Flughafen Zürich AG's (VTX:FHZN) Shares May Have Run Too Fast Too Soon

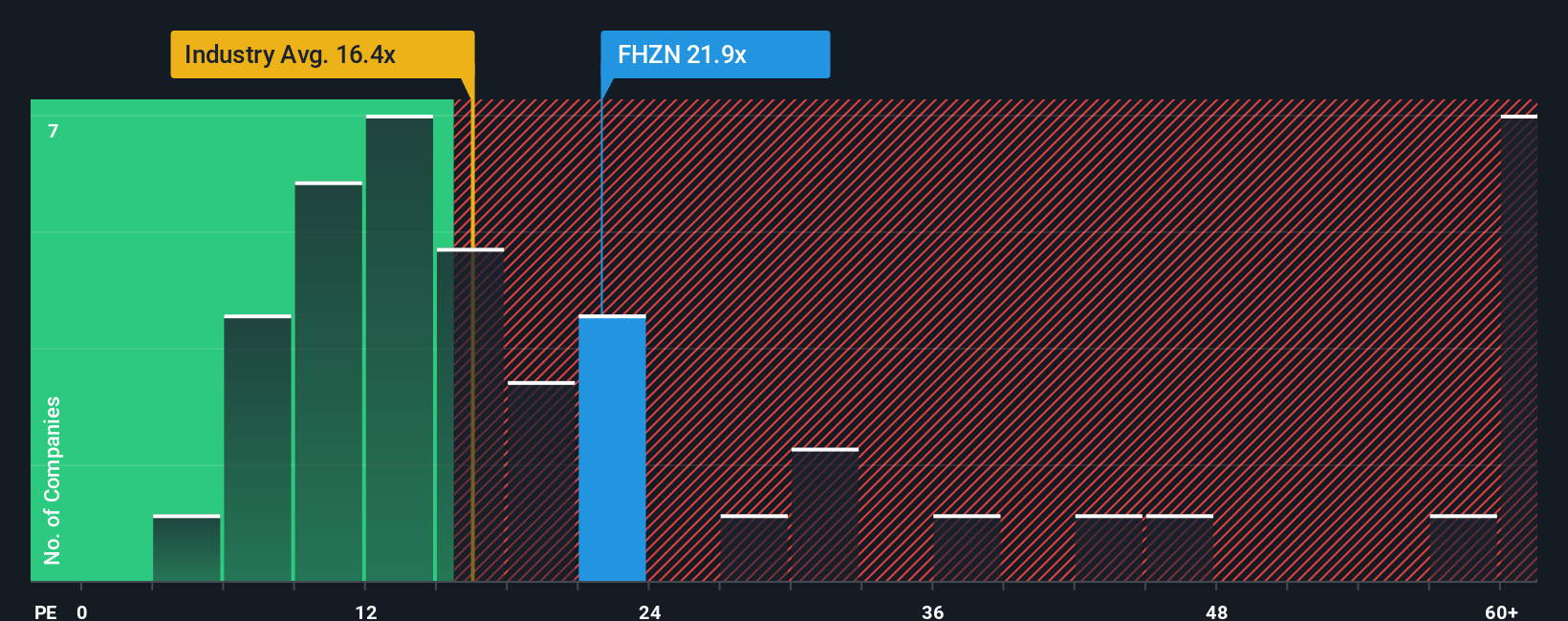

With a price-to-earnings (or "P/E") ratio of 21.9x Flughafen Zürich AG (VTX:FHZN) may be sending bearish signals at the moment, given that almost half of all companies in Switzerland have P/E ratios under 19x and even P/E's lower than 14x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Flughafen Zürich could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Flughafen Zürich

Does Growth Match The High P/E?

Flughafen Zürich's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 5.8%. Pleasingly, EPS has also lifted 272% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 2.7% per year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 12% per year growth forecast for the broader market.

In light of this, it's alarming that Flughafen Zürich's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Flughafen Zürich currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Flughafen Zürich that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.