EchoStar (SATS) Is Up 11.9% After SpaceX and AT&T Spectrum Deals Shift Its Asset Mix

- EchoStar recently completed spectrum deals with SpaceX and AT&T, receiving cash, a sizable SpaceX equity stake and fresh capital to help manage its debt load and support future projects.

- This new financial and ownership link to privately held SpaceX, whose valuation has reportedly risen very sharply, is reshaping how investors view EchoStar’s asset base and growth options.

- Next, we’ll examine how EchoStar’s growing exposure to SpaceX recalibrates its investment narrative around spectrum monetization and capital allocation.

Find companies with promising cash flow potential yet trading below their fair value.

EchoStar Investment Narrative Recap

To own EchoStar today, you need to believe its spectrum portfolio and satellite capabilities can be translated into tangible cash flows, while the balance sheet pressures get contained. The recent SpaceX and AT&T spectrum deals directly support the near term catalyst of spectrum monetization and debt reduction, but they do not fully remove the biggest risk around heavy debt maturities, ongoing losses and funding needs for its LEO direct to device ambitions.

The creation of EchoStar Capital, with a dedicated leadership team focused on capital allocation, now looks especially relevant alongside the SpaceX and AT&T transactions. It gives the company an internal vehicle to manage proceeds from spectrum sales, its SpaceX stake and any future asset moves in a more focused way, which could influence how quickly EchoStar addresses its funding gap for LEO investments and its efforts to stabilize the core business.

Yet investors should also be aware of how EchoStar’s sizable upcoming debt maturities could interact with its new exposure to SpaceX and...

Read the full narrative on EchoStar (it's free!)

EchoStar's narrative projects $16.0 billion revenue and $1.6 billion earnings by 2028.

Uncover how EchoStar's forecasts yield a $79.83 fair value, a 3% downside to its current price.

Exploring Other Perspectives

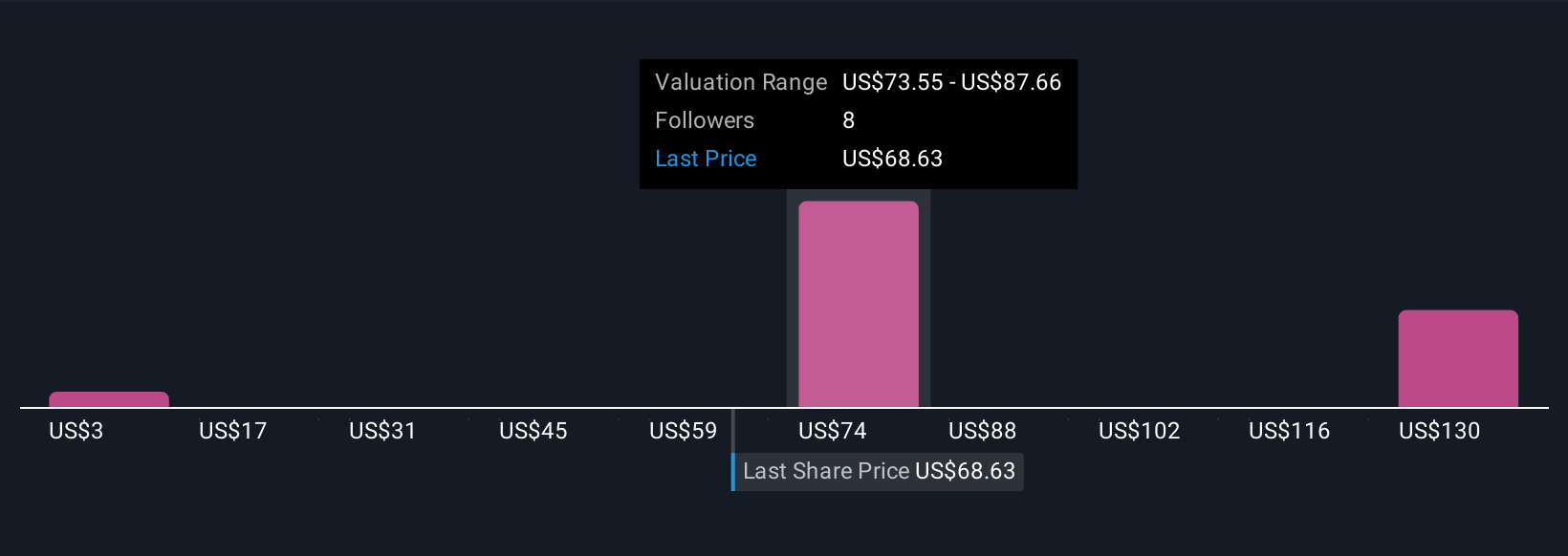

Five members of the Simply Wall St Community value EchoStar between US$2.98 and US$156.99, underscoring how far opinions can diverge. Set that against EchoStar’s heavy debt load and funding needs, and it becomes even more important to compare several independent views on what could drive its future performance.

Explore 5 other fair value estimates on EchoStar - why the stock might be worth as much as 91% more than the current price!

Build Your Own EchoStar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EchoStar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free EchoStar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EchoStar's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com