Does Silver Tiger Metals' (TSXV:SLVR) CA$40 Million Equity Raise Reframe Its Long-Term Funding Story?

- Silver Tiger Metals Inc. recently completed a follow-on equity offering of CA$40.00 million at CA$0.73 per share and reported a reduced quarterly net loss of CA$924,249 for the period ended September 30, 2025.

- The combination of fresh equity capital, slightly lower losses, and heightened visibility from recent mining conference presentations may reshape how investors view the company’s funding runway and project ambitions.

- We’ll now explore how the new CA$40.00 million equity raise influences Silver Tiger Metals’ investment narrative amid these recent corporate updates.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Silver Tiger Metals' Investment Narrative?

For someone looking at Silver Tiger Metals, the big picture is still about believing that the El Tigre silver gold project can move from permits and studies to a real mine. The recent CA$40.00 million equity raise, combined with slightly lower quarterly losses and fresh conference exposure, meaningfully extends the funding runway and takes some pressure off near term financing risk, even if it does come with additional dilution on top of this year’s prior raise. With environmental approvals in hand and a PFS that outlines defined project economics, near term catalysts now tilt more toward construction decisions, project financing structures, and any progress on the planned underground assessment, rather than survival funding. The biggest risks remain execution, permitting compliance, and value erosion if more equity is needed later on.

However, there is a key funding trade off here that investors should be aware of. Despite retreating, Silver Tiger Metals' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

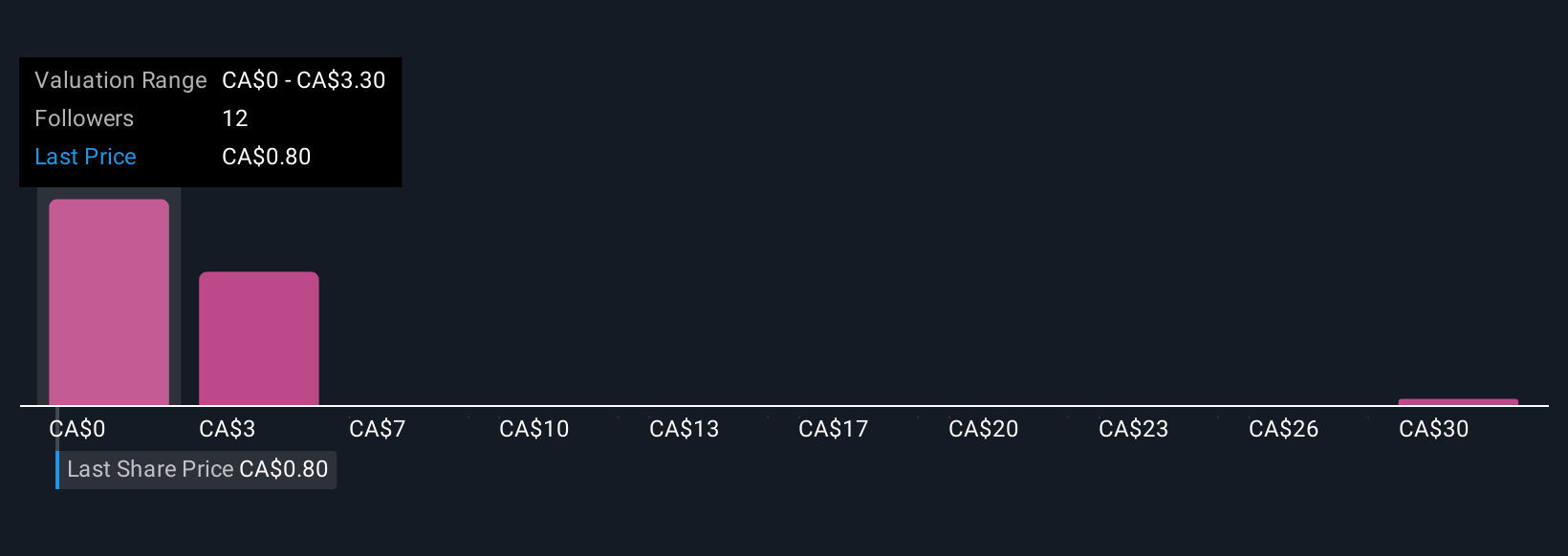

Seven fair value estimates from the Simply Wall St Community span roughly CA$3.30 to CA$33.00 per share, showing how far apart individual views on Silver Tiger’s upside really are. When you set that against the recent CA$40.00 million equity raise and the ongoing risk of future dilution, it underlines why many market participants are focusing on how capital intensive the path to first production could become.

Explore 7 other fair value estimates on Silver Tiger Metals - why the stock might be a potential multi-bagger!

Build Your Own Silver Tiger Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silver Tiger Metals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Silver Tiger Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silver Tiger Metals' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com