W. R. Berkley (WRB): Valuation Check After Special Dividend and Strong Quarterly Underwriting, Investment Gains

W. R. Berkley (WRB) just put extra cash on the table, declaring a 1 dollar per share special dividend alongside its regular payout, after another solid quarter of underwriting and investment income growth.

See our latest analysis for W. R. Berkley.

Despite the special and regular dividends highlighting management confidence and Mitsui Sumitomo taking a sizable stake, the stock has cooled off recently. Short term share price returns are negative, even as multi year total shareholder returns remain strong, suggesting momentum is pausing rather than breaking.

If this kind of steady compounder has your attention, it could be a good moment to see what else is working in financials and beyond via fast growing stocks with high insider ownership

With the shares now trading at a double digit discount to analyst targets, but a rich multi year run behind them, is W. R. Berkley still quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 10.1% Undervalued

With the narrative fair value sitting above the latest 66.72 dollar close, the valuation case leans on margins and earnings power holding up into a softer cycle.

Prudent capital management, shown by a growing investment portfolio benefitting from higher new money yields and conservative reserving, is increasing investment income and book value per share, laying a foundation for higher long term earnings and the potential for resumed share buybacks.

Curious how flat revenue, rising margins, and a richer future earnings multiple can still point to upside from here? The narrative unpacks the math and the assumptions driving that conclusion. Want to see which levers really move the fair value line?

Result: Fair Value of $74.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, underwriting discipline could erode as competition and pricing soften, while elevated social inflation may pressure loss trends and squeeze those projected margin gains.

Find out about the key risks to this W. R. Berkley narrative.

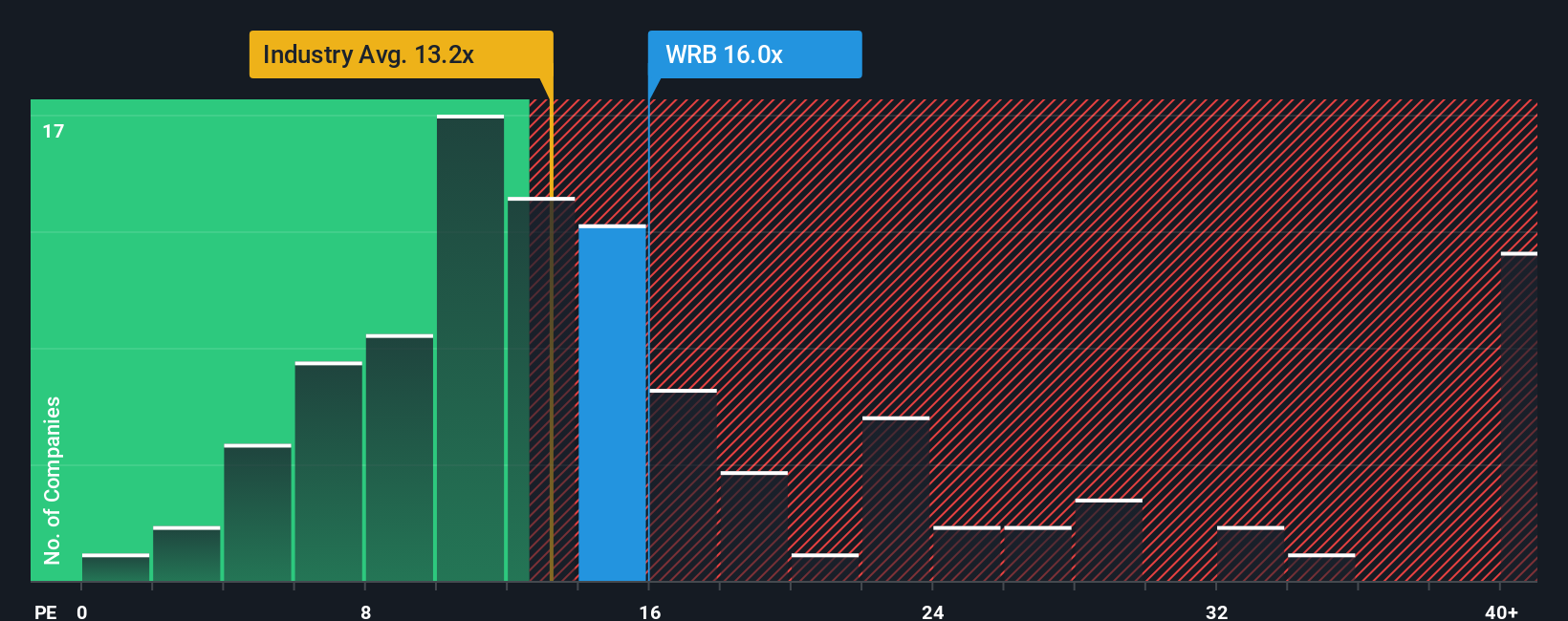

Another View: Market Ratios Flash a Caution Sign

On simple earnings ratios, the story looks very different. WRB trades at about 13.3 times earnings, above both the US insurance average and peers at 12.8 times, and above its own fair ratio of 12.8 times, pointing to a modest valuation premium rather than a clear bargain.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W. R. Berkley Narrative

If you see the story differently or want to stress test the numbers yourself, you can create your own W. R. Berkley view in minutes with Do it your way

A great starting point for your W. R. Berkley research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single insurer, use the Simply Wall St Screener to lock onto fresh opportunities before the crowd moves and potential gains slip away.

- Capture powerful compounding potential by targeting income focused companies through these 15 dividend stocks with yields > 3% that balance yield with resilient business models.

- Ride structural growth trends by zeroing in on innovators at the frontier of automation and machine learning via these 26 AI penny stocks.

- Position ahead of broad market re ratings by scanning these 905 undervalued stocks based on cash flows that trade below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com