Assessing CRA International (CRAI)’s Valuation After Its Strong Three-Year Shareholder Returns

CRA International (CRAI) has quietly rewarded patient shareholders, with the stock up around 5% over the past month and roughly 72% over the past 3 years, outpacing many consulting peers.

See our latest analysis for CRA International.

Zooming out, CRA International’s $189.31 share price sits on the back of a modest year to date share price return but a much stronger three year total shareholder return, suggesting longer term momentum is still firmly intact.

If CRA International has piqued your interest, this is a good moment to see what else the market is rewarding and explore fast growing stocks with high insider ownership.

With CRA International trading at a sizeable discount to analyst targets while also boasting robust multi year returns, investors now face a key question: Is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 24.1% Undervalued

With CRA International last closing at $189.31 against a narrative fair value of $249.50, the valuation view leans optimistic and hinges on specific growth levers.

The boom in global M&A activity, with worldwide dealmaking up 33% year over year in the first half of 2025, is creating a greater need for expert economic and legal analysis on cross border transactions, positioning CRA to win more high value assignments and drive incremental revenue.

Want to see what underpins this gap between current price and fair value? The narrative leans on steady top line expansion, resilient margins, and a richer future earnings multiple. Curious how those moving parts combine to justify a premium valuation path over time?

Result: Fair Value of $249.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could falter if global M&A and antitrust activity slows meaningfully, or if rising talent costs compress CRA International’s margins.

Find out about the key risks to this CRA International narrative.

Another Take On Value

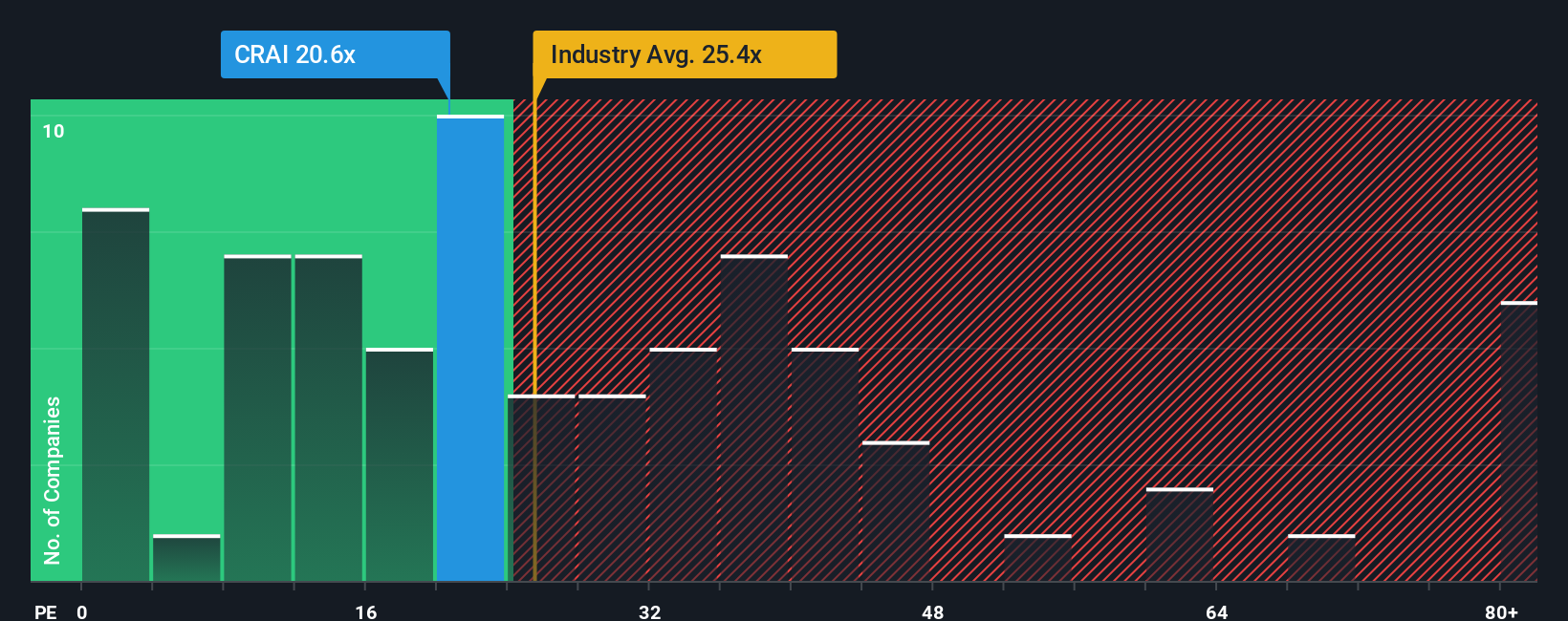

While the narrative fair value marks CRA International as 24.1% undervalued, its current price to earnings ratio of about 22 times screens as expensive versus a fair ratio of 18 times, even if it still looks cheaper than peers. Could sentiment be running ahead of fundamentals here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CRA International Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding CRA International.

Looking for more investment ideas?

Right now is the moment to widen your opportunity set, because some of the market’s most compelling themes are hiding in plain sight on the Simply Wall Street Screener.

- Capture powerful long term growth trends by reviewing these 26 AI penny stocks that benefit from accelerating adoption of intelligent software and automation.

- Lock in potential income streams by scanning these 15 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow.

- Position ahead of possible re ratings by analyzing these 905 undervalued stocks based on cash flows before the wider market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com