Steven Madden (SHOO): Reassessing Valuation After Mixed Q3 Results and Kurt Geiger-Driven Guidance Boost

Steven Madden (SHOO) just delivered a mixed third quarter, with softer revenue but upbeat guidance that leans heavily on its Kurt Geiger acquisition, and investors are now trying to price that shift in momentum.

See our latest analysis for Steven Madden.

That upbeat Kurt Geiger driven outlook helps explain why the stock has surged. A 90 day share price return of 43.87 percent and a 3 year total shareholder return of 43.17 percent suggest momentum is rebuilding after a quieter year.

If this mix of fashion and accelerating sentiment has your attention, it could be a good moment to look beyond footwear and explore fast growing stocks with high insider ownership.

Yet with the shares now trading close to Wall Street’s target and earnings still lagging revenue growth, investors face a tougher call: is Steven Madden still undervalued, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 30% Overvalued

With Steven Madden closing at $43.88 against a narrative fair value of $43.75, the story leans toward a modestly stretched valuation driven by ambitious recovery assumptions.

Analysts have nudged their average price target on Steven Madden modestly higher to $43, citing a series of upgrades and target raises into the low to mid $40s as they gain confidence in margin recovery, faster inventory turns, and the company's longer term earnings power.

Want to see what is really behind this seemingly precise fair value line? The narrative quietly blends robust earnings growth, expanding margins, and a future valuation multiple that looks more like a quality compounder than a cyclical fashion name. Curious how those moving parts stack up over the next few years and why they point to this specific fair value range instead of something far higher or far lower.

Result: Fair Value of $43.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff uncertainty and slower than expected margin recovery could quickly undermine these optimistic assumptions and force a rethink on fair value.

Find out about the key risks to this Steven Madden narrative.

Another View, Deep Discount on Cash Flows

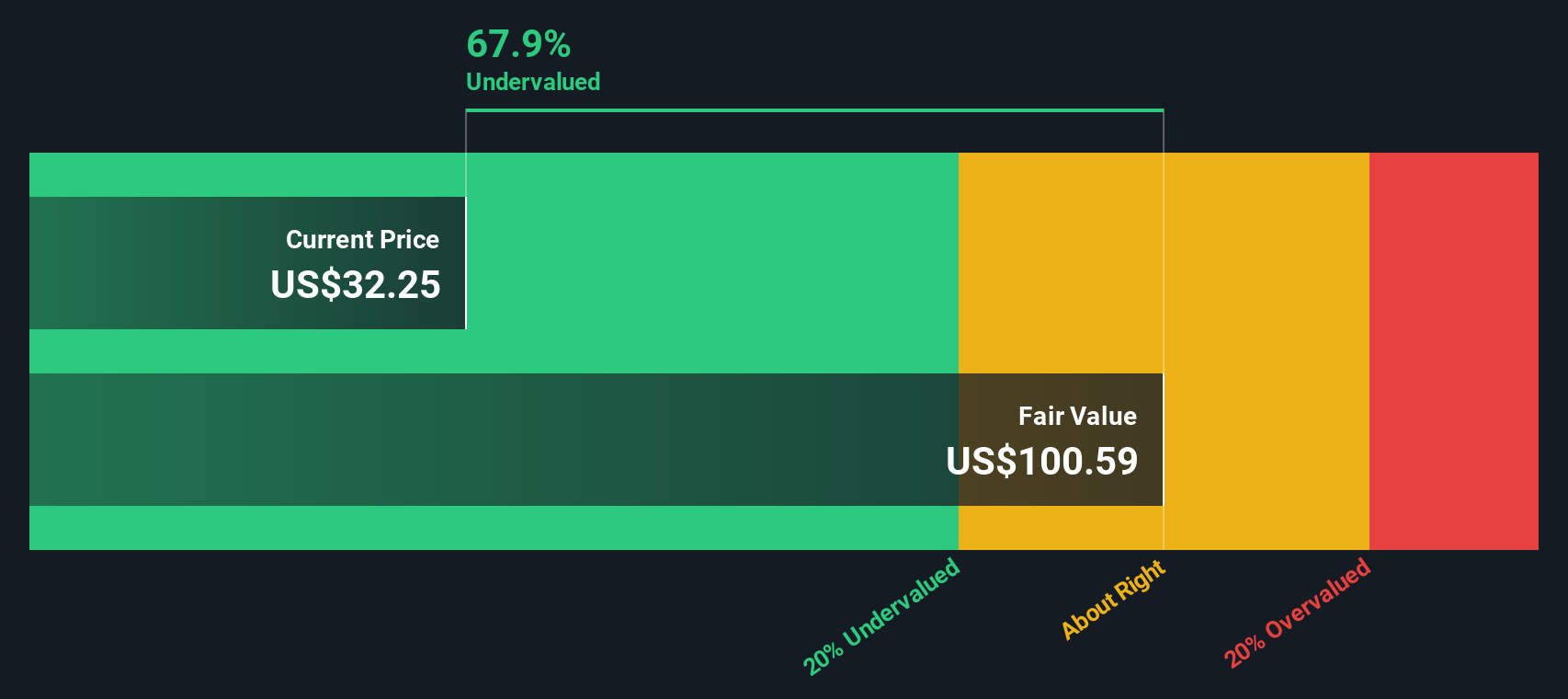

While the narrative fair value suggests Steven Madden is roughly 30 percent overvalued, our DCF model paints a very different picture, implying the shares trade about 61 percent below intrinsic value at $111.87. This raises an important question: Is the market underestimating future cash flows, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Steven Madden for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Steven Madden Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Steven Madden research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to uncover focused, data driven stock ideas tailored to your strategy.

- Target income potential with these 15 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow while still keeping quality front and center.

- Ride structural growth trends by zeroing in on these 26 AI penny stocks shaping how businesses, consumers, and entire industries use intelligent technology.

- Strengthen your margin of safety using these 905 undervalued stocks based on cash flows that the market may be overlooking based on their future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com