Is It Too Late to Consider Microsoft After Its Rapid AI and Cloud Expansion in 2025

- If you are wondering whether Microsoft is still a smart buy at current levels or if the easy money has already been made, you are not alone, and we are going to tackle that question directly.

- Despite a slight pullback of 1.8% over the last week and 2.7% over the last month, the stock is still up 15.4% year to date and has delivered a 101.6% return over three years, plus 136.1% over five years, which keeps it firmly on growth investors’ radars.

- Recent headlines around Microsoft have focused on its expanding AI ecosystem, including deeper integrations of Copilot across Windows and Office, as well as ongoing cloud presence via Azure partnerships with major enterprises. These themes have reinforced the narrative that Microsoft is at the center of long term digital transformation, even as short term sentiment moves around.

- On our valuation framework, Microsoft scores a 4/6 value score, reflecting that it appears undervalued on four of six key checks. In this article, we will unpack what that means across different valuation approaches, and then finish by exploring an additional way to think about its overall worth.

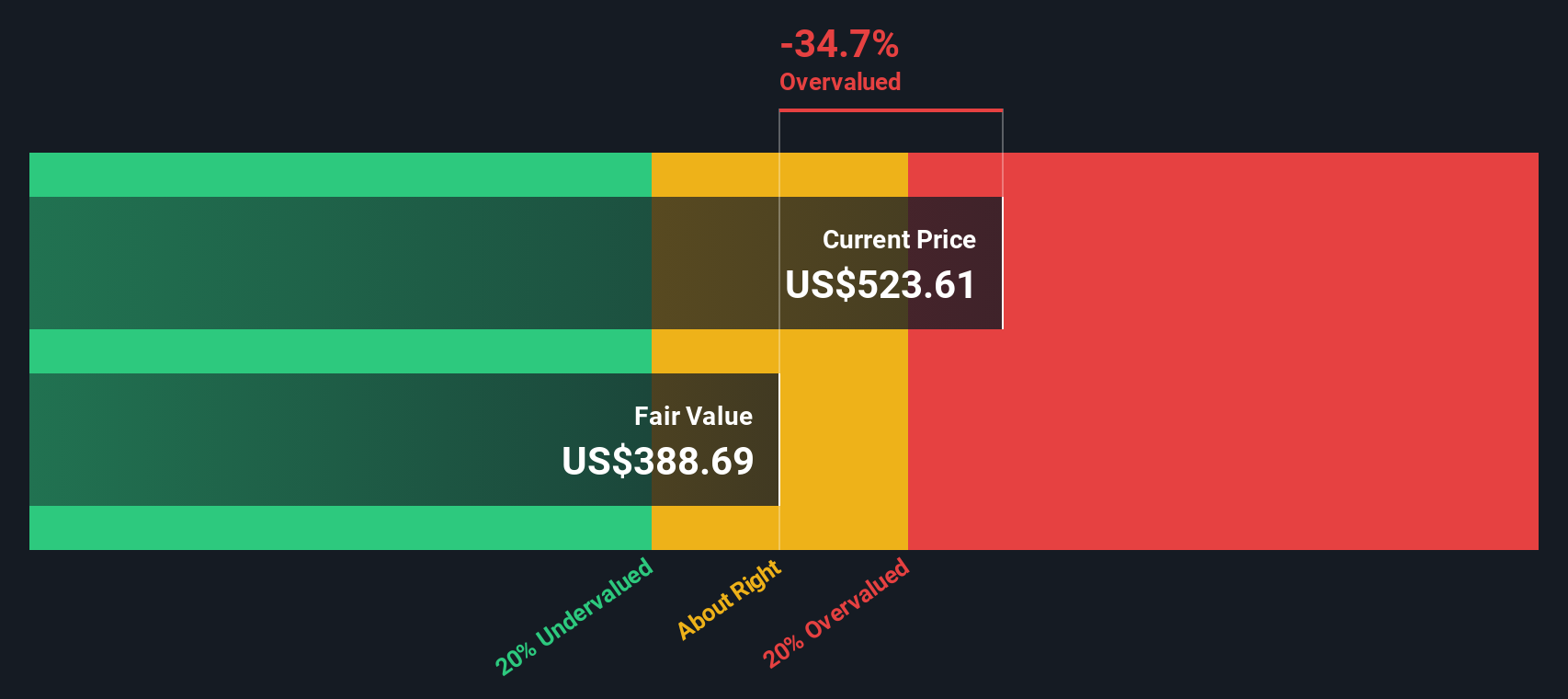

Approach 1: Microsoft Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today in $ terms. For Microsoft, the model starts with last twelve months free cash flow of about $89.4 billion and applies a 2 Stage Free Cash Flow to Equity approach, where near term analyst forecasts are blended with longer term extrapolations by Simply Wall St.

Analysts see Microsoft’s free cash flow rising strongly over the next few years, with longer range projections pointing to around $206.2 billion of free cash flow by 2030. All of these future cash flows, from 2026 through 2035 and beyond, are discounted back to their present value using a required rate of return to reflect risk and the time value of money.

On this basis, the DCF model estimates an intrinsic value of about $599.56 per share. That implies the stock is trading at roughly a 19.4% discount to this fair value estimate, which indicates that the market may not be fully pricing in Microsoft’s expected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Microsoft is undervalued by 19.4%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

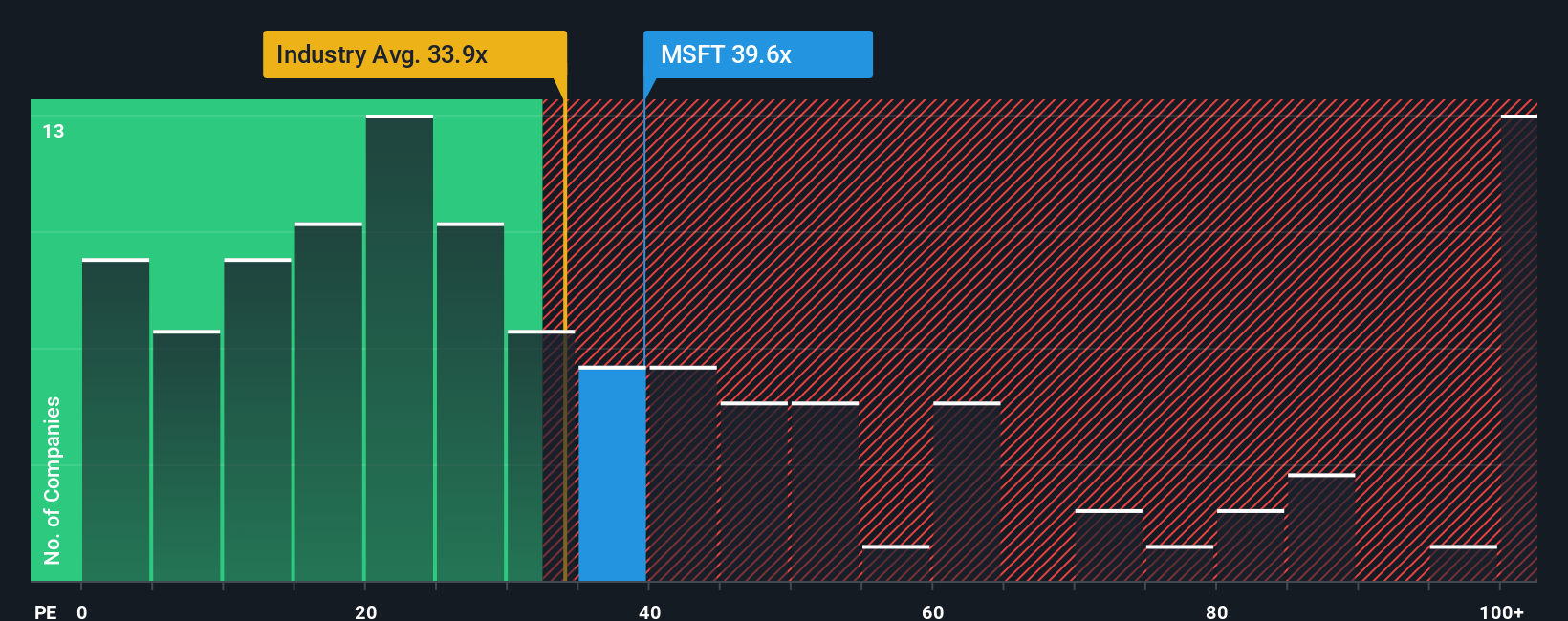

Approach 2: Microsoft Price vs Earnings

For a profitable, mature business like Microsoft, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty argue for a lower, more conservative multiple.

Microsoft currently trades on a PE of about 34.23x, which is above the broader Software industry average of roughly 31.54x and below the peer group average of around 36.71x. To move beyond these broad comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what Microsoft’s PE should be, given its earnings growth outlook, profitability, size, industry, and risk profile. This Fair Ratio for Microsoft is 52.72x, meaning the model suggests investors could reasonably pay a much higher multiple than the current market price implies.

Because the Fair Ratio is tailored to Microsoft’s specific fundamentals rather than generic comparables, it provides a more nuanced valuation anchor, and the current PE being well below this level indicates that the shares may appear undervalued on an earnings multiple basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

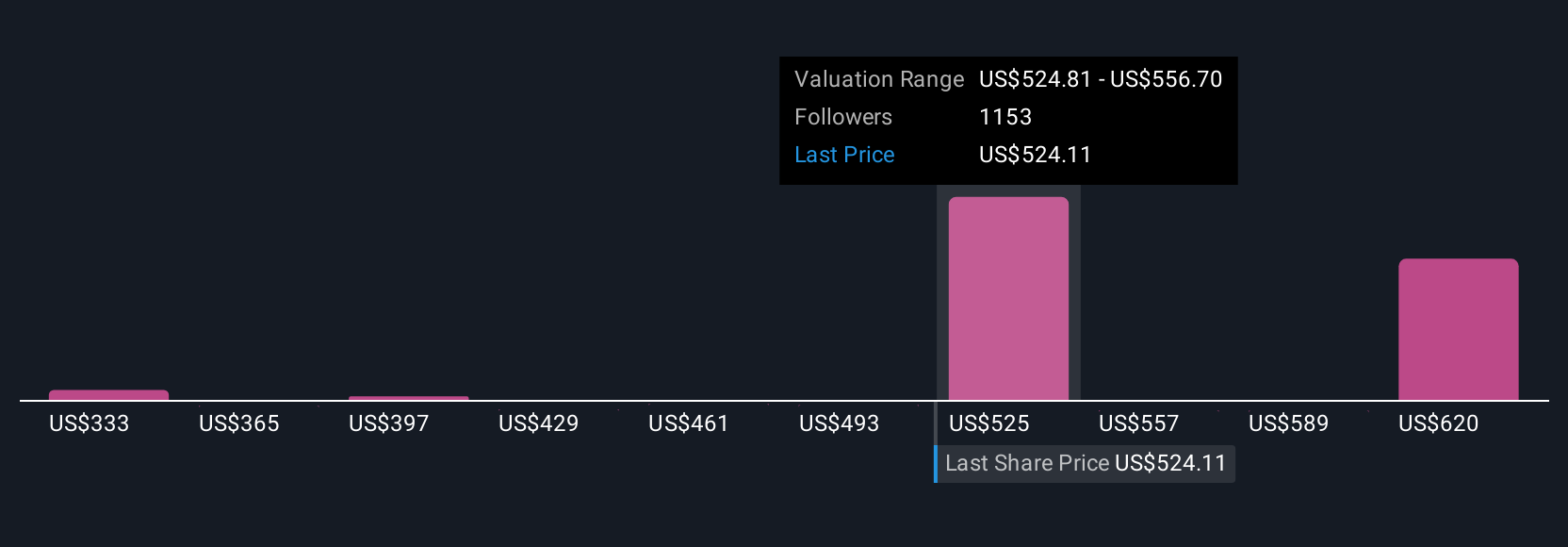

Upgrade Your Decision Making: Choose your Microsoft Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which are simple stories you build around a company that connect your view of its future revenue, earnings and margins to a concrete forecast and Fair Value estimate. These Narratives live as easy to use tools on Simply Wall St’s Community page, where millions of investors share their perspectives and help you decide when to buy or sell by comparing each Narrative’s Fair Value to today’s market price. The platform keeps those valuations updated automatically as new news or earnings arrive. One Microsoft Narrative might frame the company as a leaking dreadnought facing AI, PC and gaming headwinds, with a Fair Value closer to about $360. Another might see a resilient AI and cloud leader compounding high margin growth and supporting a Fair Value nearer $625. Your job is simply to choose the story that best matches your beliefs and risk tolerance, then act when the gap between Price and Fair Value in that Narrative becomes compelling.

For Microsoft, however, we will make it really easy for you with previews of two leading Microsoft Narratives:

Fair value in this narrative: $625.41

Implied undervaluation vs last close: about 22.8%

Forecast revenue growth: about 15.28%

- Frames Microsoft as a durable AI and cloud platform leader, with Azure, Copilot and security driving high margin, recurring growth.

- Assumes double digit annual revenue growth and a modestly rising profit margin, supported by a sticky subscription and backlog driven model.

- Sees elevated AI and data center CapEx, contract concentration and execution risk as manageable trade offs for an 18% plus upside to fair value.

Fair value in this narrative: $420.00

Implied overvaluation vs last close: about 15.0%

Forecast revenue growth: about 0.78%

- Argues that AI enthusiasm masks structural headwinds across PCs, gaming and Windows, and that Microsoft is overpaying for uncertain AI infrastructure returns.

- Highlights dependence on OpenAI, intensifying competition from Gemini and open source models, and the risk that AI cannibalizes per seat Office revenue.

- Warns that deteriorating Windows user experience, internal morale issues and capital intensive data centers could erode Microsoft’s traditional software like economics.

Together, these contrasting Narratives give you a clear valuation range and risk spectrum, so you can decide whether you lean toward the resilient AI compounder story or the leaking dreadnought view before making your next move on Microsoft.

Do you think there's more to the story for Microsoft? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com