from about ¥0.5 to ¥25.2, underscoring how quarterly earnings can swing even as the top line stays around the mid ¥5 billion to ¥6 billion mark. With trailing 12 month results shaped by a modest net profit margin and a sizable one off gain, investors are likely to focus on how sustainable the current margin profile really is.

See our full analysis for Ateam Holdings.With the latest numbers on the table, the next step is to see how this earnings profile lines up with the dominant narratives around Ateam Holdings, and where the data starts to challenge those stories.

Curious how numbers become stories that shape markets? Explore Community Narratives

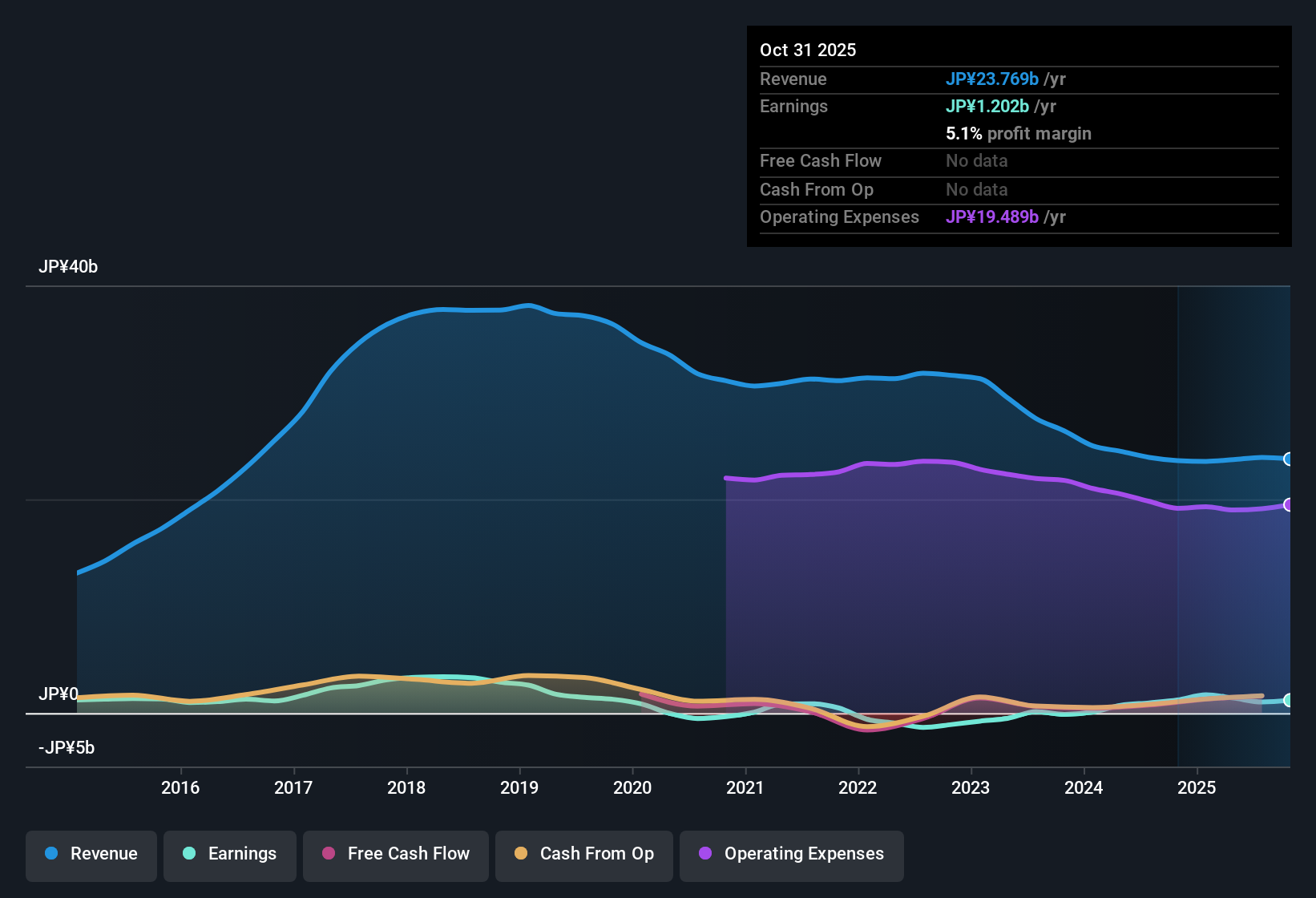

Margins Lean on 5.1% TTM Profit

- Over the last 12 months Ateam earned ¥1,202 million of net income on ¥23,769 million of revenue, equating to a 5.1% net profit margin that sits just below the prior year’s 5.2% margin.

- What stands out for the bullish view that the business has structurally improved is that five year earnings growth of 39.9% per year and the move into consistent profitability now sit alongside this mid single digit margin, yet

- recent quarterly swings, from ¥9 million net income in Q4 2025 to ¥295 million in Q1 2026, show that reported profit can still move around even if the annual margin looks steady,

- which means the bullish claim of durable profitability is partly supported by the multi year trend but faces pushback from the short term volatility visible in the quarterly figures.

Investors who see Ateam as an emerging earnings compounder may want to dig deeper into how that 5.1% margin is being earned and how stable it really is over time. 📊 Read the full Ateam Holdings Consensus Narrative.

Large ¥491M One Off Distorts Trend

- The trailing 12 month numbers include a ¥491 million one off gain within the ¥1,202 million of net income, which means a sizeable portion of reported profit is not from recurring operations.

- Bears argue that headline profitability looks stronger than the underlying run rate here, and the figures give them something to point to because

- removing a ¥491 million one off from ¥1,202 million of net income would leave a much lower base of earnings to value,

- and that adjustment matters when quarterly net income has ranged from as low as ¥9 million to as high as ¥468 million over the last year, reinforcing the cautious view that reported profit can be flattered by non recurring items.

Skeptical investors watching that one off gain may focus on how future reports look once this boost falls out of the comparison base. 🐻 Ateam Holdings Bear Case

Valuation Sits Between Industry And Peers

- Ateam trades on a trailing P E of 17.3 times, lower than the JP Entertainment industry average of 18.7 times but higher than its peer group at 14.8 times, while a DCF fair value of ¥1,422.68 compares with the current share price of ¥1,121.

- Supporters of the bullish narrative point to that gap between price and DCF fair value as potential upside, and the data offers some backing because

- the share price sits about 21.2% below the stated DCF fair value even after including the one off boosted earnings in the inputs,

- yet the fact that the P E is richer than peers at 14.8 times shows the market is already assigning Ateam a relative premium, which tempers how much of that theoretical DCF upside investors may be willing to credit until earnings quality looks cleaner.

Anyone weighing Ateam against other entertainment names will likely compare that peer premium with the implied discount to DCF fair value before deciding if today’s price offers enough margin of safety. 🐂 Ateam Holdings Bull Case

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ateam Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Ateam’s reliance on a large one off gain, volatile quarterly profits, and only mid single digit margins raises questions about the durability of its earnings power.

If those profit swings make you uneasy, use our stable growth stocks screener (2088 results) to quickly focus on businesses with steadier revenue and earnings trends that can support more consistent long term performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com