3 Asian Stocks Estimated To Be Up To 36.2% Below Intrinsic Value

As Asian markets navigate a landscape marked by mixed economic signals and evolving monetary policies, investors are increasingly focused on identifying opportunities that may be undervalued relative to their intrinsic worth. In this context, understanding the fundamentals of a stock becomes crucial, as it can help uncover potential value in an environment where market conditions are constantly shifting.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥154.08 | CN¥302.65 | 49.1% |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.73 | CN¥9.38 | 49.6% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥81.57 | CN¥161.77 | 49.6% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.05 | CN¥26.06 | 49.9% |

| Meitu (SEHK:1357) | HK$7.51 | HK$14.61 | 48.6% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩29250.00 | ₩56972.54 | 48.7% |

| Japan Eyewear Holdings (TSE:5889) | ¥1975.00 | ¥3843.99 | 48.6% |

| East Buy Holding (SEHK:1797) | HK$20.42 | HK$40.27 | 49.3% |

| China Ruyi Holdings (SEHK:136) | HK$2.45 | HK$4.81 | 49.1% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.28 | CN¥55.83 | 49.3% |

We'll examine a selection from our screener results.

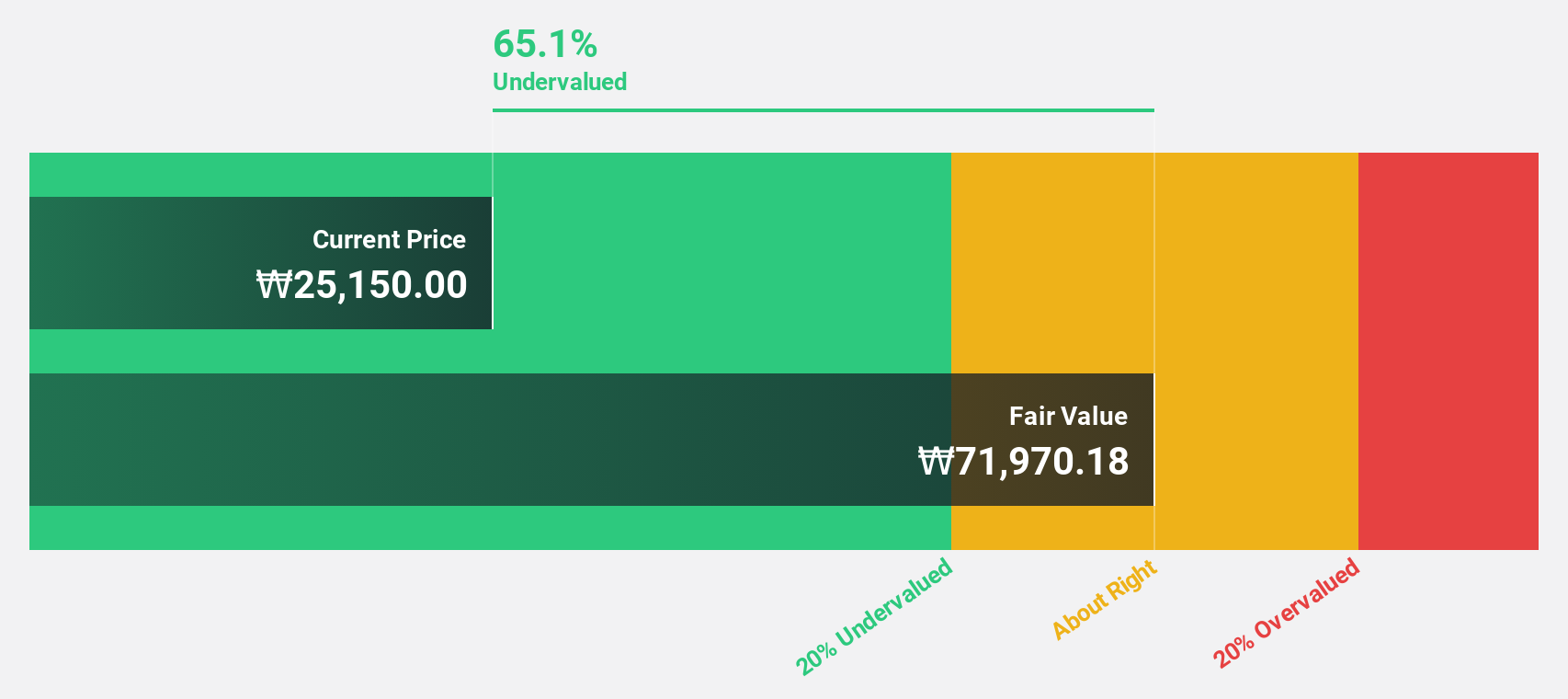

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a pharmaceutical company that manufactures and sells pharmaceutical products both in South Korea and internationally, with a market cap of approximately ₩2.59 trillion.

Operations: Hanall Biopharma generates revenue through the manufacturing and sale of pharmaceutical products domestically and internationally.

Estimated Discount To Fair Value: 12%

Hanall Biopharma's recent profitability and earnings growth highlight its potential as an undervalued stock based on cash flows. Despite trading at ₩51,100, below the estimated fair value of ₩58,048.36, the discount is modest at 12%. The company reported a turnaround with net income of KRW 690.22 million for the nine months ended September 2025 compared to a loss last year. Earnings are projected to grow significantly by over 50% annually in the near term.

- Our expertly prepared growth report on Hanall Biopharma implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Hanall Biopharma with our detailed financial health report.

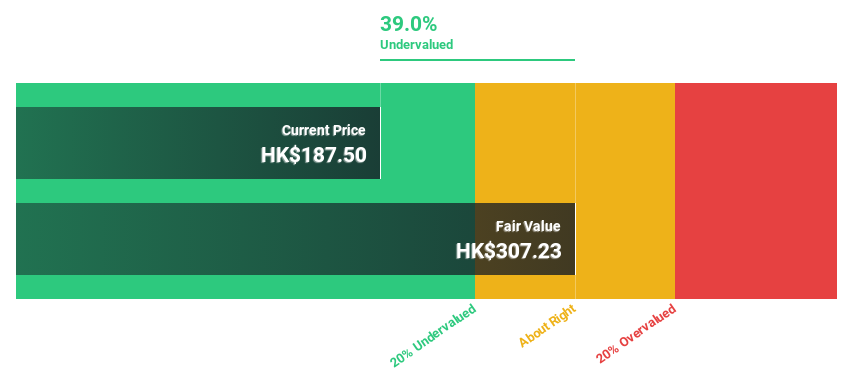

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the R&D, manufacturing, and commercialization of novel drugs in oncology and immunology both in China and internationally, with a market cap of approximately HK$107.27 billion.

Operations: The company's revenue is derived from its pharmaceuticals segment, totaling CN¥1.50 billion.

Estimated Discount To Fair Value: 30.2%

Sichuan Kelun-Biotech Biopharmaceutical's strategic partnerships and pipeline advancements underscore its status as an undervalued stock based on cash flows. The company, trading at HK$460, is valued below its estimated fair value of HK$658.7. Recent collaborations, such as with Crescent Biopharma for oncology therapeutics development and a $185 million private placement, enhance its growth prospects. Forecasts indicate revenue growth of 36.2% annually and profitability within three years, surpassing market averages in Hong Kong.

- According our earnings growth report, there's an indication that Sichuan Kelun-Biotech Biopharmaceutical might be ready to expand.

- Take a closer look at Sichuan Kelun-Biotech Biopharmaceutical's balance sheet health here in our report.

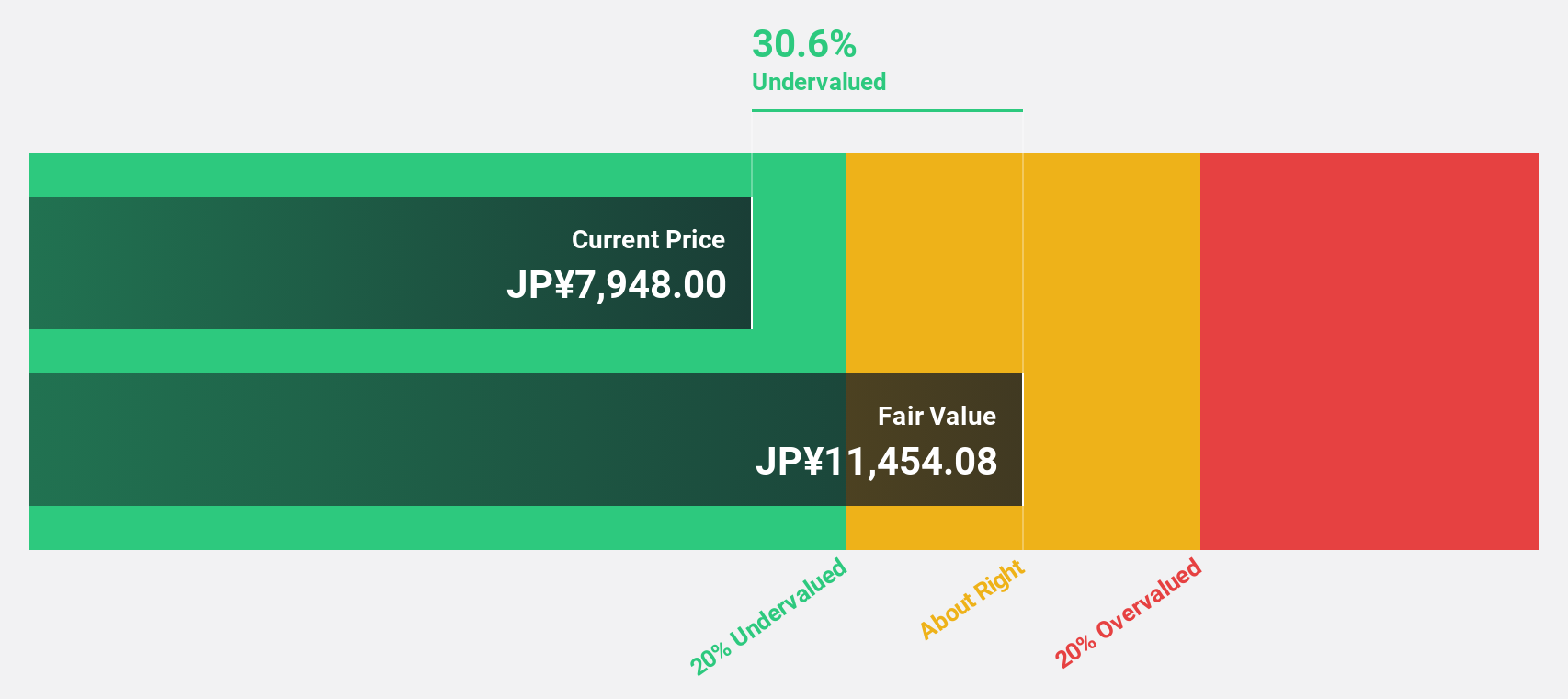

Recruit Holdings (TSE:6098)

Overview: Recruit Holdings Co., Ltd. offers HR technology and business solutions aimed at transforming the world of work, with a market cap of ¥11.67 trillion.

Operations: The company's revenue is derived from three main segments: Staffing at ¥1.66 billion, HR Technology at ¥1.26 billion, and Marketing Matching Technologies at ¥688.75 million.

Estimated Discount To Fair Value: 36.2%

Recruit Holdings is trading at ¥8,249, significantly below its estimated fair value of ¥12,922.48, highlighting its undervaluation based on cash flows. Recent guidance revisions project revenue and profit growth for the fiscal year ending March 2026. The company's share repurchase program aims to enhance shareholder returns and capital efficiency. Despite recent volatility, earnings grew by 19.6% last year and are expected to outpace the Japanese market with a forecasted annual growth of 9.9%.

- Our comprehensive growth report raises the possibility that Recruit Holdings is poised for substantial financial growth.

- Navigate through the intricacies of Recruit Holdings with our comprehensive financial health report here.

Turning Ideas Into Actions

- Investigate our full lineup of 276 Undervalued Asian Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com