Is It Too Late To Consider USA Rare Earth After Its 49.9% One Year Surge?

- Wondering if USA Rare Earth is still flying under the radar at its current price, or if the easy money has already been made? This article will walk through what the numbers really say about its value.

- After a 28.0% jump over the last week and a 39.2% gain year to date, USA Rare Earth's 49.9% return over the past year has put it firmly on the radar of growth focused investors, even though the 30 day move is roughly flat at -0.8%.

- That momentum has come alongside growing attention on US friendly supply chains for critical minerals and fresh investor interest in companies tied to the rare earths theme. Policy headlines about strategic materials security and capital flowing into related projects have helped frame USA Rare Earth less as a niche play and more as a potential strategic asset in portfolios.

- Even so, USA Rare Earth scores just 2/6 on our valuation checks. In this article, we will break down what traditional valuation approaches say about the stock, then finish with a more holistic way to think about its true long term worth.

USA Rare Earth scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: USA Rare Earth Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those projections back to a present value in $. For USA Rare Earth, the latest twelve month Free Cash Flow is about -$39.0 Million, reflecting a business still in an investment and development phase rather than a mature cash generator.

Analysts and extrapolated estimates point to a sharp improvement ahead, with projected Free Cash Flow turning positive and reaching roughly $438.5 Million by 2035. Simply Wall St uses a 2 Stage Free Cash Flow to Equity model for these projections, with analyst inputs for the first few years and then a gradually slowing growth profile as the company matures.

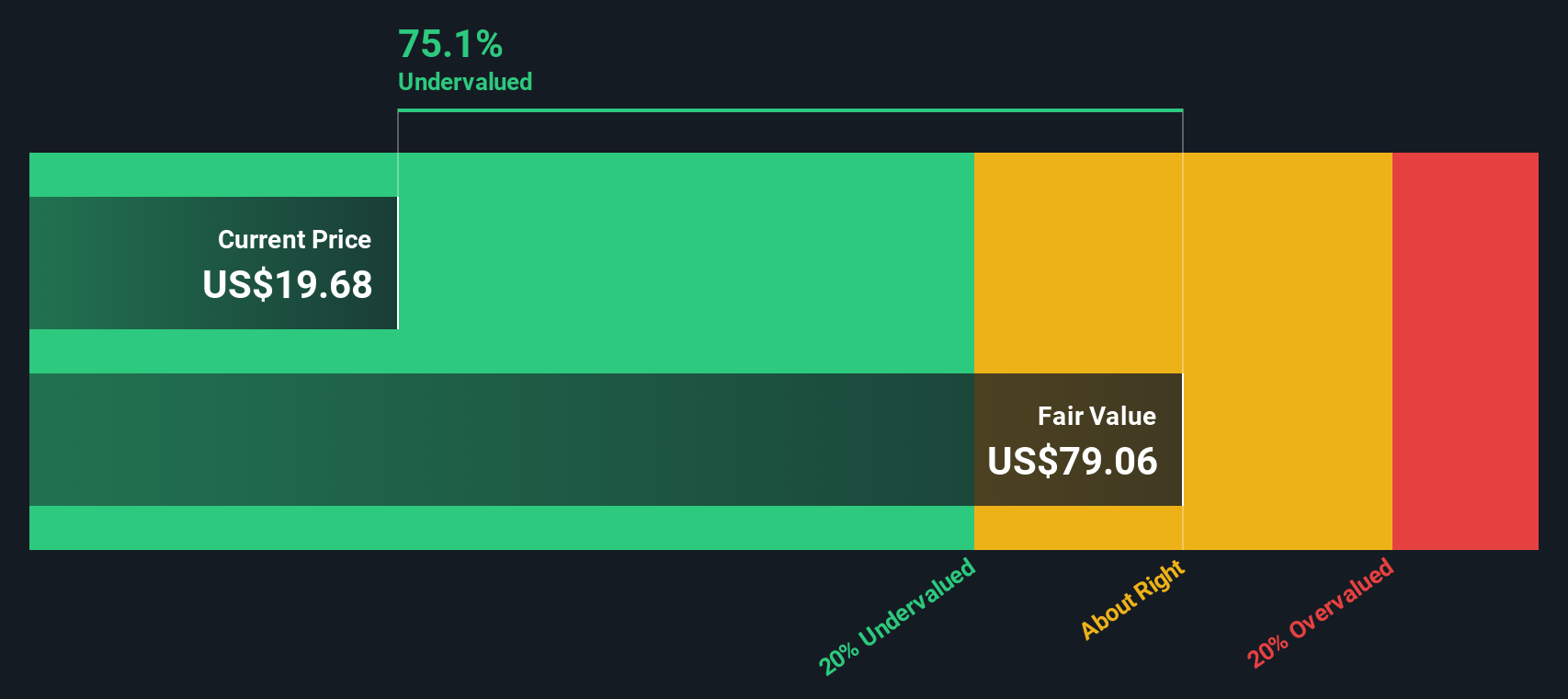

Aggregating and discounting these future cash flows results in an estimated intrinsic value of about $40.05 per share. Relative to the current share price, this implies the stock is trading at a 57.0% discount, indicating potential upside if the cash flow ramp materializes broadly as expected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests USA Rare Earth is undervalued by 57.0%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: USA Rare Earth Price vs Book

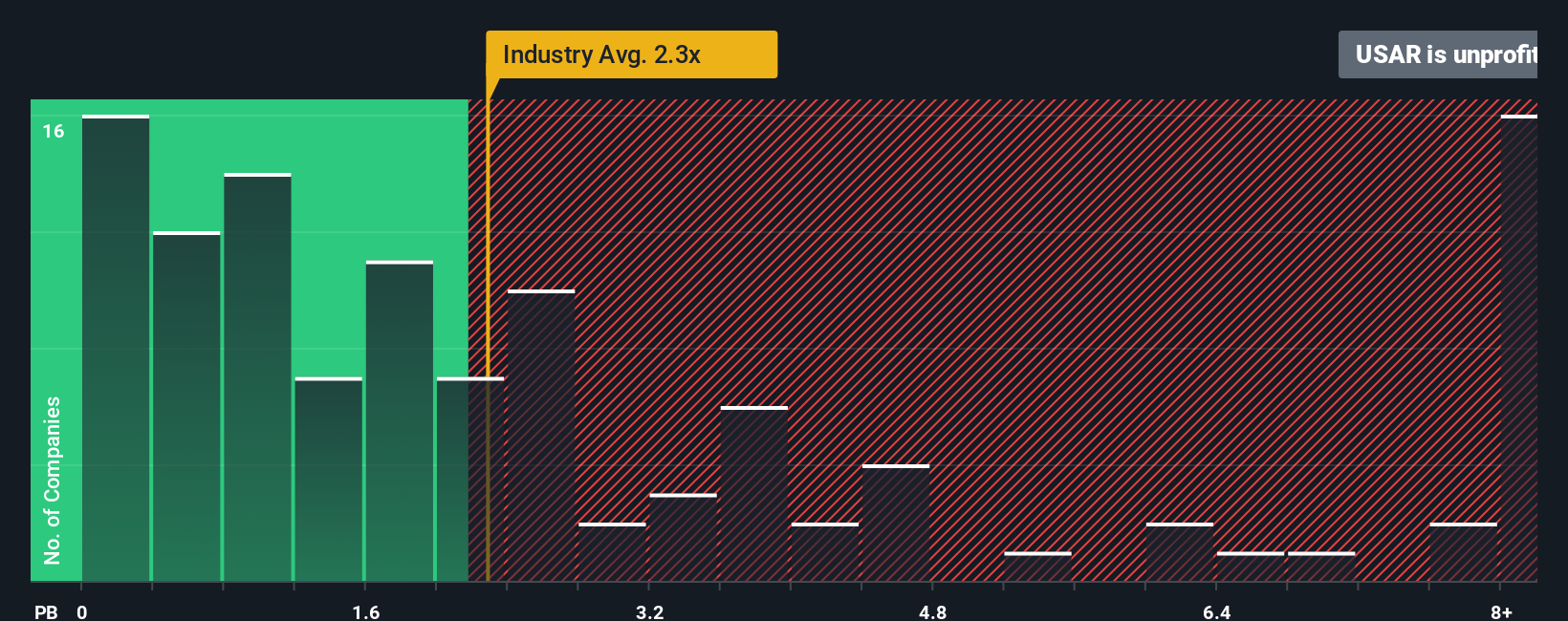

For asset heavy, early stage miners that are not yet profitable, the price to book ratio is often a more useful yardstick than earnings based multiples. It anchors valuation to the company’s net assets, which can be easier to assess while cash flows and earnings remain volatile.

In general, faster growth, stronger balance sheets and lower perceived risk justify paying a higher price to book multiple, while weaker prospects and higher uncertainty usually warrant a discount. Against that backdrop, USA Rare Earth currently trades at about -37.72x book value, which is very unusual compared with both the Metals and Mining industry average of roughly 2.16x and a peer average closer to 8.64x. On the surface that gap might suggest the market is heavily penalising the stock, but simple comparisons like this can be misleading.

Simply Wall St’s Fair Ratio framework aims to address this by estimating the price to book multiple that would be reasonable given USA Rare Earth’s specific mix of expected growth, risk profile, profitability, industry positioning and market cap. Because it is tailored to the company rather than a broad peer group, it provides a more nuanced guide to value than basic industry or peer averages alone. In USA Rare Earth’s case, the current market multiple sits below this Fair Ratio, which indicates that the stock still appears undervalued on a book value basis.

Result: UNDERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

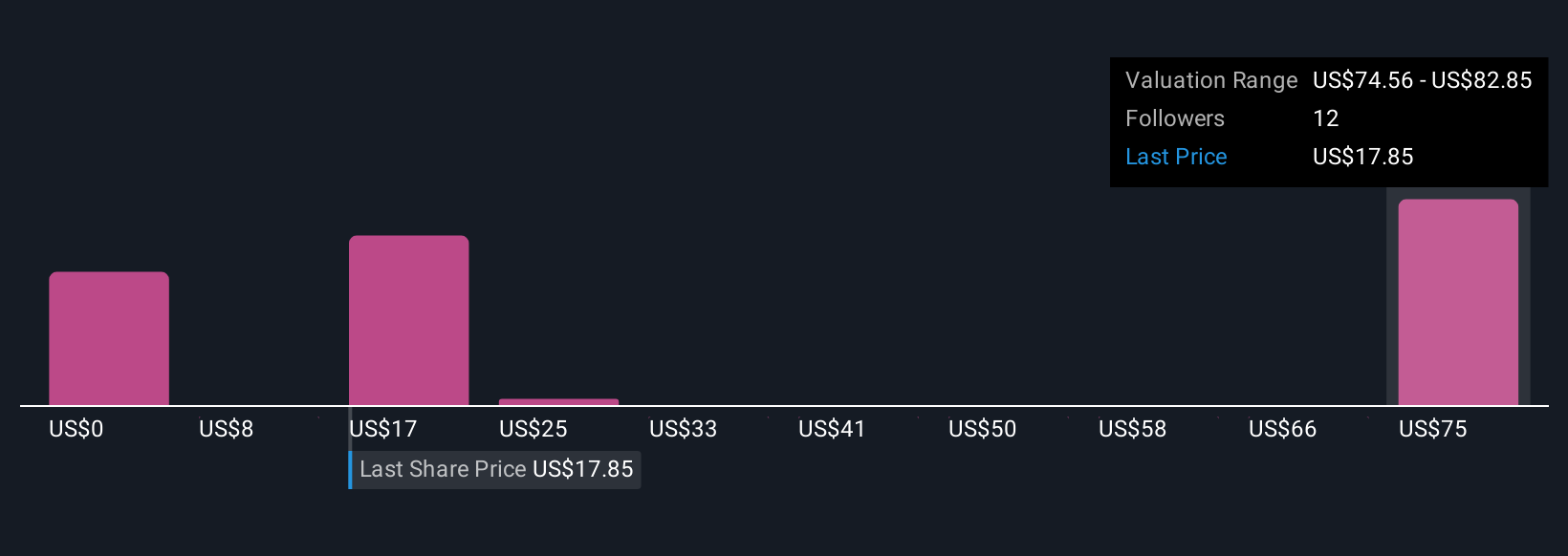

Upgrade Your Decision Making: Choose your USA Rare Earth Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers behind it. A Narrative is your own explanation of what you think will happen to a business, captured through assumptions about its future revenue, earnings and margins, which then flow into a financial forecast and finally a fair value estimate. On Simply Wall St, Narratives are an easy, accessible tool inside the Community page, where millions of investors explore and share different stories about the same stock. Narratives can help inform your decision making by allowing you to compare your Fair Value to the current Price, and they are updated dynamically as new information, such as news or earnings, is released. For example, one USA Rare Earth Narrative might assume rapid demand growth and assign a much higher fair value, while another might be more cautious about execution risk and set a far lower price target.

Do you think there's more to the story for USA Rare Earth? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com