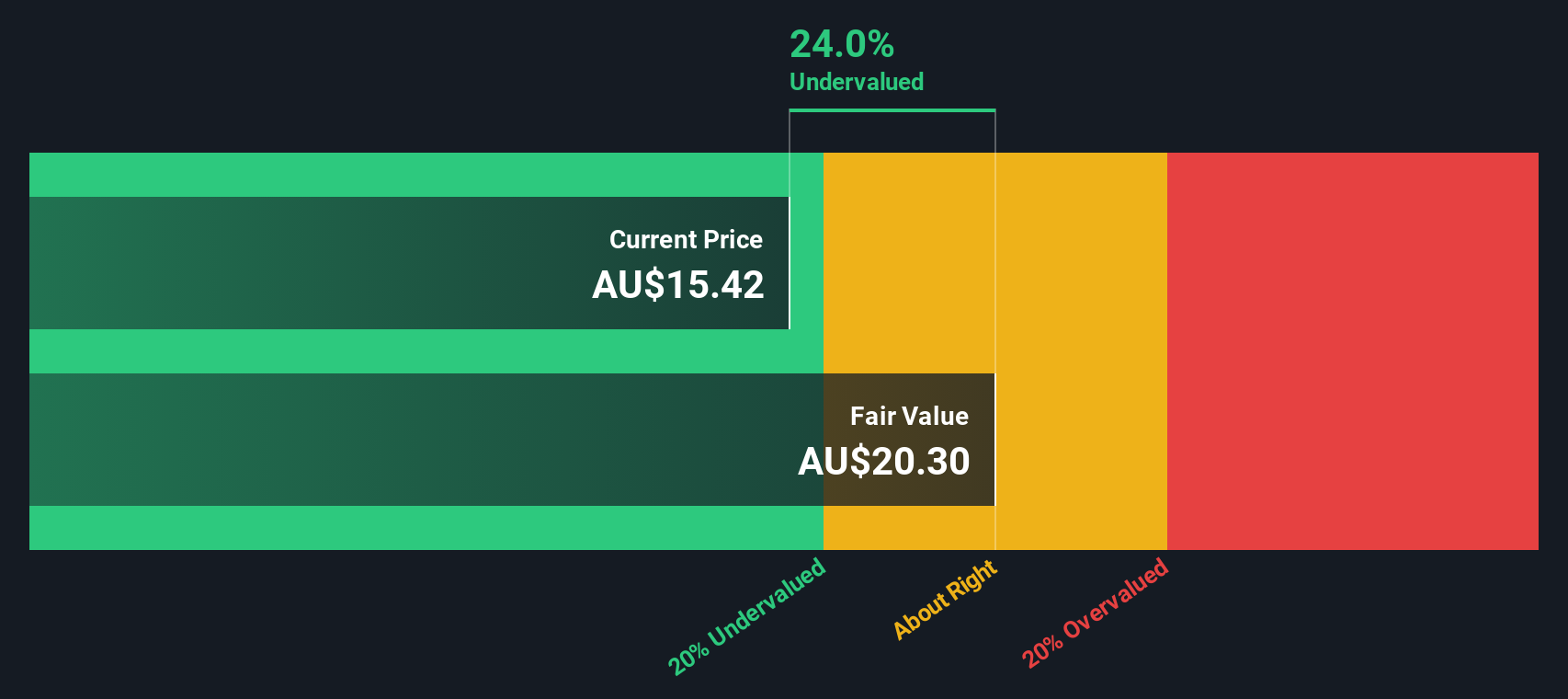

Premier Investments (ASX:PMV) Valuation After A$100m Buyback And Softer First-Half Earnings Outlook

Premier Investments (ASX:PMV) has put a A$100 million on market share buyback on the table just as it guides to weaker first half earnings, a combination that is getting investors attention.

See our latest analysis for Premier Investments.

The new buyback lands after a bruising stretch for investors, with Premier’s share price down sharply year to date and over the past quarter, even as its five year total shareholder return remains positive and recent earnings guidance has cooled momentum.

If this mix of pressure and opportunity has you rethinking your watchlist, it could be worth scanning fast growing stocks with high insider ownership for other ideas where insiders are backing the growth story with their own capital.

With Premier trading well below analyst targets but bracing for softer earnings, are investors being offered a mispriced retail turnaround, or is the market simply marking down a stock whose best growth is already reflected?

Price-to-Earnings of 16.9x: Is it justified?

On a headline basis, Premier Investments looks inexpensive, with its 16.9x price to earnings ratio sitting below both peers and the wider specialty retail sector.

The price to earnings multiple compares what investors pay today for each dollar of current earnings, a core yardstick for mature, profitable retailers like Premier. Given the company is forecast to grow earnings at a mid single digit to high single digit pace, the current discount suggests the market is reluctant to fully price in that outlook.

Stacking Premier against its competitive set sharpens that picture. Its 16.9x multiple trails the Australian Specialty Retail industry average of 22.4x and even the peer average of 19x. Relative to an estimated fair price to earnings ratio of 22.2x, there is a valuation gap that could narrow if earnings stabilise and sentiment improves.

Explore the SWS fair ratio for Premier Investments

Result: Price-to-Earnings of 16.9x (UNDERVALUED)

However, softer near term earnings and ongoing share price weakness could signal structural pressure on key brands, which may limit any valuation catch up.

Find out about the key risks to this Premier Investments narrative.

Another View: What Our DCF Model Suggests

While the 16.9x price to earnings ratio points to value, our DCF model is even more optimistic, placing fair value for Premier Investments around A$25.54, roughly 40% above the current A$15.22 share price. Is the market mispricing steady, slower growth, or sensing deeper risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Premier Investments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Premier Investments Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a personalised narrative in just minutes: Do it your way.

A great starting point for your Premier Investments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Put your research momentum to work now by using targeted screeners on Simply Wall St, so you do not miss high quality opportunities beyond Premier Investments.

- Target compelling value setups by scanning these 905 undervalued stocks based on cash flows that pair solid fundamentals with meaningful upside potential based on cash flows.

- Capture disruptive innovation by filtering for these 26 AI penny stocks that are positioned to benefit from accelerating adoption of artificial intelligence across industries.

- Support your income strategy by reviewing these 15 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com