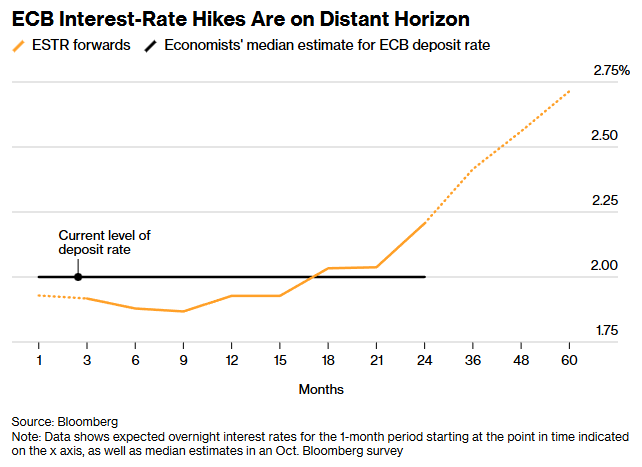

Has the policy inflection point reached? ECB hawks praise market interest rate hike bets and suggest there is no room for interest rate cuts

The Zhitong Finance App learned that ECB Executive Committee member Isabel Schnabel (Isabel Schnabel) said that investors are satisfied with their bets that the ECB's next interest rate move will be to raise interest rates. She said that although borrowing costs are at a level suitable for a period of time (unless there is a further impact), a sharp increase in consumer spending, corporate investment, and government spending on defense and infrastructure will boost the economy. “The market and survey participants all expect that the next interest rate action will be to raise interest rates, although it won't happen soon. I'm quite satisfied with these expectations”.

Schnabel was the first ECB policymaker to clearly state that borrowing costs are not only in a “favorable position” (as ECB President Lagarde and others have repeatedly emphasized), but have also bottomed out. The ECB hawkish believes that economic and inflationary risks are biased upward. She hinted that the new growth forecast could be raised during the December policy meeting.

Schnabel's confidence stems from the fact that Europe has withstood the impact of tariffs triggered by US President Trump. Consumers are benefiting from rapid wage growth and unemployment rates close to historic lows. Meanwhile, favorable financing conditions and the boom in embracing artificial intelligence (AI) technology have also boosted investment.

She said, “In the face of the biggest disruption to the international trade order since World War II, economic growth has shown far more resilience than expected.” She pointed out that the survey showed “steady expansion” before the end of the year, and “one reason why the impact of tariffs is milder than expected is that uncertainty has declined quite rapidly.”

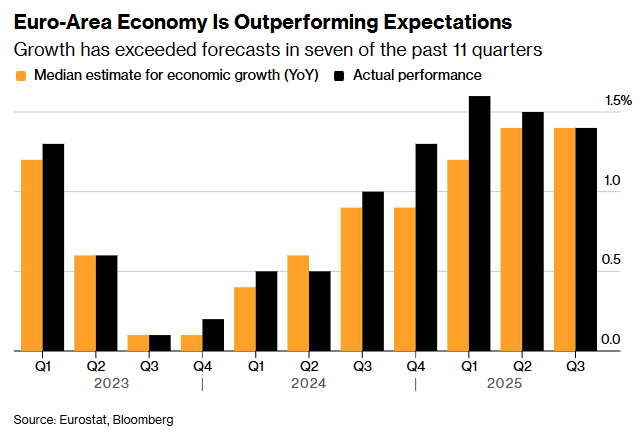

Eurozone growth exceeded expectations by 7 basis points in the past 11 quarters

The ECB's previous forecast indicates that economic growth will slow to 1% next year, then pick up again in 2027. “Since then, the outlook has become more optimistic,” Schnabel said. Data released last Friday already showed that the third quarter's performance was better than initially anticipated.

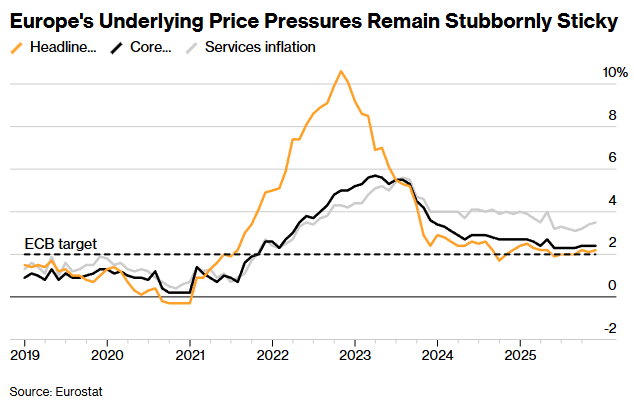

Observers will pay attention to the inflation portion of the ECB's latest economic forecast (which will be included for the first time until 2028) to determine whether falling below the 2% inflation target will be worse than previously thought. A major concern in the market is that the EU's carbon pricing system may be delayed, which could drag inflation downward in 2027.

Schnabel downplayed these concerns, arguing that as long as there is no sign that the deviation will continue, the ECB can tolerate a “moderate deviation from target.” “It's important not to be tied to a specific number,” she said. What really matters is the overall macroeconomic narrative, which reveals how the economy and inflation will evolve over time.” She added that although inflation is currently “in a good position”, service prices are still the “most important” challenge, which is due in large part to rising wages.

Eurozone core inflationary pressure remains stubborn

Meanwhile, due to a stronger euro, cheaper energy prices, and downward pressure on commodity prices caused by potential trade transfers, the impact on core inflation was less than feared. Schnabel said, “This means that in a period of economic recovery, the output gap is closing, and fiscal policy is expanding — all of these factors are usually inflationary — the decline in core inflation has stagnated. This has to be monitored very carefully.”

Schnabel declined to comment on analysts' predictions about the timing of the ECB's next interest rate action. Some are betting on raising interest rates as early as June next year. She said, “This is not something we are considering right now. The boat is naturally straight to the bridge.”

Looking ahead, Schnabel emphasized that the ECB must pay close attention to whether long-term phenomena — such as changes in economic potential and the impact of artificial intelligence — will make otherwise appropriate monetary policy settings too loose. She said, “We have to monitor whether our policies become more relaxed over time, or even too loose, and then we need to consider adjusting interest rates again.”

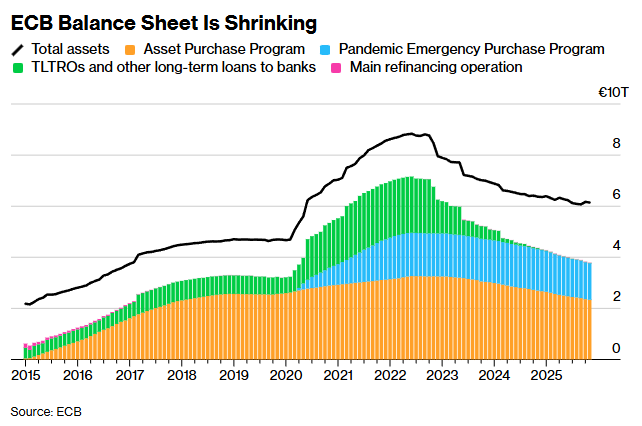

Speaking about the ECB's balance sheet, Schnabel said that the process of allowing maturing bonds to naturally shrink is progressing “smoothly,” and that stable interest rates in the money market indicate that excess liquidity is still “abundant.” This is in contrast to the US — the Federal Reserve stopped downsizing this month.

Although economists expect the ECB to follow the Federal Reserve's example in the second half of next year, Schnabel said this forecast is difficult to judge. She said, “This roughly corresponds to one end of our expected range. The other end of the range is much later.” She added that a review of the ECB's future operating framework will begin next year, but it may not be completed until 2027.