Reassessing XPEL (XPEL) Valuation After Its New Official Window Tinting Partnership With Tesla

Why the new Tesla partnership matters for XPEL

XPEL (XPEL) just landed an official partnership with Tesla, plugging its window tinting service directly into the Tesla app and pairing it with a shared warranty, a meaningful step into Tesla’s owner ecosystem.

For investors, the move is less about a quick trading pop and more about whether this OEM-backed channel can deepen XPEL’s recurring revenue, widen margins over time, and justify the stock’s strong run over the past month.

See our latest analysis for XPEL.

The Tesla tie up lands on top of an already strong run, with a 30 day share price return of about 30 percent and a year to date share price gain above 26 percent. However, the three year total shareholder return is still negative, so momentum looks to be rebuilding rather than starting from scratch.

If this Tesla move has you rethinking where growth could come from next, it might be worth exploring auto manufacturers as a way to spot other potential beneficiaries of shifting consumer demand and EV adoption.

With shares already up nearly 30 percent in a month and trading just below analyst targets, investors now face the core question: Is XPEL still undervalued, or is the Tesla powered growth story already fully priced in?

Most Popular Narrative: 5.4% Undervalued

With XPEL closing at $49.18 against a most-followed fair value of $52, the current price reflects optimism but not the full narrative.

Increasing investment and strong momentum in the personalization and referral platform, including online to offline installer network integration, is rapidly enhancing customer reach and upsell potential, which should drive higher attach rates, improved brand loyalty, and consequently higher net margins and earnings.

Curious how steady double digit growth, rising margins, and a lower future earnings multiple can all coexist in one thesis? The narrative spells out the math, assumes a specific pace for revenue and profit expansion, and then discounts everything at a single required return to land on that $52 figure. Want to see which assumptions do the heavy lifting in that 8.23 percent discount rate framework, and how far earnings must climb to keep this story intact?

Result: Fair Value of $52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising low cost competition and faster OEM adoption of factory installed films could pressure XPEL’s pricing power, margins, and long term growth narrative.

Find out about the key risks to this XPEL narrative.

Another Angle on Valuation

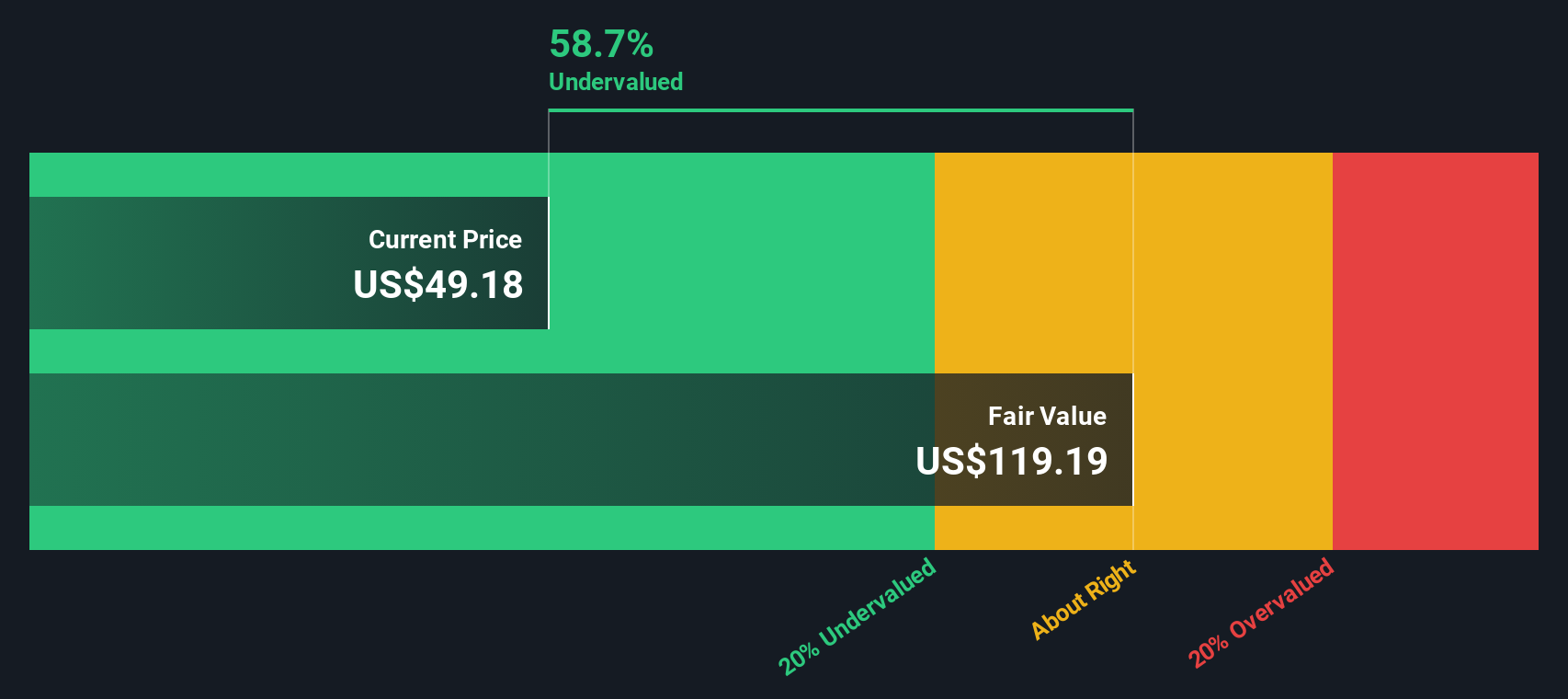

Our SWS DCF model paints a very different picture, suggesting XPEL is trading about 58.7 percent below its fair value of roughly $119 per share. If the cash flow path is even close to right, is the market underestimating the long term earnings runway?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own XPEL Narrative

If you want to dig into the numbers yourself, challenge these assumptions, and shape a thesis that fits your view, you can Do it your way in under three minutes.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding XPEL.

Ready for your next investing move?

Before you move on, lock in your advantage by scanning fresh opportunities on the Simply Wall Street Screener, where data backed ideas meet your strategy.

- Target reliable income first and let price appreciation be the bonus by reviewing these 15 dividend stocks with yields > 3% that can support a growing stream of cash returns.

- Capture tomorrow's technology leaders early by focusing on these 26 AI penny stocks positioned to monetise real world artificial intelligence demand.

- Position yourself for asymmetric upside by filtering these 81 cryptocurrency and blockchain stocks that are building durable businesses around digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com