The Bull Case For Louisiana-Pacific (LPX) Could Change Following Sharp Analyst Earnings Downgrades And Zacks Rank 5

- In recent months, Louisiana-Pacific Corporation has drawn heightened attention as analysts sharply revised down near-term earnings forecasts, with Zacks assigning the stock its weakest Rank #5 rating based on these estimate cuts.

- This shift in analyst expectations underscores how quickly sentiment around Louisiana-Pacific’s earnings power can change, even as its longer-term business themes remain in focus.

- Next, we’ll examine how this downgrade in earnings expectations and Zacks Rank #5 rating may affect Louisiana-Pacific’s existing investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Louisiana-Pacific Investment Narrative Recap

To own Louisiana-Pacific, you generally need to believe in sustained demand for engineered wood siding and OSB across new construction and repair/remodel, despite cyclical housing pressure. The recent Zacks Rank #5 downgrade and weaker earnings expectations sharpen the near term risk that softer volumes and low OSB pricing keep margins under strain, but they do not fundamentally change the long term siding-led growth story or the importance of ExpertFinish as a key short term catalyst.

The most relevant recent update is management’s guidance that full year 2025 revenue should grow about 8% to roughly US$1.68 billion, with Q4 supported by continued strength in higher value ExpertFinish siding. This reinforces how much the nearer term outlook now leans on mix and pricing in siding to offset weaker OSB profitability and softer end market demand, a balance that may look more fragile in light of the recent earnings estimate cuts and Zacks Rank shift.

Yet even with this support from ExpertFinish, investors should be aware that prolonged weakness in U.S. housing starts and repair/remodel demand could...

Read the full narrative on Louisiana-Pacific (it's free!)

Louisiana-Pacific's narrative projects $3.3 billion revenue and $435.7 million earnings by 2028.

Uncover how Louisiana-Pacific's forecasts yield a $105.88 fair value, a 26% upside to its current price.

Exploring Other Perspectives

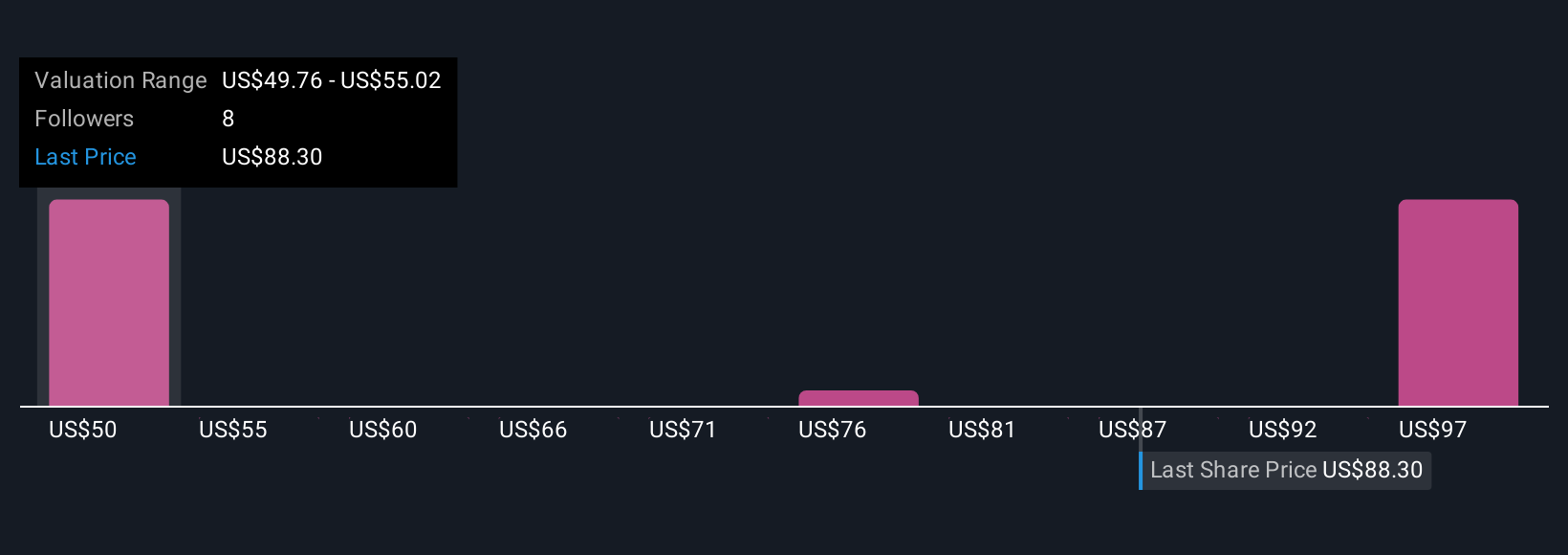

Four fair value estimates from the Simply Wall St Community span roughly US$25.68 to US$105.88 per share, highlighting sharply different views on LPX. Against this wide range, the recent earnings downgrades and concern over sustained housing and OSB pricing headwinds give you important context on how fragile near term performance could be.

Explore 4 other fair value estimates on Louisiana-Pacific - why the stock might be worth as much as 26% more than the current price!

Build Your Own Louisiana-Pacific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Louisiana-Pacific research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Louisiana-Pacific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Louisiana-Pacific's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com