Evaluating Enovix (ENVX) After Strong Revenue Growth and Rising Defense-Sector Demand

Enovix (ENVX) just posted an 85% year over year revenue jump in its fiscal 2025 third quarter, and that surprise beat is colliding with a defense driven growth story that investors are rethinking.

See our latest analysis for Enovix.

Even with the latest close at $8.96 and a strong 7 day share price return of 15.02%, Enovix is still working off a much weaker year to date share price return of 26.01%. Its 3 year total shareholder return of 22.89% shows the longer term ride has been bumpy and momentum is only just starting to rebuild.

If this defense led rebound has you rethinking the sector, it may be worth exploring aerospace and defense stocks as a way to spot other potential beneficiaries of rising security budgets.

With revenue surging, a deep discount to analyst targets, and defense demand accelerating, is Enovix still being mispriced as a niche battery maker, or is the market already accounting for the next leg of its growth story?

Most Popular Narrative: 66.7% Undervalued

With Enovix closing at $8.96 against a most popular narrative fair value of $26.90, the implied upside rests on aggressive growth and margin expansion.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $460.3 million, earnings will come to $48.3 million, and it would be trading on a PE ratio of 163.9x, assuming you use a discount rate of 7.9%.

Want to see what kind of revenue surge, margin shift, and future earnings multiple could justify that price? The narrative lays out a bold roadmap. Curious?

Result: Fair Value of $26.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected smartphone ramp up and high capital intensity could still derail execution and temper the upside implied by today’s defense driven narrative.

Find out about the key risks to this Enovix narrative.

Another Angle on Valuation

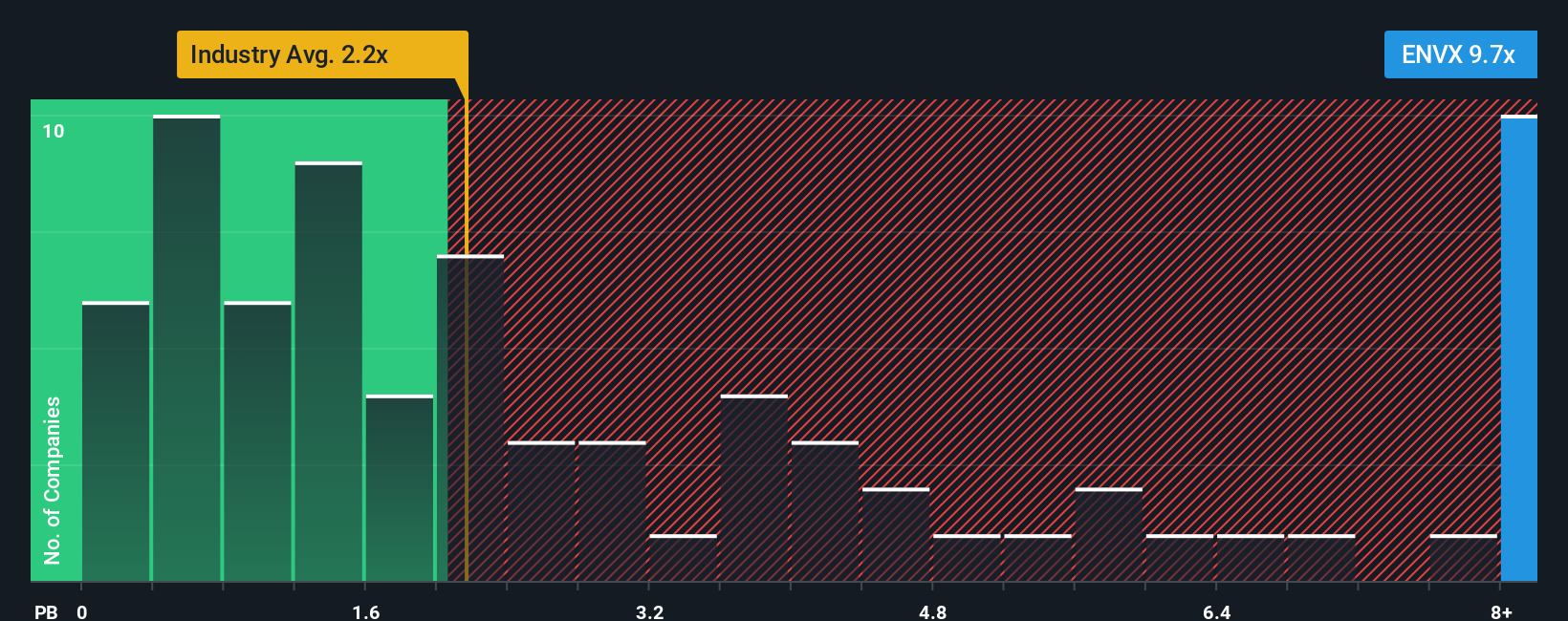

While narratives and fair value estimates suggest Enovix is deeply undervalued, its 6.4x price to book ratio paints a tougher picture. That is far richer than the US Electrical industry at 2.5x, even if it is slightly cheaper than peers on 7.1x. Is the premium justified for a still unprofitable story stock?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enovix Narrative

If you are not fully aligned with this view, or prefer to dig into the numbers yourself, you can build a custom narrative in under three minutes: Do it your way.

A great starting point for your Enovix research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more actionable investment ideas?

Do not stop at a single company when you can quickly scan the market for fresh opportunities that match your strategy, risk tolerance, and return goals.

- Target steady income potential by reviewing these 15 dividend stocks with yields > 3%. This may help anchor your portfolio with reliable cash flows.

- Capitalize on powerful technology trends by assessing these 26 AI penny stocks. These companies are shaping the next wave of productivity and innovation.

- Hunt for mispriced opportunities using these 908 undervalued stocks based on cash flows. These may offer attractive upside if the market closes the valuation gap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com