Papa John's (PZZA) Valuation Check After Major Refranchising Deal and New Store Growth Plans

Papa John's International (PZZA) just handed 85 Washington, D.C. and Baltimore locations to franchise powerhouse Pie Investments and paired that move with plans for 52 new stores by 2030, reshaping its Mid Atlantic footprint.

See our latest analysis for Papa John's International.

Even with this sizable refranchising and a 52 store growth pipeline, Papa John's 90 day share price return of minus 15.6 percent and one year total shareholder return of minus 14.4 percent suggest sentiment is still cooling and investors need convincing that these moves will translate into durable earnings momentum.

If this reshuffle has you thinking about where capital may work harder, it could be worth exploring fast growing stocks with high insider ownership as a way to spot other driven owner operators with strong growth runways.

With shares lagging both recent targets and longer term returns despite refranchising momentum, the key question now is whether Papa John’s is quietly undervalued or if the market already sees and prices in its next phase of growth.

Most Popular Narrative Narrative: 13.9% Undervalued

With the most followed narrative placing fair value ahead of the recent 41.16 dollars close, the real story sits in its detailed long term assumptions.

The analysts have a consensus price target of 52.1 dollars for Papa John's International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of 67.0 dollars, and the most bearish reporting a price target of just 42.0 dollars.

To see why slower top line expectations still support a richer future earnings multiple, and which margin path underpins it all, dig into the full narrative now.

Result: Fair Value of $47.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer comparable sales and margin pressure from higher marketing and commodity costs could quickly challenge the idea that shares are simply priced on optimism rather than fundamentals.

Find out about the key risks to this Papa John's International narrative.

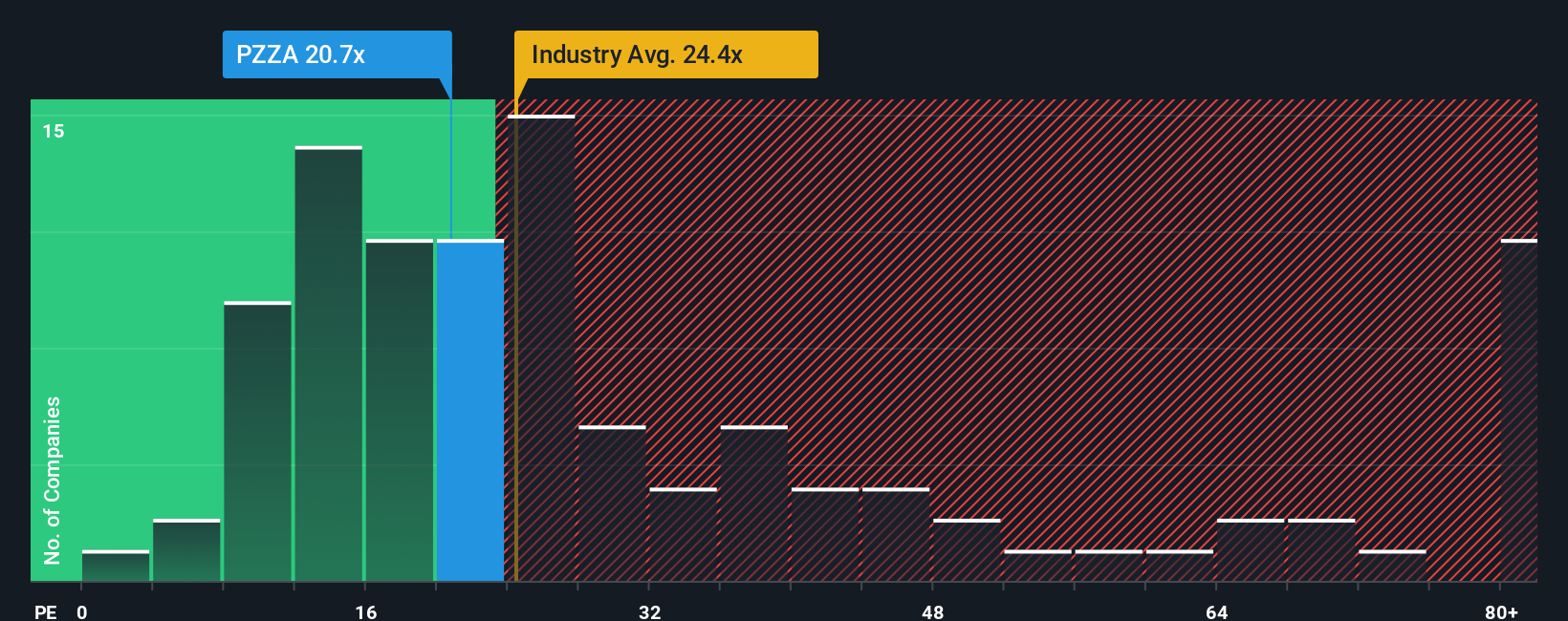

Another Lens on Valuation

Analysts may see upside, but our earnings based comparison paints a tougher picture. Papa John’s trades on 36.1 times earnings versus 23.3 times for the US hospitality sector and 13.8 times for peers, above even its 33.5 times fair ratio, raising real de rating risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Papa John's International Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in just minutes, Do it your way.

A great starting point for your Papa John's International research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put your research momentum to work by scanning powerful, pre filtered stock ideas on Simply Wall Street that many investors overlook.

- Capture potential bargains early by reviewing these 905 undervalued stocks based on cash flows that strong cash flow analysis currently flags as trading below intrinsic value.

- Position yourself ahead of structural shifts by assessing these 26 AI penny stocks that are pushing real world applications of artificial intelligence into mainstream markets.

- Boost your income strategy by targeting these 15 dividend stocks with yields > 3% with the resilience to keep paying attractive yields through different parts of the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com