Taking Stock of Coastal Financial (CCB) Valuation After TD Cowen’s Reaffirmed Buy and Growth Outlook

Coastal Financial (CCB) is back on investors radar after TD Cowen reiterated a bullish stance, pointing to faster revenue growth, slower expense creep, and an improving earnings trajectory, even as the Chief Risk Officer departs.

See our latest analysis for Coastal Financial.

The latest bullish commentary appears to be reinforcing a trend that was already in motion, with Coastal’s share price up 33.71 percent year to date and a striking 52.76 percent total shareholder return over the past twelve months. This suggests momentum is still building rather than fading.

If Coastal’s run has you thinking more broadly about financial growth stories, it could be a good time to explore fast growing stocks with high insider ownership for other potentially overlooked opportunities.

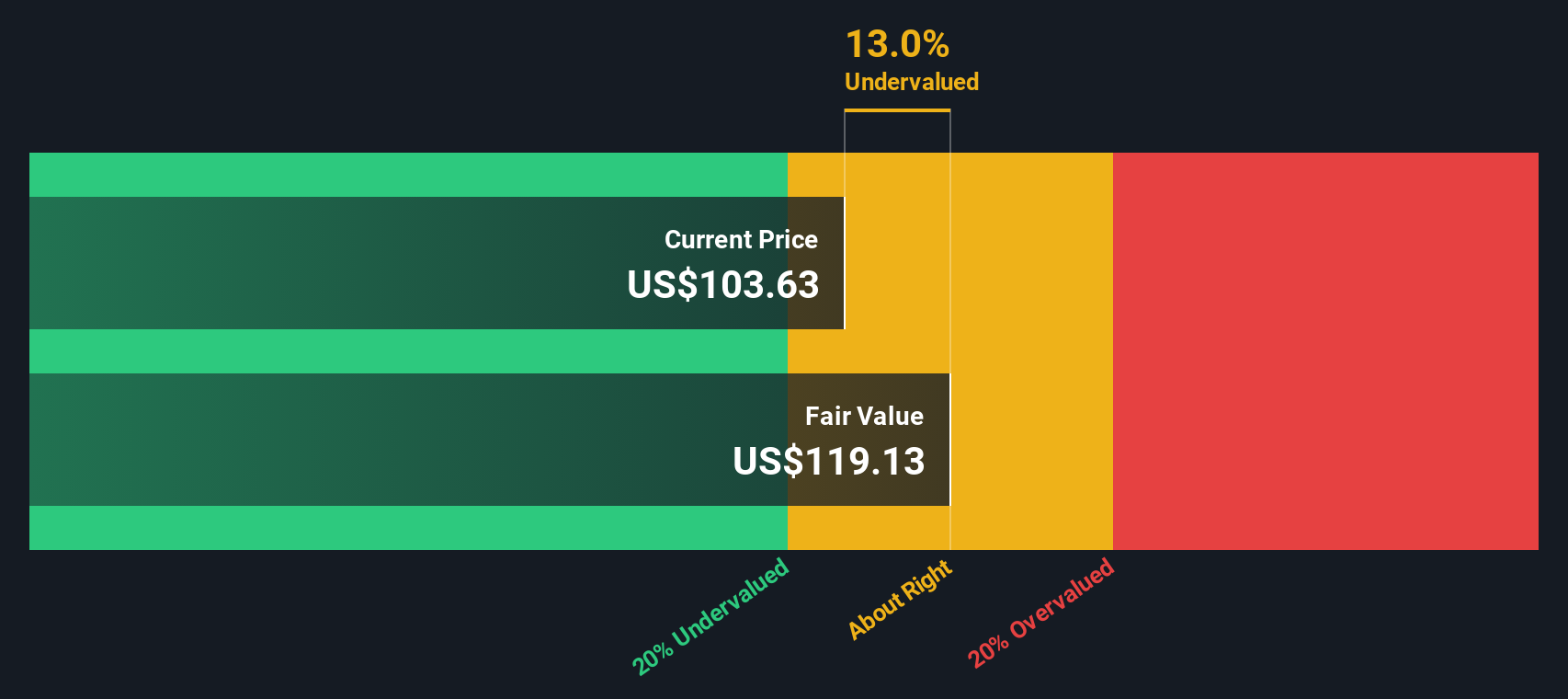

With the stock already up sharply and trading at only a modest discount to analysts targets, investors now face a key question: Is Coastal still undervalued, or are markets already pricing in years of future growth?

Price to Earnings of 35.9x: Is it justified?

On a headline basis, Coastal Financial looks richly priced, with its 35.9x price to earnings multiple sitting well above the recent 113.32 dollars share price context and pointing to an optimistic earnings outlook relative to peers.

The price to earnings ratio compares what investors pay today for each dollar of current earnings, a key lens for assessing banks where profitability and credit quality can swing quickly. For Coastal, a 35.9x multiple suggests the market is assigning a premium to its earnings stream rather than treating it as a typical regional bank.

That premium appears to reflect confidence in the company’s ability to grow faster than most banks, but it also means expectations are set high. The multiple is not just elevated versus the US Banks industry average of 11.6x, it is also significantly above an estimated fair price to earnings ratio of 22.1x that our models suggest the market could ultimately gravitate toward if growth or sentiment normalise.

Compared with both the broader US Banks industry average of 11.6x and a peer average of 12.5x, Coastal’s 35.9x multiple stands out as aggressively priced, implying investors are prepared to pay roughly three times the going rate for bank earnings in anticipation of outsized growth.

Explore the SWS fair ratio for Coastal Financial

Result: Price to Earnings of 35.9x (OVERVALUED)

However, several risks could challenge this premium, including a sudden slowdown in revenue growth or regulatory scrutiny related to its Banking as a Service platform.

Find out about the key risks to this Coastal Financial narrative.

Another View, our DCF model

While the price to earnings lens suggests expensive, our DCF model points the other way, indicating that Coastal is trading about 16.3 percent below an estimated fair value of 135.35 dollars. If the projected cash flows materialise, today’s rich multiple could represent a discounted entry point.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coastal Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coastal Financial Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can put together a personalised view in just a few minutes: Do it your way.

A great starting point for your Coastal Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Coastal has sharpened your appetite for opportunity, do not stop here. The next wave of potential winners is waiting for investors willing to act now.

- Capture potential bargains before the crowd by reviewing these 905 undervalued stocks based on cash flows that the market may be mispricing relative to their future cash flows.

- Target cutting edge innovation by focusing on these 26 AI penny stocks at the forefront of next generation artificial intelligence breakthroughs.

- Lock in potential income streams by assessing these 15 dividend stocks with yields > 3% that combine attractive yields with the strength to sustain payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com