Investors Holding Back On United Internet AG (ETR:UTDI)

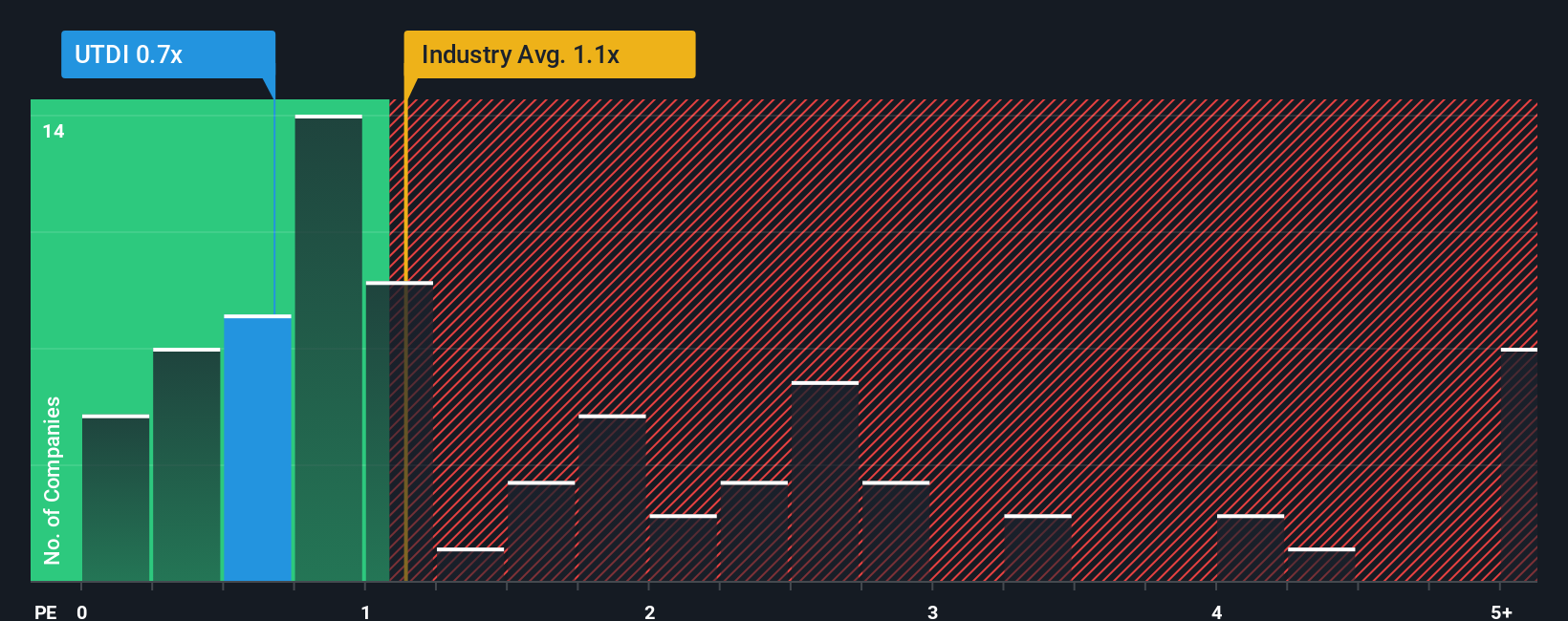

It's not a stretch to say that United Internet AG's (ETR:UTDI) price-to-sales (or "P/S") ratio of 0.7x seems quite "middle-of-the-road" for Telecom companies in Germany, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for United Internet

How Has United Internet Performed Recently?

Recent revenue growth for United Internet has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on United Internet will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on United Internet will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For United Internet?

In order to justify its P/S ratio, United Internet would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.9%. The latest three year period has also seen a 8.9% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 3.9% per year over the next three years. With the industry only predicted to deliver 1.7% each year, the company is positioned for a stronger revenue result.

In light of this, it's curious that United Internet's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does United Internet's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that United Internet currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You always need to take note of risks, for example - United Internet has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.