I'LL (TSE:3854) Margin Expansion Reinforces Bullish Profitability Narrative After Q1 2026 Results

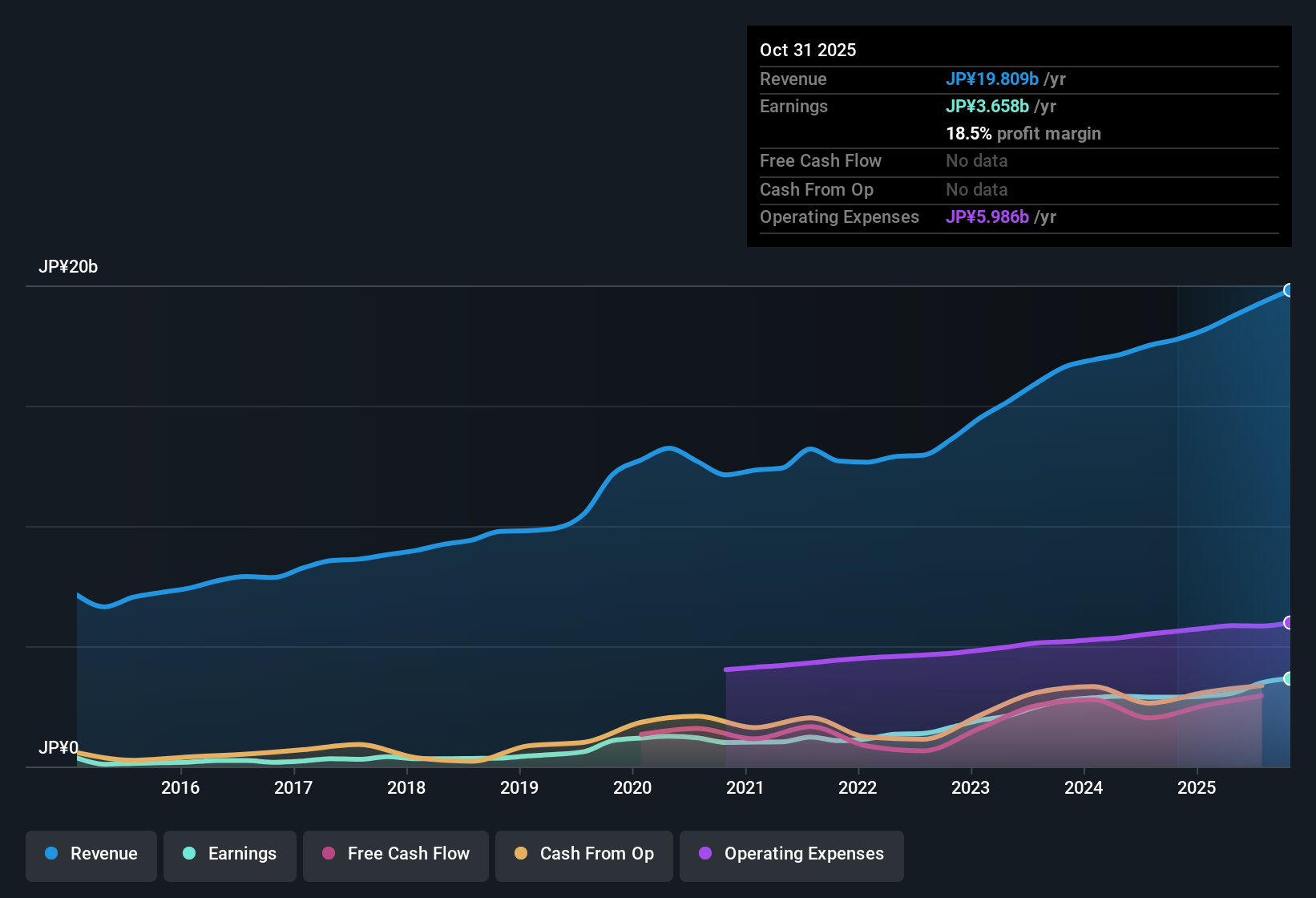

I'LL (TSE:3854) opened Q1 2026 with revenue of about ¥5.1 billion and basic EPS of ¥36.57, while trailing twelve month figures show revenue of roughly ¥19.8 billion and EPS of ¥148.20, underlining the scale of its recent earnings power. The company has seen revenue move from ¥4.6 billion in Q4 2024 to ¥5.1 billion in the latest quarter and quarterly EPS step up from ¥28.08 to ¥36.57 over the same span, setting the backdrop for margins that now sit on a noticeably stronger footing.

See our full analysis for I'LL.With the latest numbers on the table, the next step is to weigh them against the most popular narratives around I'LL to see which storylines are confirmed by the data and which ones start to look stretched.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Strengthen With 18.5% Net Profit Level

- Over the last 12 months, I'LL generated about ¥19.8 billion in revenue and ¥3.7 billion in net income, which works out to an 18.5% net profit margin compared with 16.2% the prior year.

- What stands out for the bullish view is how this margin profile lines up with the strong earnings trajectory, with trailing EPS at ¥148.20 after growing 26.7% year on year, even as:

- Quarterly net income rose from ¥703 million in Q4 2024 to ¥914.9 million in Q1 2026 alongside revenue moving from ¥4.6 billion to ¥5.1 billion.

- Across the last five years, earnings growth has averaged about 26.8% per year, which heavily supports a thesis that recent profitability is not a one off spike.

📊 Read the full I'LL Consensus Narrative.

Forecast Growth Of About 8% Per Year

- Looking ahead, earnings are forecast to grow around 8.4% per year and revenue about 8.3% per year, which is faster than the broader Japanese market's expected 4.6% annual revenue growth.

- Investors leaning bullish can point to these mid single digit forecasts as a step down from the recent 26.7% EPS growth, yet still see a reasonable runway because:

- Trailing revenue of roughly ¥19.8 billion is already up from about ¥17.5 billion two years earlier, showing that the business has scaled to a higher base before those more moderate growth rates start applying.

- Quarterly EPS has climbed from ¥28.08 in Q4 2024 to ¥36.57 in Q1 2026, so even if future growth slows from past highs, it is being measured off meaningfully improved per share earnings.

Valuation Sits Below DCF Fair Value

- At a share price of ¥2,369, I'LL trades below the DCF fair value estimate of about ¥2,538.04 and on a 16.2x P/E, compared with 26.3x for peers and 19.3x for the broader software industry.

- For bullish investors, this relative discount looks particularly interesting when set against the company's profitability record, because:

- Net margin at 18.5%, up from 16.2%, sits beside those lower multiples, which suggests the stock is not paying up for the recent improvement in earnings efficiency.

- With EPS over the last year at ¥148.20 and the share price below the DCF fair value, the combination of proven profit growth and a below peer P/E can be read as valuation support rather than a warning sign.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on I'LL's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While I'LL's profitability and valuation look appealing today, its forecast 8% earnings growth marks a clear slowdown from the much stronger historical pace.

If that deceleration leaves you wanting more momentum, use our high growth potential stocks screener (46 results) to quickly focus on established names still projected to deliver significantly faster earnings expansion over the next few years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com