How Investors Are Reacting To Getty Realty (GTY) Locking In US$250 Million Of Unsecured Debt

- Earlier this month, Getty Realty Corp. entered into a Note Purchase Agreement for US$250 million of senior unsecured notes to repay revolving credit facility borrowings and fund general corporate purposes.

- By locking in this unsecured funding, Getty Realty is reshaping its debt mix in a way that could influence its investment capacity and risk profile.

- We'll now examine how this new US$250 million unsecured financing affects Getty Realty's investment narrative, particularly its balance sheet strength.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Getty Realty Investment Narrative Recap

To own Getty Realty, you need to believe in the resilience of convenience and auto-focused net lease properties in the face of structural shifts like EV adoption and changing mobility habits. The new US$250,000,000 senior unsecured notes mainly refine Getty’s capital structure in the near term rather than materially altering the key catalyst of continued acquisition-driven growth or the major risk of long-term pressure on legacy fuel-oriented sites.

The recent expansion and extension of Getty’s revolving credit facility in January 2025 is particularly relevant here, as it set the stage for today’s funding move by increasing liquidity and pushing out near-term maturities. Taken together, the larger revolver and the new unsecured notes give Getty more room to support its acquisition pipeline, even as competition for deals and tighter cap rates could affect the returns on new investments.

But while the funding picture looks stronger, investors should also be aware of the longer term risk that...

Read the full narrative on Getty Realty (it's free!)

Getty Realty's narrative projects $252.2 million revenue and $92.5 million earnings by 2028.

Uncover how Getty Realty's forecasts yield a $32.14 fair value, a 15% upside to its current price.

Exploring Other Perspectives

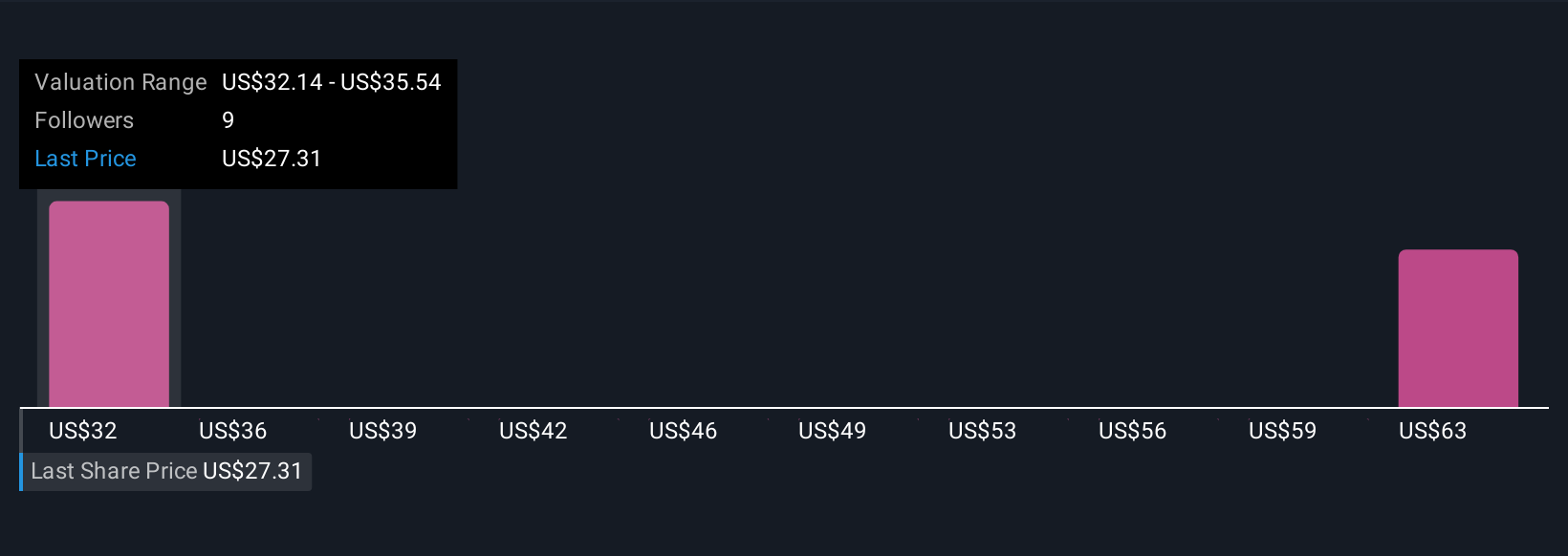

Simply Wall St Community members have only two fair value estimates for Getty Realty, ranging from US$32.14 to US$67.09, underscoring how far apart individual views can be. When you set those numbers against the company’s reliance on acquisition driven growth in a market where competition for assets can compress returns, it becomes clear why it helps to weigh several perspectives before forming your own view.

Explore 2 other fair value estimates on Getty Realty - why the stock might be worth just $32.14!

Build Your Own Getty Realty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Getty Realty research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Getty Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Getty Realty's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com