Middle Eastern Dividend Stocks To Consider In December 2025

As the Middle Eastern markets experience an upward trend, buoyed by expectations of a U.S. Federal Reserve rate cut, investors are increasingly turning their attention to dividend stocks as a stable income source amidst fluctuating economic conditions. In this environment, selecting dividend stocks with strong fundamentals and consistent payout histories can provide a reliable avenue for income generation and portfolio diversification.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.49% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.37% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.76% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.49% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.54% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.12% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.05% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.40% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.79% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.99% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Middle Eastern Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

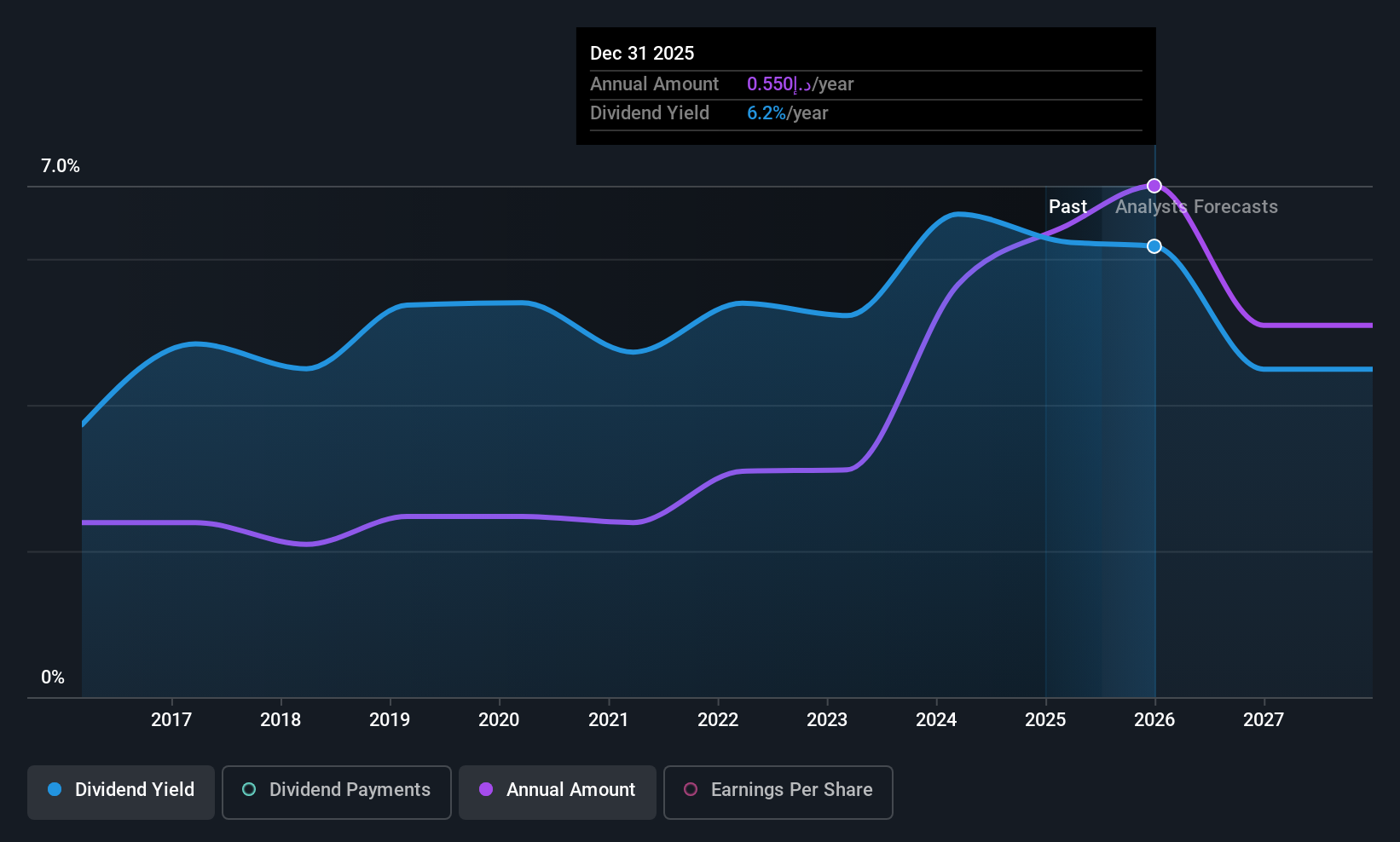

Commercial Bank of Dubai PSC (DFM:CBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Commercial Bank of Dubai PSC offers commercial and retail banking services in the United Arab Emirates with a market capitalization of AED28.03 billion.

Operations: The revenue segments for Commercial Bank of Dubai PSC consist of Personal Banking at AED2.13 billion, Corporate Banking at AED1.33 billion, and Institutional Banking at AED1.48 billion.

Dividend Yield: 5.4%

Commercial Bank of Dubai PSC offers a stable dividend profile, with reliable and growing payments over the past decade. Its current payout ratio of 46.7% suggests dividends are well-covered by earnings, projected to remain sustainable with a future payout forecast at 39.3%. Despite offering a lower yield (5.4%) compared to top-tier payers in the AE market, its price-to-earnings ratio (8.6x) indicates good value relative to the market average (11.7x). However, high non-performing loans (4%) and low bad loan allowance (93%) may warrant caution. Recent earnings growth further supports its dividend reliability.

- Dive into the specifics of Commercial Bank of Dubai PSC here with our thorough dividend report.

- According our valuation report, there's an indication that Commercial Bank of Dubai PSC's share price might be on the expensive side.

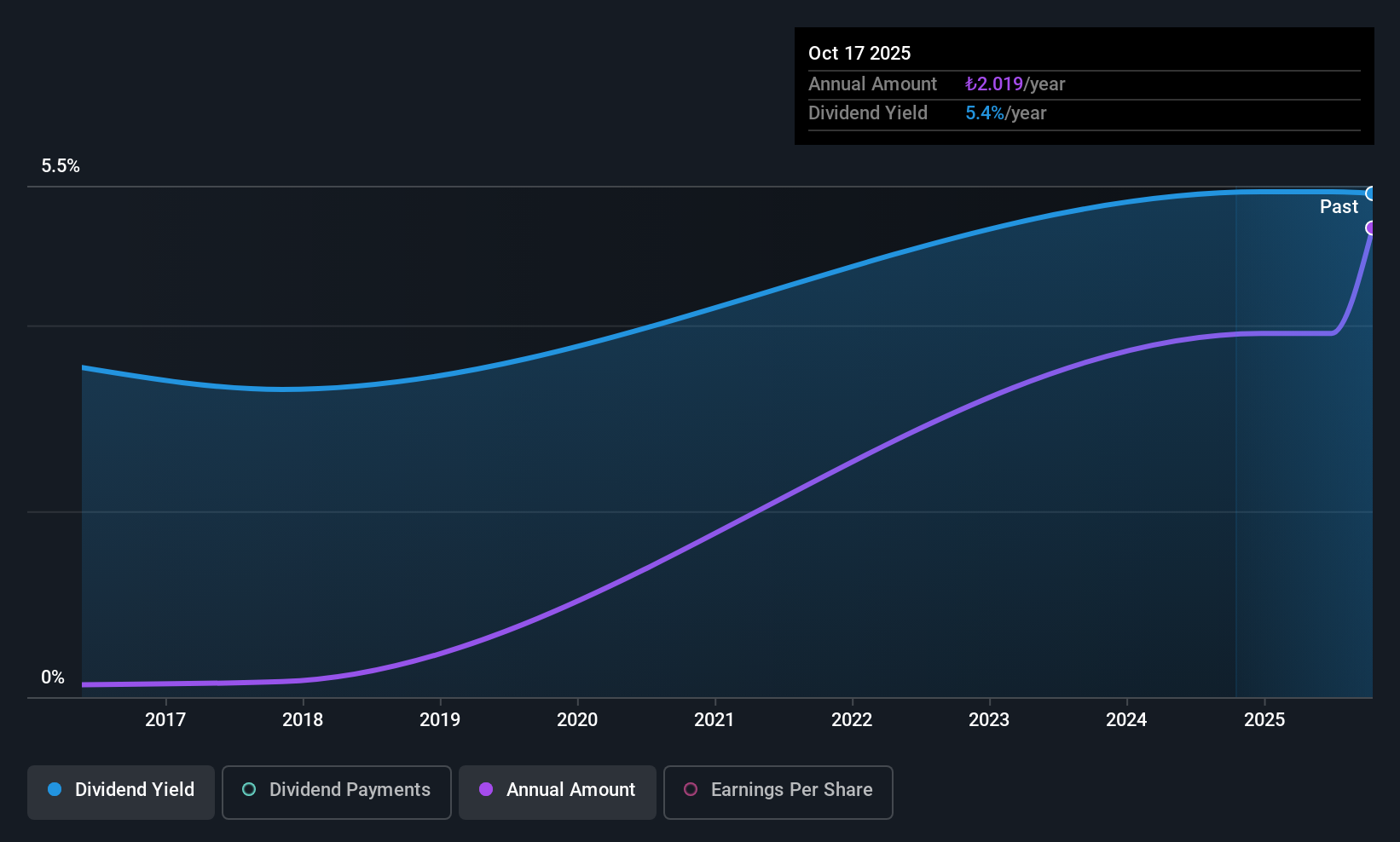

Turcas Petrol (IBSE:TRCAS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Turcas Petrol A.S. is a Turkish investment company engaged in the petrol and energy sectors, with a market capitalization of TRY10.78 billion.

Operations: Turcas Petrol A.S. generates its revenue primarily from investments in the petrol and energy sectors in Turkey.

Dividend Yield: 4.4%

Turcas Petrol's dividend yield of 4.37% ranks in the top 25% of Turkish dividend payers, yet its sustainability is questionable due to lack of free cash flows and earnings coverage. Despite a low payout ratio (26.9%), dividends have been volatile over the past decade. Recent earnings showed a decline in quarterly net income to TRY 405.82 million from TRY 626.68 million year-on-year, though nine-month figures were stable at TRY 804.65 million, indicating potential challenges in maintaining consistent dividends.

- Click to explore a detailed breakdown of our findings in Turcas Petrol's dividend report.

- Our valuation report unveils the possibility Turcas Petrol's shares may be trading at a premium.

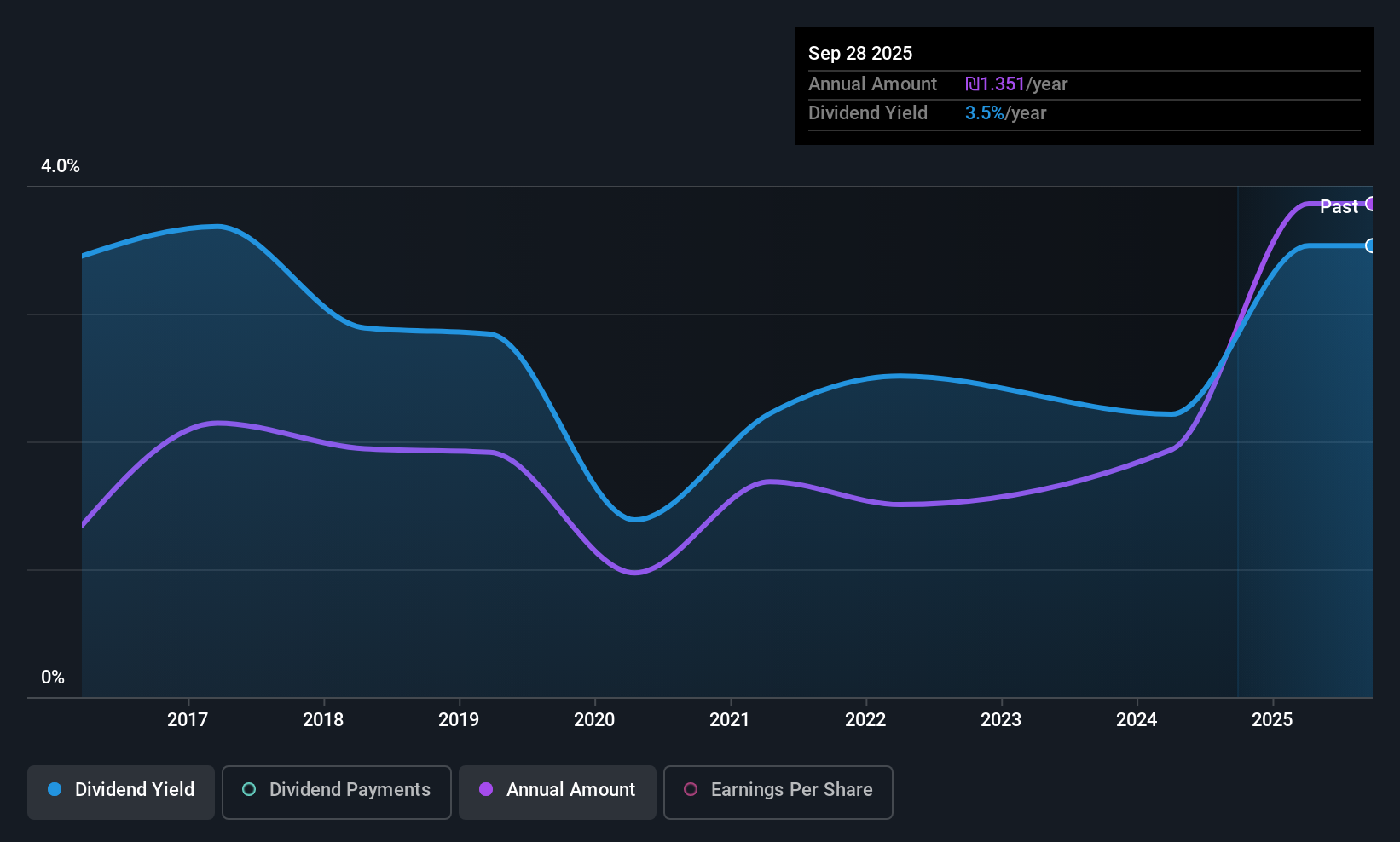

Shufersal (TASE:SAE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shufersal Ltd. operates a chain of supermarkets under the Shufersal brand name in Israel, with a market cap of ₪10.67 billion.

Operations: Shufersal Ltd.'s revenue primarily comes from its retail chains, generating ₪14.58 billion, with an additional contribution of ₪275 million from its real estate sector.

Dividend Yield: 3.4%

Shufersal's dividend prospects are mixed; while its cash payout ratio of 21% suggests strong coverage by free cash flows, the 81.3% earnings payout ratio raises sustainability concerns. Dividends have grown over the past decade but remain volatile and unreliable. Recent earnings show a decline in quarterly net income to ILS 152 million from ILS 237 million year-on-year, though nine-month figures are stable at ILS 499 million, reflecting potential challenges in maintaining dividend stability.

- Navigate through the intricacies of Shufersal with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Shufersal shares in the market.

Where To Now?

- Delve into our full catalog of 59 Top Middle Eastern Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com