How Investors Are Reacting To Arista Networks (ANET) Upbeat 2026 Revenue Outlook Amid AI Network Demand

- In the past quarter, Arista Networks reported strong third-quarter 2025 results, with revenues and adjusted earnings rising year over year, and guided for fourth-quarter revenues between US$2.30 billion and US$2.40 billion plus 2026 revenues of about US$10.65 billion.

- The upbeat guidance underscores how sustained demand for AI and high-bandwidth networking, supported by recent product launches, is shaping Arista’s growth outlook.

- Next, we’ll examine how this upbeat 2026 revenue outlook of about US$10.65 billion may influence Arista Networks’ existing investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Arista Networks Investment Narrative Recap

To own Arista Networks today, you need to believe high performance cloud and AI networking will keep requiring specialized Ethernet solutions that Arista can profitably supply, even as competition and customer concentration stay intense. The latest guidance for about US$10.65 billion of 2026 revenue reinforces the near term AI networking demand story, but does not remove the key risk that a few hyperscale and AI customers still drive a large share of Arista’s business.

Against this backdrop, the company’s recent revenue guidance update is the most relevant development. Management is calling for fourth quarter 2025 revenue of US$2.30 billion to US$2.40 billion, alongside that 2026 target of roughly US$10.65 billion. This stronger near term visibility on large AI and cloud deployments directly feeds into the main catalyst investors are watching: whether Arista can convert current AI networking demand into more durable, multi year growth across its cloud and data center portfolio.

Yet, in contrast, investors should still be aware of how quickly demand from a few hyperscale customers could shift and...

Read the full narrative on Arista Networks (it's free!)

Arista Networks’ narrative projects $13.6 billion revenue and $5.4 billion earnings by 2028. This requires 19.5% yearly revenue growth and about a $2.1 billion earnings increase from $3.3 billion today.

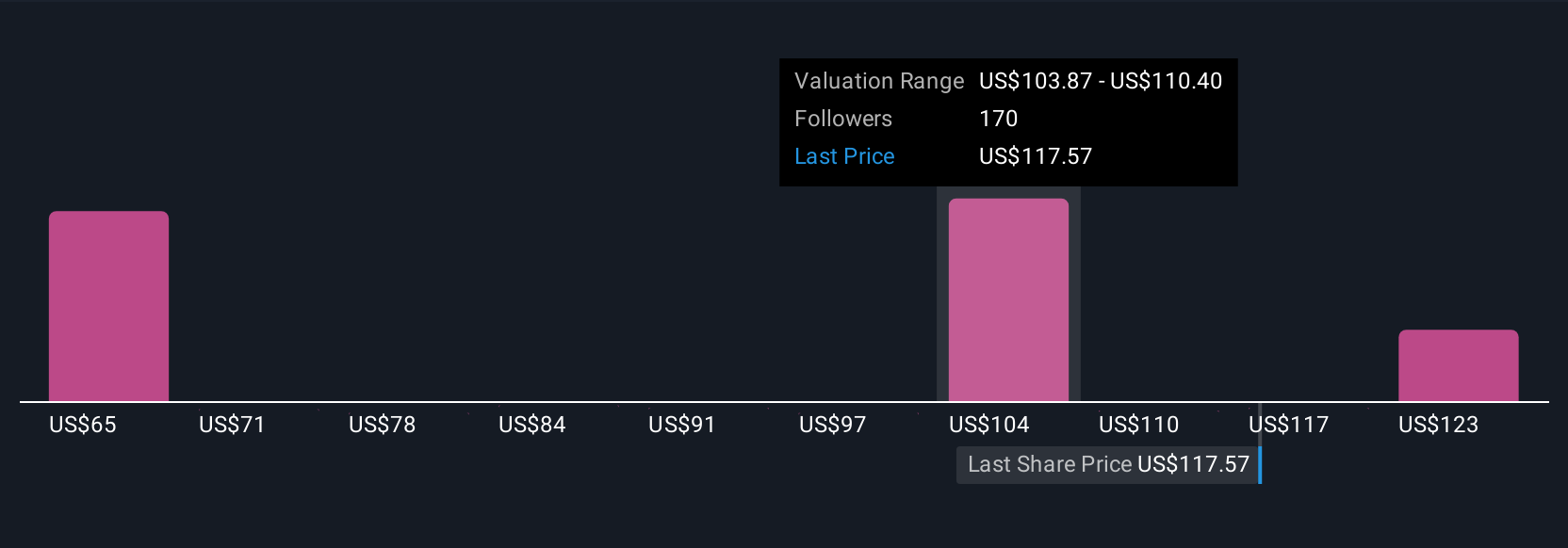

Uncover how Arista Networks' forecasts yield a $164.08 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Before this news, the most optimistic analysts were assuming Arista could reach about US$15.4 billion in revenue and US$5.9 billion in earnings by 2028, tying that outlook to strong AI driven demand and growing exposure to hyperscalers. Compared with the consensus view, that is a much more optimistic take on how far AI networking adoption and large customer spending could go, and this latest guidance may encourage you to revisit whether those bullish expectations, and their risks around customer concentration, still feel realistic.

Explore 20 other fair value estimates on Arista Networks - why the stock might be worth 12% less than the current price!

Build Your Own Arista Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arista Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arista Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arista Networks' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com