3 Asian Dividend Stocks With Yields Up To 7.9%

As global markets keep a close eye on interest rate decisions and economic indicators, Asian economies are navigating their own unique challenges and opportunities. Amidst this backdrop, dividend stocks in Asia offer a compelling option for investors seeking income, particularly as they can provide stability through regular payouts even when market conditions fluctuate.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.92% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.51% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.97% | ★★★★★★ |

| NCD (TSE:4783) | 4.44% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.72% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.81% | ★★★★★★ |

Click here to see the full list of 1035 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Lion Rock Group (SEHK:1127)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lion Rock Group Limited is an investment holding company that offers printing services to international book publishers and media companies, with a market cap of HK$1.07 billion.

Operations: Lion Rock Group Limited generates revenue from its primary segments, with Printing contributing HK$1.77 billion and Publishing adding HK$875.57 million.

Dividend Yield: 7.9%

Lion Rock Group's dividend payments are well covered by earnings and cash flows, with payout ratios of 39.1% and 26.6%, respectively, placing it among top dividend payers in Hong Kong. However, its dividends have been volatile over the past decade. Recent board changes include the appointment of Ms. Ng Cheuk Hei as an independent non-executive director to strengthen governance, while Mr. Chu transitions to a non-executive role, maintaining strategic influence within the company’s subsidiary Asia Pacific Offset Limited.

- Delve into the full analysis dividend report here for a deeper understanding of Lion Rock Group.

- Our expertly prepared valuation report Lion Rock Group implies its share price may be lower than expected.

Sanyo Shokai (TSE:8011)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanyo Shokai Ltd. is a Japanese company involved in the manufacture and sale of men's and women's clothing and accessories, with a market capitalization of ¥36.69 billion.

Operations: Sanyo Shokai Ltd.'s revenue primarily comes from its Fashion Related segment, totaling ¥59.67 billion.

Dividend Yield: 3.9%

Sanyo Shokai's dividend payments have been volatile and are not covered by free cash flows, although they are supported by earnings with a payout ratio of 66.4%. The dividend yield of 3.88% is competitive within Japan's market. Recent share buybacks totaling ¥1.635 billion aimed to enhance shareholder returns but faced criticism for favoring a major shareholder, prompting calls for broader repurchase actions to ensure fairness and uphold shareholder value.

- Click to explore a detailed breakdown of our findings in Sanyo Shokai's dividend report.

- Our comprehensive valuation report raises the possibility that Sanyo Shokai is priced higher than what may be justified by its financials.

TS Financial Holding (TWSE:2887)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TS Financial Holding Co., Ltd. (TWSE:2887) operates through its subsidiaries to offer a range of financial products and services, with a market cap of approximately NT$478.68 billion.

Operations: TS Financial Holding Co., Ltd. generates revenue through its subsidiaries, with contributions of NT$8.15 billion from Taishin Life and NT$5.27 billion from Taishin Securities Merger.

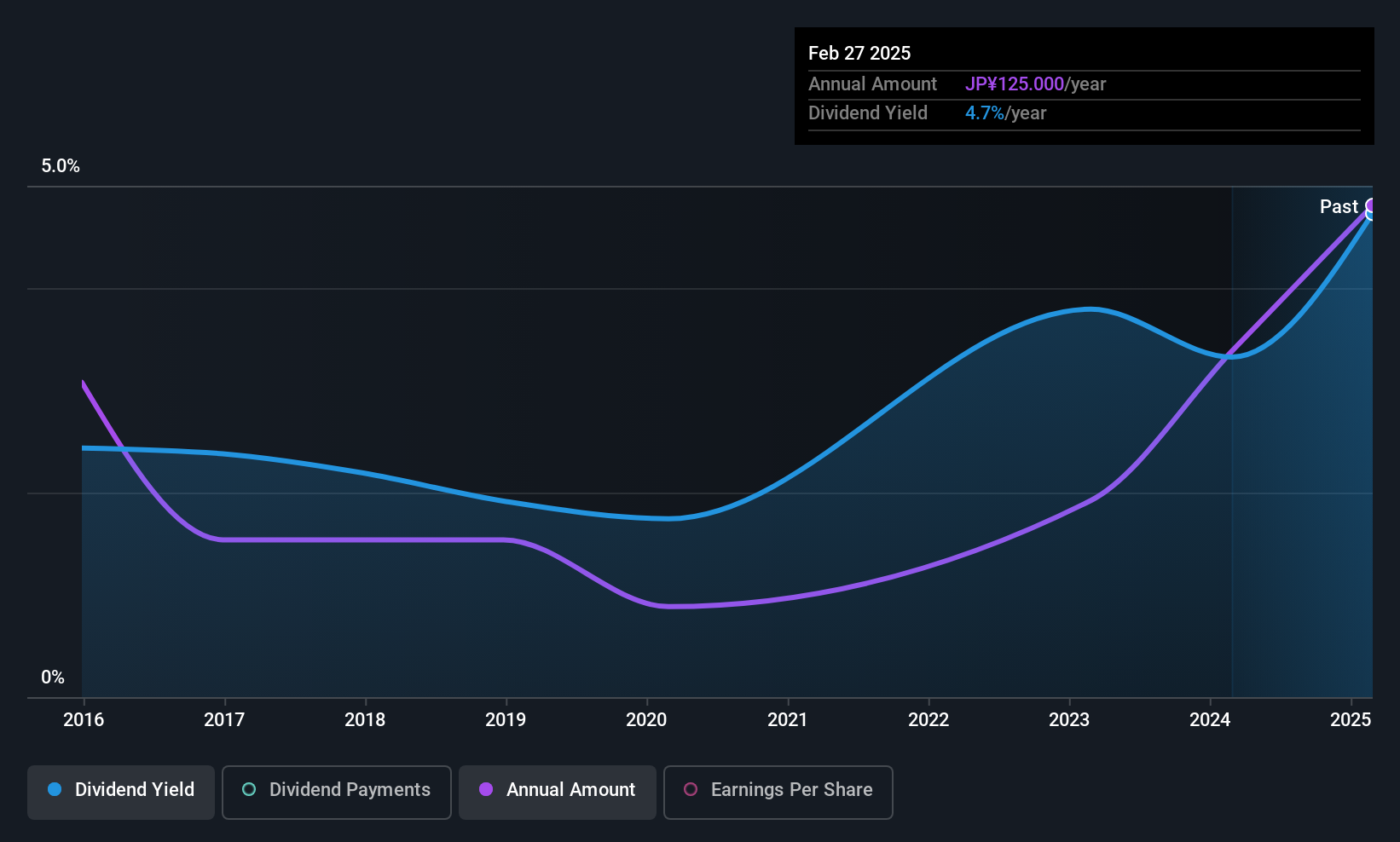

Dividend Yield: 4.7%

TS Financial Holding's recent earnings report shows significant growth, with net income rising to TWD 12.39 billion for Q3 2025. Despite a dividend yield of 4.68%, which is below the top quartile in Taiwan, dividends are covered by earnings with a payout ratio of 58%. However, dividend payments have been volatile over the past decade, and funding primarily through external borrowing poses higher risk compared to customer deposits. The stock trades below its estimated fair value.

- Take a closer look at TS Financial Holding's potential here in our dividend report.

- Upon reviewing our latest valuation report, TS Financial Holding's share price might be too optimistic.

Turning Ideas Into Actions

- Reveal the 1035 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com