The Bull Case For ADP Could Change Following Weak Small-Business Hiring And Resilient Wage Growth – Learn Why

- In early December 2025, Automatic Data Processing’s National Employment Report showed private employers shed 32,000 jobs in November, with broad-based hiring weakness led by small businesses and pockets of softness in manufacturing, information, construction, and professional and business services.

- Despite this hiring slowdown, the same report showed continued wage growth, with pay for job-stayers and job-changers still rising, highlighting an unusual mix of weaker employment demand alongside resilient pay gains.

- We’ll examine how this weaker-than-expected private payrolls reading, especially the small-business pullback, may reshape Automatic Data Processing’s existing investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Automatic Data Processing Investment Narrative Recap

To own ADP, you generally need to believe in long term demand for outsourced, cloud based HR and payroll services, supported by the company’s scale and profitability. The weak November ADP jobs report highlights softer small business hiring and payrolls, which could reinforce concerns about slowing U.S. payroll growth in the near term, but it does not materially change the core investment case or the key risk around moderating pay per control metrics and retention.

The most relevant recent update here is ADP’s Q3 FY2025 earnings, where revenue grew year on year and guidance pointed to mid single digit revenue growth. That backdrop of steady, if slower, growth helps frame the latest employment data as a potential short term headwind to payroll linked metrics, rather than a shift in the broader catalyst of ongoing adoption of ADP’s Next Gen cloud and AI driven HR platforms.

Yet while the business appears resilient, investors should still pay close attention to slowing payroll growth and the possibility that...

Read the full narrative on Automatic Data Processing (it's free!)

Automatic Data Processing's narrative projects $24.3 billion revenue and $5.1 billion earnings by 2028. This requires 5.7% yearly revenue growth and about a $1.0 billion earnings increase from $4.1 billion today.

Uncover how Automatic Data Processing's forecasts yield a $293.23 fair value, a 12% upside to its current price.

Exploring Other Perspectives

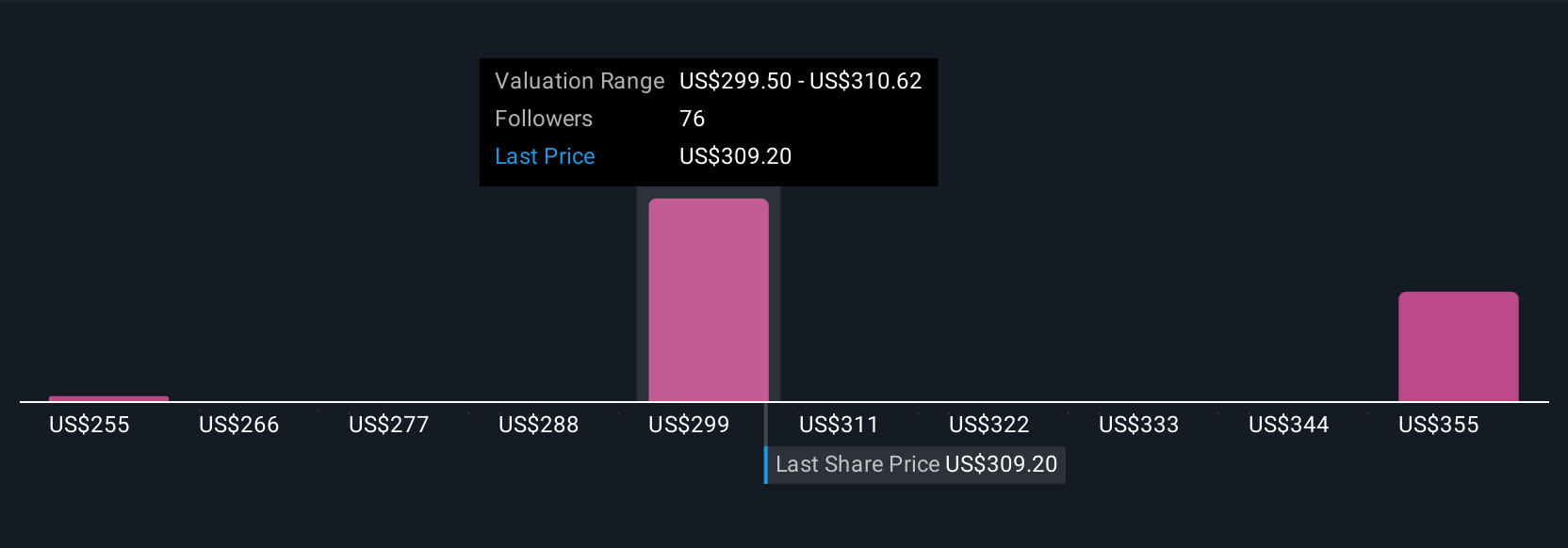

Four fair value estimates from the Simply Wall St Community span roughly US$276 to US$388 per share, underlining how far apart views on ADP’s worth can be. Against this wide range, the recent ADP jobs report and concerns about slower U.S. payroll growth give you a concrete risk to weigh as you compare these different viewpoints on the company’s future performance.

Explore 4 other fair value estimates on Automatic Data Processing - why the stock might be worth as much as 48% more than the current price!

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Automatic Data Processing's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com