Did Wheaton’s US$300 Million Hemlo Gold Stream Just Shift Wheaton Precious Metals' (TSX:WPM) Investment Narrative?

- Wheaton Precious Metals Corp. recently completed a US$300 million gold streaming agreement with Hemlo Mining Corp. to support its acquisition of the Hemlo Mine from Barrick, securing long-term access to a portion of the mine’s gold production at 20% of spot prices.

- The deal not only delivers immediate production and cash flow but also lifts Wheaton’s gold reserves and resources and grants it a right of first refusal over future precious metals financings linked to Hemlo.

- We’ll now examine how locking in long-life gold volumes at Hemlo, with upside linked to production schedules, may reshape Wheaton’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Wheaton Precious Metals Investment Narrative Recap

To own Wheaton Precious Metals, you generally need to believe in its ability to convert a growing stream of long-life gold and silver contracts into rising cash flows over time. The Hemlo gold stream fits that thesis by adding diversified, low-operating-risk exposure, but it does not fundamentally change the key near term driver, which remains execution and ramp-up across the broader growth pipeline, nor does it materially reduce the overarching risk of fiercer competition for quality streaming deals.

Among recent announcements, the reaffirmation of Wheaton’s 2025 and long term production guidance stands out beside the Hemlo deal, because it underlines how new streams are intended to support a clearer volume growth path. Hemlo bolsters reserves and provides incremental ounces, but the larger production targets still hinge on timely delivery from existing projects like Salobo III and Blackwater, where any delays or underperformance could blunt the benefit of adding another mid sized, long life stream.

Yet while the Hemlo agreement broadens Wheaton’s opportunity set, investors should still be alert to how intensifying competition for streaming deals could...

Read the full narrative on Wheaton Precious Metals (it's free!)

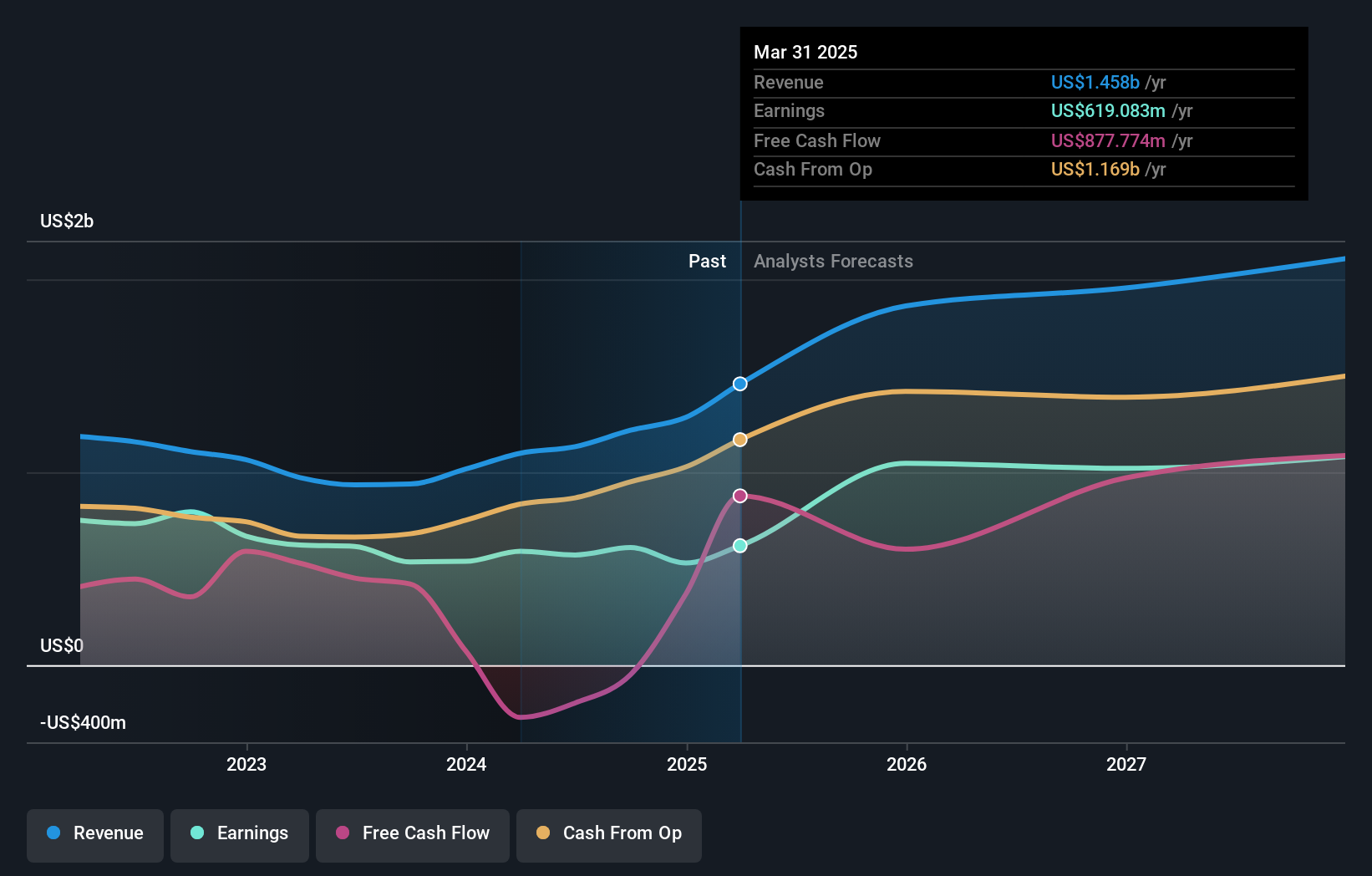

Wheaton Precious Metals' narrative projects $2.2 billion revenue and $1.1 billion earnings by 2028. This requires 9.2% yearly revenue growth and about a $311 million earnings increase from $789.0 million today.

Uncover how Wheaton Precious Metals' forecasts yield a CA$182.74 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently see fair value for Wheaton between CA$111.58 and CA$186.39, highlighting a wide spread of expectations. You may want to weigh those views against the growing competition in streaming and royalties, which could influence how effectively new deals like Hemlo translate into long term value creation.

Explore 7 other fair value estimates on Wheaton Precious Metals - why the stock might be worth 25% less than the current price!

Build Your Own Wheaton Precious Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wheaton Precious Metals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Wheaton Precious Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wheaton Precious Metals' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com