Targa Resources (TRGP): Reassessing Valuation After Recent Share Price Momentum

Targa Resources (TRGP) has been quietly grinding higher, with the stock up about 5% over the past month and 13% in the past 3 months, outpacing many midstream peers.

See our latest analysis for Targa Resources.

Zooming out, the recent 3 month share price return of 12.6 percent sits against a mildly negative year to date share price return and a still exceptional 3 year total shareholder return of about 182 percent. This suggests momentum is rebuilding after a pause.

If Targa’s move has you thinking more broadly about energy infrastructure and income, it could be a good moment to explore fast growing stocks with high insider ownership.

With solid earnings growth, a hefty intrinsic value discount and analyst targets still pointing higher, the key question now is simple: Is Targa Resources undervalued today, or is the market already baking in its next leg of growth?

Most Popular Narrative: 13.1% Undervalued

With Targa Resources last closing at $180.74 against a narrative fair value of $208.00, the story leans toward upside and hinges on future growth delivery.

Substantial investment in integrated export infrastructure including the expansion and debottlenecking of LPG export facilities and new fractionation trains directly leverages rising international and petrochemical sector demand for U.S. NGLs, creating long term opportunities to enhance utilization and operating leverage, which should support higher earnings and margins.

Curious how mid single digit revenue growth, rising margins and a premium future earnings multiple can still point to upside from here? Discover the assumptions powering that $208 fair value and how they reshape the long term profit profile behind this stock.

Result: Fair Value of $208 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising Permian competition and potential midstream overbuild could pressure fees, squeeze margins, and slow the volume and earnings growth that this thesis depends on.

Find out about the key risks to this Targa Resources narrative.

Another View: Market Multiple Says Rich, Not Cheap

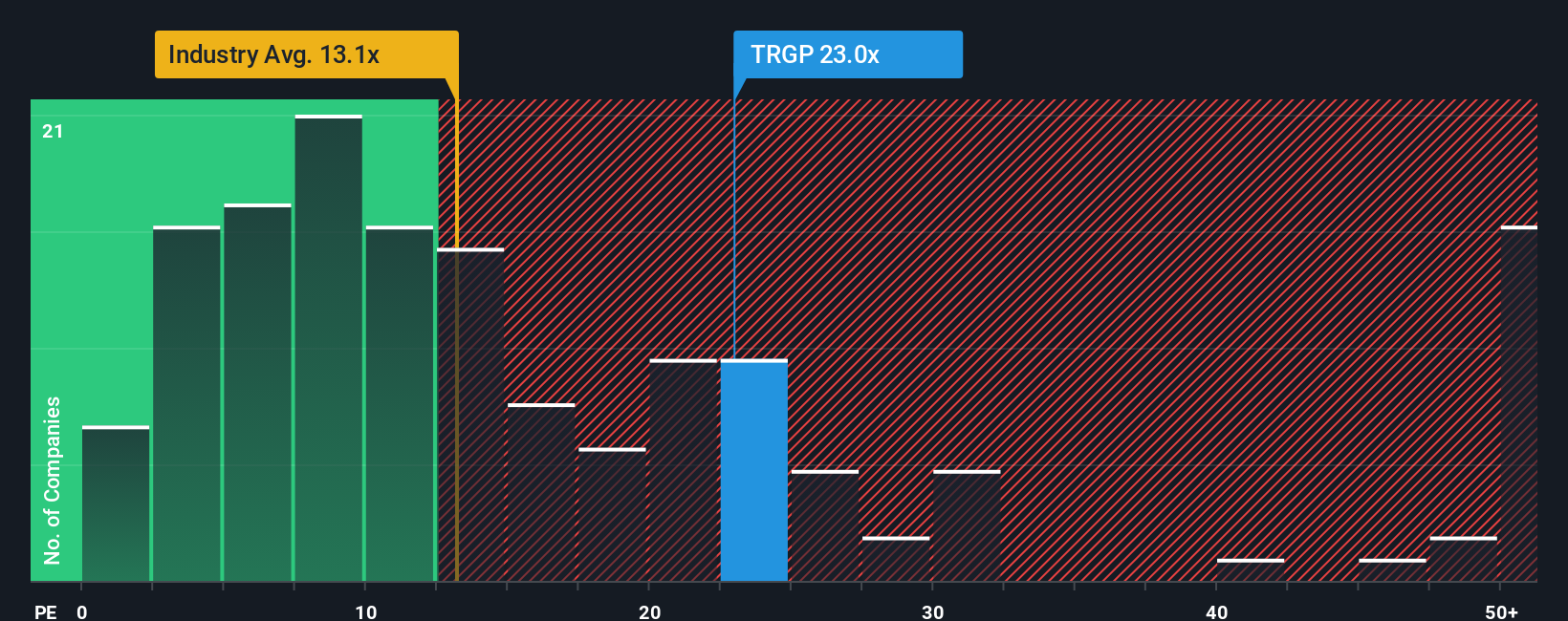

While narrative and intrinsic value work point to upside, the market’s own yardstick tells a cooler story. At about 24 times earnings, Targa trades well above both peers at 14.8 times and the wider US Oil and Gas group at 13.8 times, and even above its 20.3 times fair ratio.

That premium suggests investors are already paying up for execution and growth, leaving less room for error if volumes, margins, or capital discipline slip from here. Is this a deserved quality premium, or a valuation that could mean future returns are more muted than the story implies?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Targa Resources Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your Targa Resources research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next set of opportunities by using focused stock screens that uncover ideas you will not spot from headlines alone.

- Capture potential mispricings by using these 908 undervalued stocks based on cash flows, which flags companies trading below what their cash flows may justify.

- Position for breakthroughs in automation and machine intelligence with these 26 AI penny stocks, built to surface high impact names in this space.

- Strengthen your income strategy through these 15 dividend stocks with yields > 3%, targeting companies that combine yield with solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com