Can Oscar Health (OSCR) Turn Claims Volatility Into an Edge With Its Tech-Driven Platform?

- In the past quarter, Oscar Health drew fresh attention as investors reacted to mixed analyst views, bullish options activity, and an analyst upgrade, against a backdrop of higher-than-expected claims losses earlier in the year but Q3 2025 revenue rising 23% year over year.

- At the same time, Oscar’s growing membership above 2 million and excess capital to absorb temporary losses have reinforced a view that its technology-led platform could still benefit from structural shifts in the U.S. healthcare system despite policy and medical loss ratio headwinds.

- We’ll now examine how this renewed optimism around Oscar’s structural position and excess capital cushion may reshape its investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Oscar Health Investment Narrative Recap

To own Oscar Health, you need to believe its technology and growing 2 million-plus membership can eventually translate into sustainable profitability despite periods of elevated claims and policy uncertainty. The latest quarter, with higher-than-expected claims losses but 23% year-over-year revenue growth in Q3 2025 and mixed analyst reactions, does not fundamentally change the near term focus on medical loss ratio normalization as the key catalyst, or execution on pricing and underwriting as the main risk.

The reaffirmed 2025 guidance for US$12.0 billion to US$12.2 billion in revenue and a US$300 million to US$200 million loss from operations is especially relevant here, because it frames current losses alongside continued top line expansion and ongoing market rollouts ahead of 2026 rate increases. Against that backdrop, bullish options activity and an analyst upgrade have mainly affected sentiment rather than the underlying operational milestones investors are watching.

Yet investors should be aware that if medical loss ratios stay elevated for longer than expected, it could...

Read the full narrative on Oscar Health (it's free!)

Oscar Health’s narrative projects $12.4 billion revenue and $245.4 million earnings by 2028. This implies 4.9% yearly revenue growth and an earnings increase of about $406.6 million from -$161.2 million today.

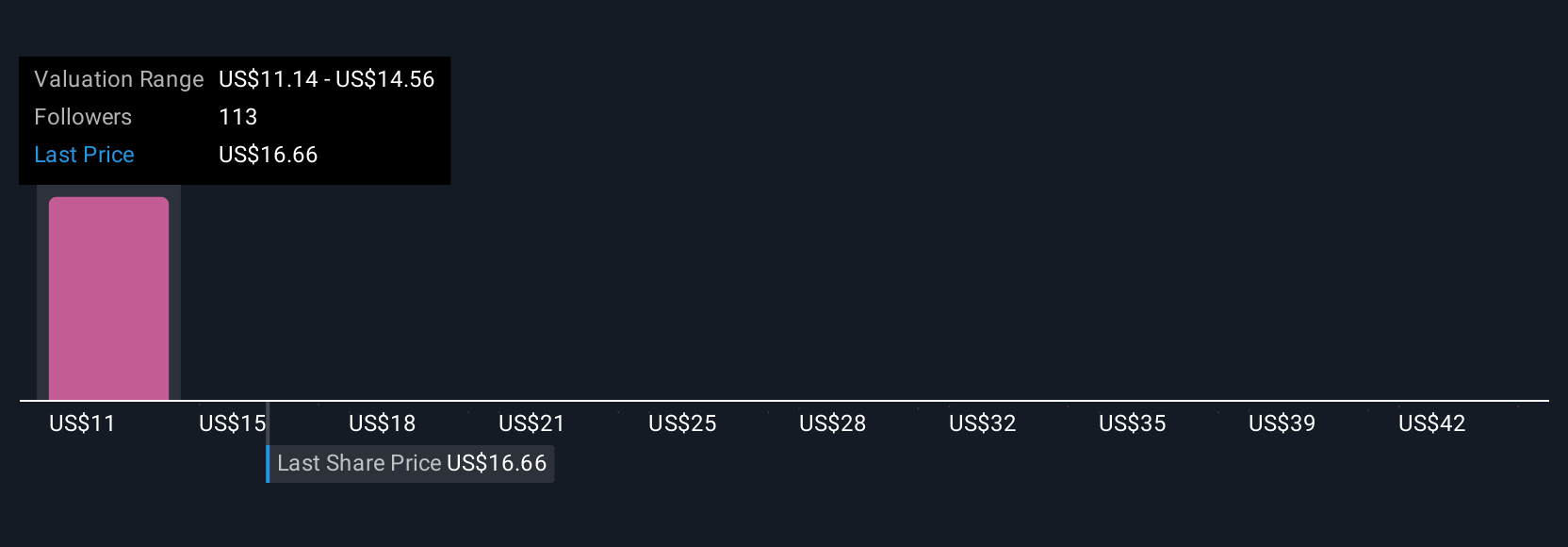

Uncover how Oscar Health's forecasts yield a $14.38 fair value, a 14% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer 23 different fair value views for Oscar Health, ranging from US$11.52 to US$66 per share, underlining how far apart individual assessments can be. When you compare that spread with the current focus on whether higher market morbidity can be repriced through 2026 rate filings, it highlights why many investors are weighing several viewpoints before forming a view on the company’s longer term performance.

Explore 23 other fair value estimates on Oscar Health - why the stock might be worth over 3x more than the current price!

Build Your Own Oscar Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Oscar Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oscar Health's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com