How Investors May Respond To Cognizant (CTSH) Expanding AI Fleet Management Capabilities With Merchants Fleet Partnership

- Cognizant recently announced a strategic partnership with Merchants Fleet to modernize the fleet management company's sales, operations, and customer service using AI-powered automation, predictive analytics, and generative AI.

- The deal highlights how Cognizant is applying advanced technology to tackle long-standing industry issues like complex billing, slow repairs, and limited vehicle performance visibility in a rapidly evolving fleet management market.

- Next, we’ll explore how this AI-driven Merchants Fleet partnership influences Cognizant’s investment narrative and its focus on large-scale digital transformation.

Find companies with promising cash flow potential yet trading below their fair value.

Cognizant Technology Solutions Investment Narrative Recap

To own Cognizant, you need to believe it can convert demand for large, AI-driven transformations into steady revenue and margin progress, despite modest recent growth. The Merchants Fleet deal reinforces Cognizant’s positioning in applied enterprise AI, but does not materially alter the core near term catalyst around scaling multi-year GenAI programs or the key risk that hyperscalers and AI vendors intensify competition and compress pricing.

The expanded Synapse commitment to upskill two million people by 2030 sits alongside the Merchants Fleet partnership as another sign of Cognizant leaning into AI at scale, which matters if clients increasingly prefer automation-rich, IP-heavy solutions over traditional outsourcing. How well these efforts translate into differentiated offerings and higher value work will be central to whether the company can offset structural risks from automation and evolving client buying patterns.

Yet investors should also be aware that rising competition from cloud and AI platforms could pressure Cognizant’s pricing power and its ability to...

Read the full narrative on Cognizant Technology Solutions (it's free!)

Cognizant Technology Solutions’ narrative projects $23.5 billion revenue and $2.9 billion earnings by 2028.

Uncover how Cognizant Technology Solutions' forecasts yield a $84.70 fair value, a 5% upside to its current price.

Exploring Other Perspectives

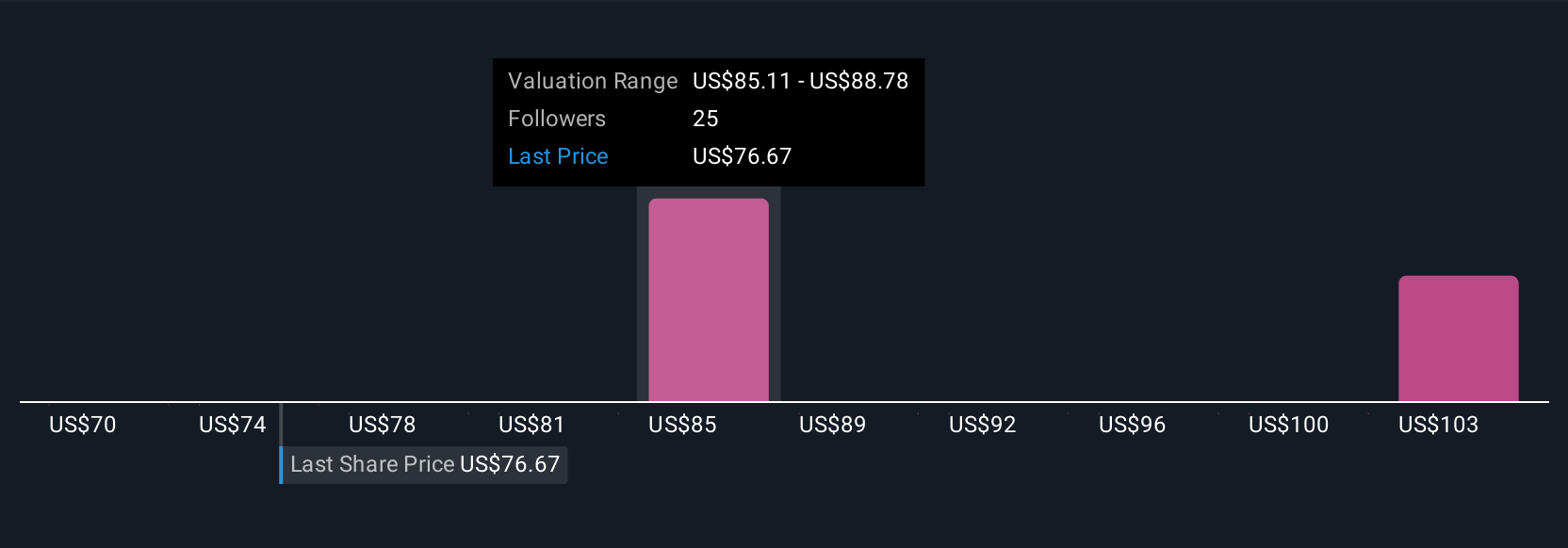

Eight fair value estimates from the Simply Wall St Community span roughly US$66 to US$125 per share, showing how far apart views on Cognizant’s potential currently sit. Against this spread, the key catalyst remains whether clients move from pilots to broad GenAI rollouts with partners like Cognizant, which could heavily influence how those differing expectations about future performance play out over time.

Explore 8 other fair value estimates on Cognizant Technology Solutions - why the stock might be worth as much as 55% more than the current price!

Build Your Own Cognizant Technology Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognizant Technology Solutions research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Cognizant Technology Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognizant Technology Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com