ASX Penny Stocks To Watch In December 2025

The Australian market is currently experiencing a cautious atmosphere as traders anticipate the Reserve Bank of Australia's decision to hold interest rates steady, with futures indicating a slight downturn. Despite this uncertainty, there remains interest in exploring investment opportunities beyond the major indices. Penny stocks, often representing smaller or newer companies, continue to attract attention for their potential to offer significant returns when backed by strong financials. In this article, we will explore three such penny stocks that stand out for their balance sheet resilience and potential growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.395 | A$113.2M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.52 | A$71.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.80 | A$49.81M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$441.09M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.26 | A$240.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$38.45M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.88 | A$3.29B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.20 | A$1.35B | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.39 | A$132.75M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.48 | A$650.45M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 415 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Australian Gold and Copper (ASX:AGC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Australian Gold and Copper Limited is an exploration company focused on developing a multi-asset gold portfolio in Australia, with a market cap of A$57.90 million.

Operations: Currently, there are no reported revenue segments for this exploration-focused company.

Market Cap: A$57.9M

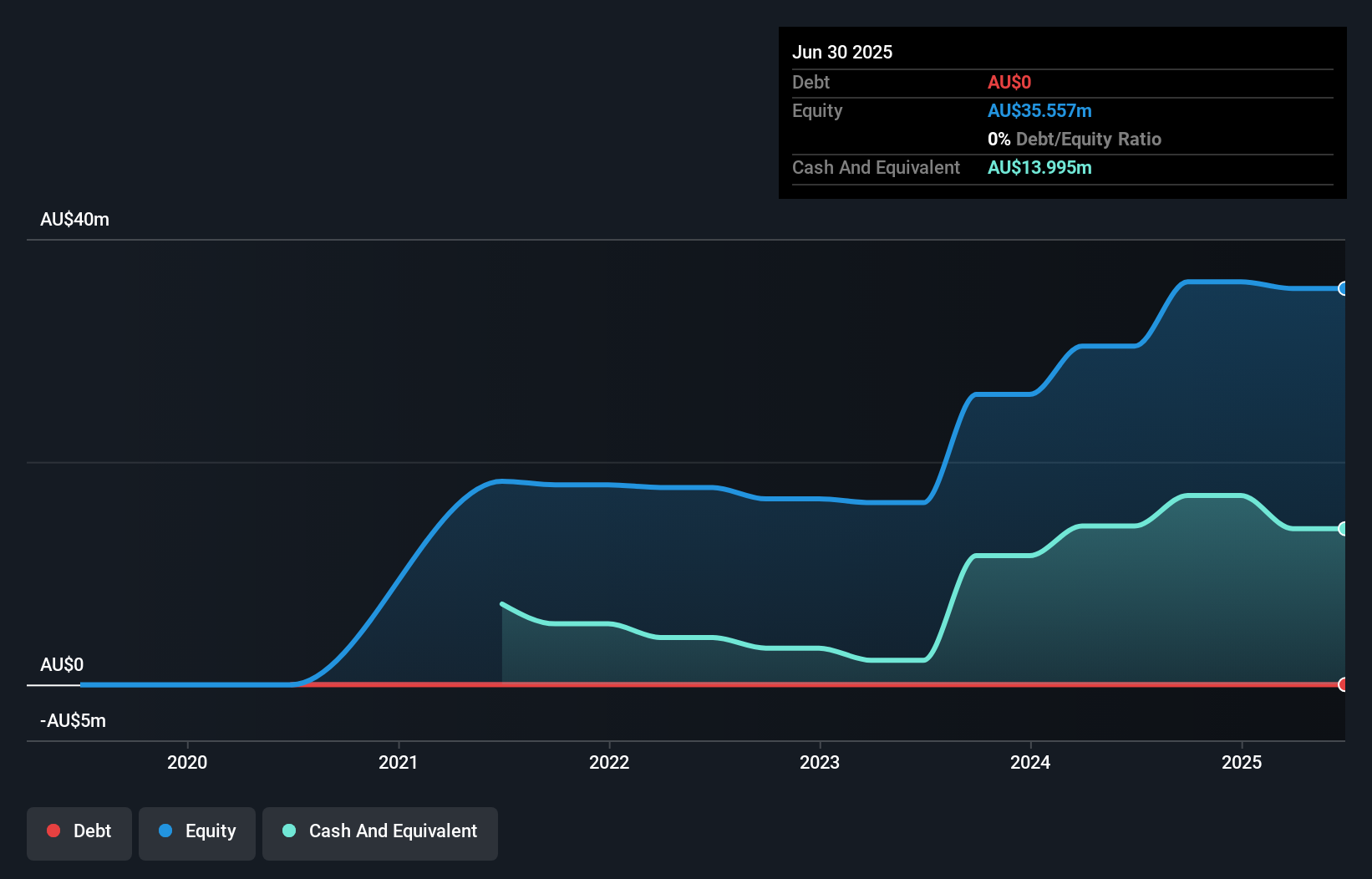

Australian Gold and Copper Limited, with a market cap of A$57.90 million, is a pre-revenue exploration company focused on expanding its gold portfolio in Australia. The recent acquisition of the Browns Reef tenement package significantly increases its exploration footprint in the South Cobar Basin to 2,600km². This positions AGC as a dominant titleholder in this emerging mineral province, with plans for extensive drilling at the Evergreen target set for early 2026. Despite being debt-free and having sufficient short-term assets to cover liabilities, AGC remains unprofitable with ongoing net losses reported annually.

- Unlock comprehensive insights into our analysis of Australian Gold and Copper stock in this financial health report.

- Assess Australian Gold and Copper's previous results with our detailed historical performance reports.

Horizon Oil (ASX:HZN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Horizon Oil Limited is involved in the exploration, development, and production of oil and gas properties across China, New Zealand, Australia, and Thailand with a market cap of A$325.52 million.

Operations: Horizon Oil's revenue is derived from its operations in Australia ($14.82 million), China ($47.59 million), and New Zealand ($42.89 million).

Market Cap: A$325.52M

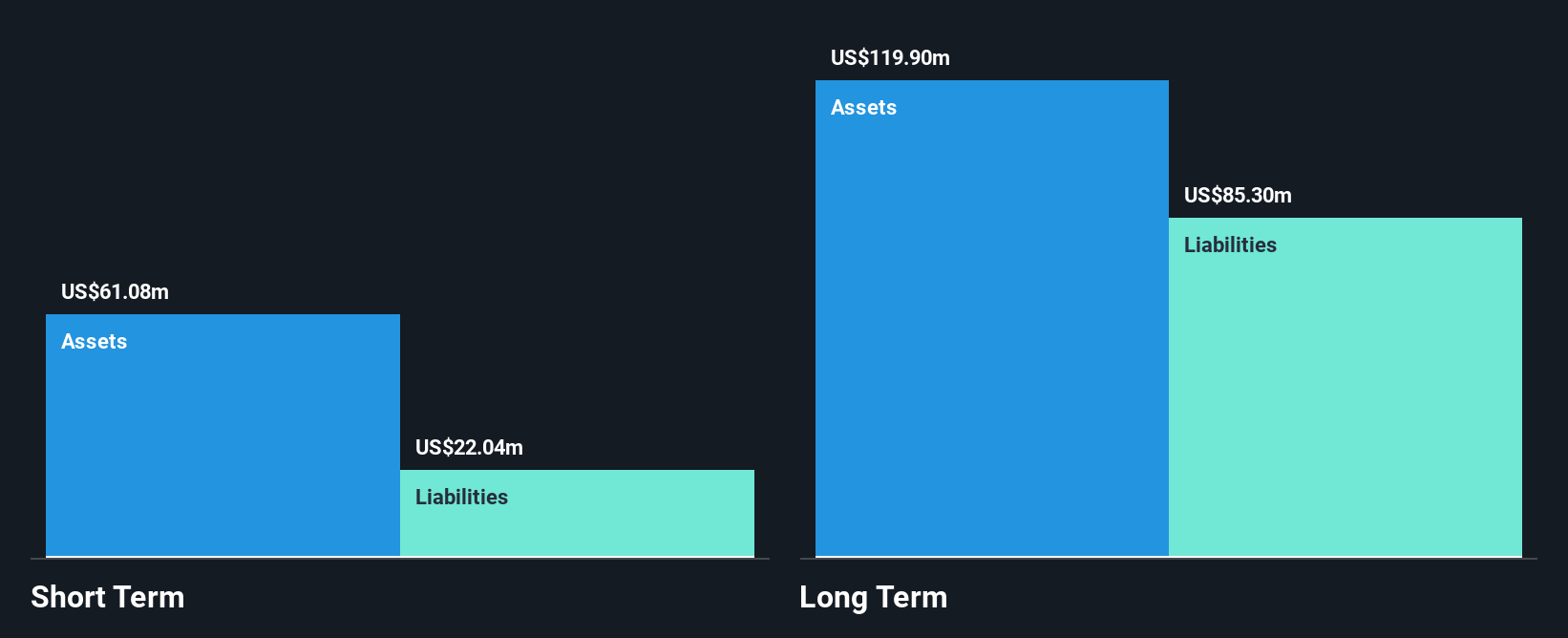

Horizon Oil Limited, with a market cap of A$325.52 million, operates across several regions and derives significant revenue from China (A$47.59 million) and New Zealand (A$42.89 million). The company's short-term assets exceed its short-term liabilities, though they fall short of covering long-term liabilities. Despite having more cash than debt and well-covered interest payments by EBIT, Horizon's net profit margins have declined to 11.6% from last year's 23.2%. The dividend yield of 14.57% is not well supported by earnings or free cash flow, raising sustainability concerns despite the experienced management team and board stability.

- Click here to discover the nuances of Horizon Oil with our detailed analytical financial health report.

- Evaluate Horizon Oil's historical performance by accessing our past performance report.

WAM Strategic Value (ASX:WAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WAM Strategic Value Limited focuses on investing in discounted assets and has a market cap of A$202.64 million.

Operations: The company generates revenue primarily through investing activities, amounting to A$18.53 million.

Market Cap: A$202.64M

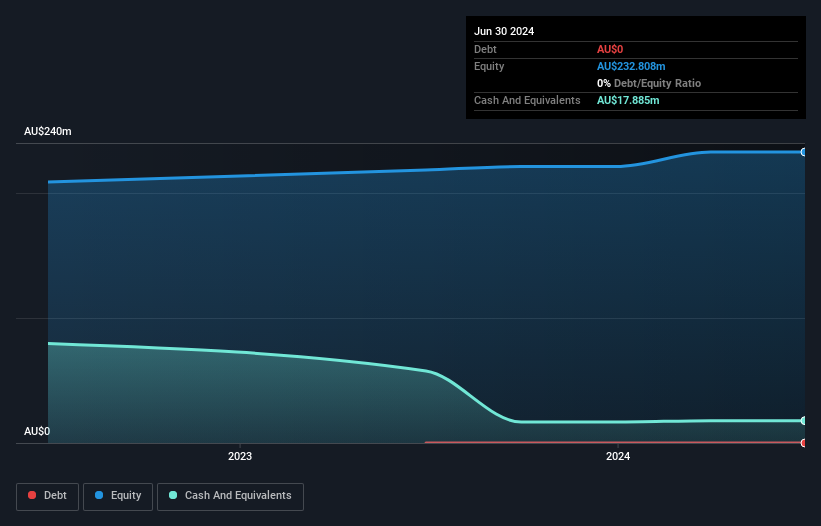

WAM Strategic Value Limited, with a market cap of A$202.64 million, focuses on investing in discounted assets and has generated A$18.53 million in revenue through these activities. The company is debt-free and maintains stable weekly volatility at 2%. Its short-term assets (A$45.9M) comfortably cover its short-term liabilities (A$8.4M). Despite a price-to-earnings ratio of 17.6x being below the Australian market average, WAM's earnings growth has been negative over the past year, with a decline in revenue by 51.7%. The dividend yield of 5.33% is not well covered by earnings, though profit margins have improved to 62.1%.

- Take a closer look at WAM Strategic Value's potential here in our financial health report.

- Understand WAM Strategic Value's track record by examining our performance history report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 415 ASX Penny Stocks by clicking here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com