CONMED (CNMD) Is Down 10.0% After Exiting Gastroenterology To Refocus On Minimally Invasive Surgery

- In early December 2025, Olympus, W. L. Gore & Associates, and CONMED announced that U.S. commercial support and distribution of the GORE VIABIL biliary stent will shift from CONMED to Olympus on January 1, 2026, with CONMED continuing full product support through December 31, 2025.

- At the same time, CONMED confirmed it will exit its gastroenterology product lines altogether, aiming to improve its gross margin profile and concentrate resources on minimally invasive, robotic, and laparoscopic surgery offerings despite investor concerns about losing a meaningful revenue stream.

- We’ll now explore how CONMED’s exit from gastroenterology reshapes its investment narrative, especially its focus on higher-growth minimally invasive surgery.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CONMED Investment Narrative Recap

To own CONMED, you need to believe the company can pivot away from lower-margin gastroenterology toward its core minimally invasive, robotic and laparoscopic surgery platforms, while fixing profitability. The exit from gastroenterology looks more like a clean-up of the portfolio than a shift in the core thesis, though it does raise near term questions about replacing lost revenue and managing already thin margins after a difficult earnings year.

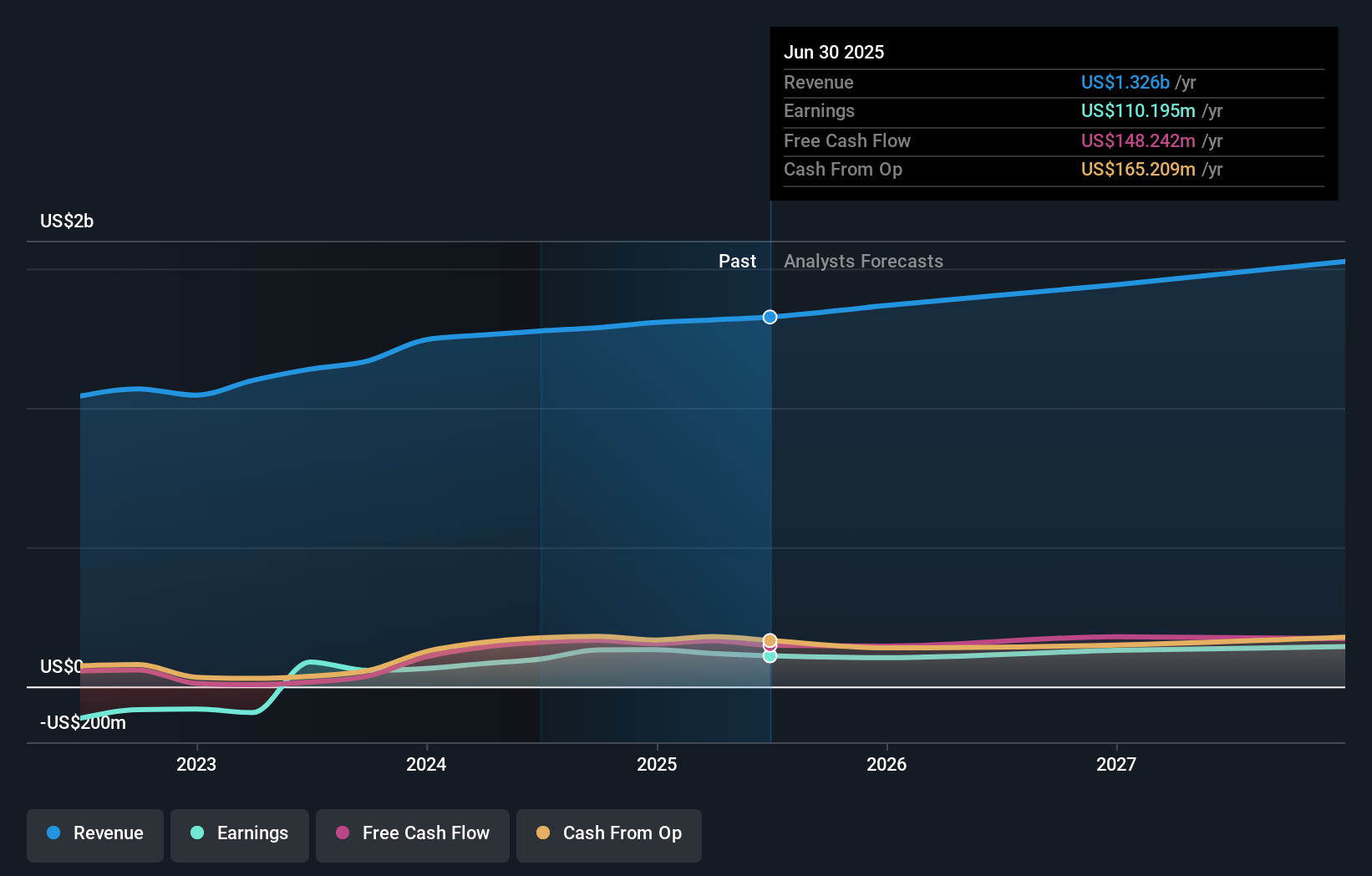

The most relevant recent update here is management’s reaffirmed 2025 revenue guidance of US$1.365 billion to US$1.372 billion and adjusted EPS of US$4.48 to US$4.53, even as it exits gastroenterology and absorbs tariff-related EPS pressure. That stance ties the gastro exit directly to the key short term catalyst: proving that operational improvements and higher value products like AirSeal and Buffalo Filter can offset lost sales while lifting margins.

Yet behind that confidence, investors still need to be aware of the risk that elevated SG&A and R&D spending, plus ongoing transformation costs, could...

Read the full narrative on CONMED (it's free!)

CONMED's narrative projects $1.6 billion revenue and $154.0 million earnings by 2028. This requires 5.7% yearly revenue growth and a roughly $43.8 million earnings increase from $110.2 million.

Uncover how CONMED's forecasts yield a $54.00 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster tightly around US$54 to US$55 per share, underscoring how differently individual investors can view the same numbers. You should weigh those views against the central catalyst that CONMED must show its minimally invasive surgery focus can support growth while absorbing the earnings drag from exiting gastroenterology, since that is likely to shape how the stock behaves over time.

Explore 2 other fair value estimates on CONMED - why the stock might be worth just $54.00!

Build Your Own CONMED Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CONMED research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free CONMED research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CONMED's overall financial health at a glance.

No Opportunity In CONMED?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com