Ivanhoe Mines (TSX:IVN): Valuation Check After Upgraded Kamoa-Kakula Production Guidance and Growth Outlook

Ivanhoe Mines (TSX:IVN) just laid out fresh production guidance for its Kamoa-Kakula copper complex, flagging sharply higher output and sales through 2026 and 2027, and giving investors clearer medium term growth visibility.

See our latest analysis for Ivanhoe Mines.

Despite the latest guidance and management reshuffle, Ivanhoe Mines’ share price return tells a mixed story. A recent 30 day share price return of 13.32 percent and a 5 year total shareholder return of 140.92 percent suggest that long term momentum remains intact, even as near term sentiment has been more cautious.

If this kind of growth story has your attention, it could be a good moment to broaden your horizons and discover fast growing stocks with high insider ownership.

With production set to surge and the share price still trading at a discount to analyst targets, is Ivanhoe Mines an undervalued copper growth story, or are markets already pricing in the next leg of expansion?

Most Popular Narrative Narrative: 20.6% Undervalued

With Ivanhoe Mines last closing at CA$14.72 against a narrative fair value of CA$18.55, the story leans in favor of upside, setting the scene for an ambitious growth outlook.

Completion and ramp-up of the Kamoa-Kakula smelter (targeted for September) and the associated drop in logistics costs are expected to meaningfully reduce unit costs, directly boosting future operating margins and cash flow.

Want to see how aggressive volume growth, expanding margins, and a premium future earnings multiple all connect into one price tag? Dive in to unpack the full valuation playbook behind this narrative.

Result: Fair Value of $18.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, operational setbacks at Kamoa-Kakula or prolonged dewatering issues, along with rising capex demands, could quickly challenge the bullish copper growth narrative.

Find out about the key risks to this Ivanhoe Mines narrative.

Another View: Rich on Earnings

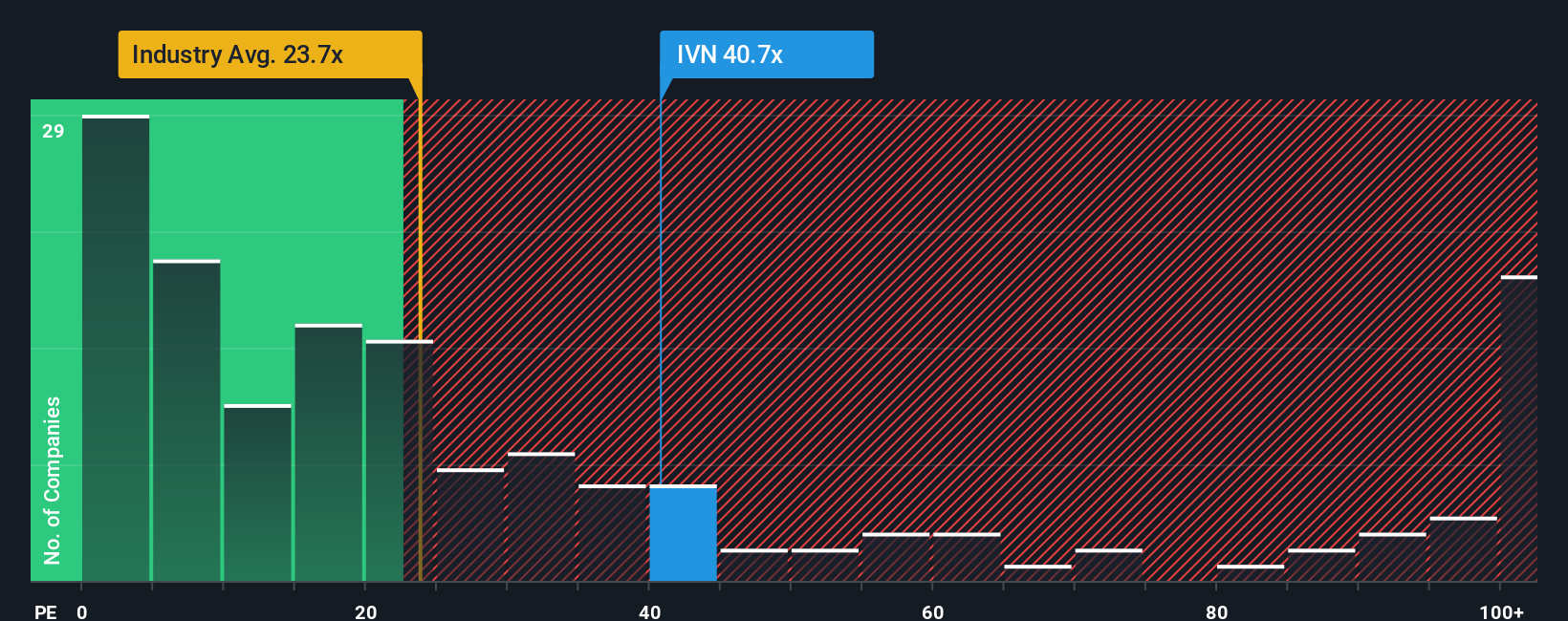

While the narrative fair value suggests upside, the earnings lens paints a tougher picture. Ivanhoe Mines trades on a price to earnings ratio of 49.5 times, far richer than the Canadian metals and mining average of 21.2 times and its own fair ratio of 27.6 times. This implies that any earnings stumble could hit the share price hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ivanhoe Mines Narrative

If you see things differently or simply want to dig into the numbers yourself, you can build a custom Ivanhoe Mines story in minutes: Do it your way.

A great starting point for your Ivanhoe Mines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next set of opportunities by scanning high conviction themes our community tracks closely, so you are not left reacting late.

- Capitalize on market mispricings by targeting quality companies trading below their intrinsic value through these 908 undervalued stocks based on cash flows.

- Ride structural growth trends in automation and digital intelligence by zeroing in on tomorrow’s potential leaders with these 26 AI penny stocks.

- Strengthen your portfolio’s income engine by focusing on reliable cash generators via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com