Fabrinet (FN): Reviewing Valuation After a Strong Multi‑Year Share Price Run

Fabrinet (FN) has quietly turned into one of the market’s stronger compounders, with the stock gaining about 12% this year and roughly tripling over the past 3 years, driven by steady revenue and profit growth.

See our latest analysis for Fabrinet.

That steady execution has not gone unnoticed, with a 90 day share price return of almost 30% and a one year total shareholder return of around 101% signaling momentum that still looks constructive rather than exhausted.

If Fabrinet’s run has you wondering what else is working in tech hardware and communications, it might be a good time to explore high growth tech and AI stocks as your next set of ideas.

With Fabrinet now trading almost exactly at analyst targets after a powerful multi year run, investors are left to decide: is this a rare high quality compounder still misunderstood, or has the market already priced in its future growth?

Most Popular Narrative Narrative: 0.2% Undervalued

Fabrinet’s fair value estimate of $479.25 sits almost exactly on the last close at $478.45. This frames the story as a razor thin mispricing call.

The decision to accelerate capacity expansion (Building 10) due to robust customer demand and new program ramps positions Fabrinet to capture additional large-scale opportunities in AI infrastructure and next-gen telecom, likely supporting both sustained revenue growth and operating leverage as fixed costs are spread over higher output.

Want to see the math behind this near perfect price call? The narrative leans on powerful growth forecasts and a punchy future earnings multiple. Curious which assumptions really carry the weight here? Explore the details to uncover the projections that justify this tight fair value band.

Result: Fair Value of $479.25 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, customer concentration and ongoing supply bottlenecks in next generation transceivers could quickly challenge the growth assumptions that underpin Fabrinet’s near perfect valuation case.

Find out about the key risks to this Fabrinet narrative.

Another Lens on Valuation

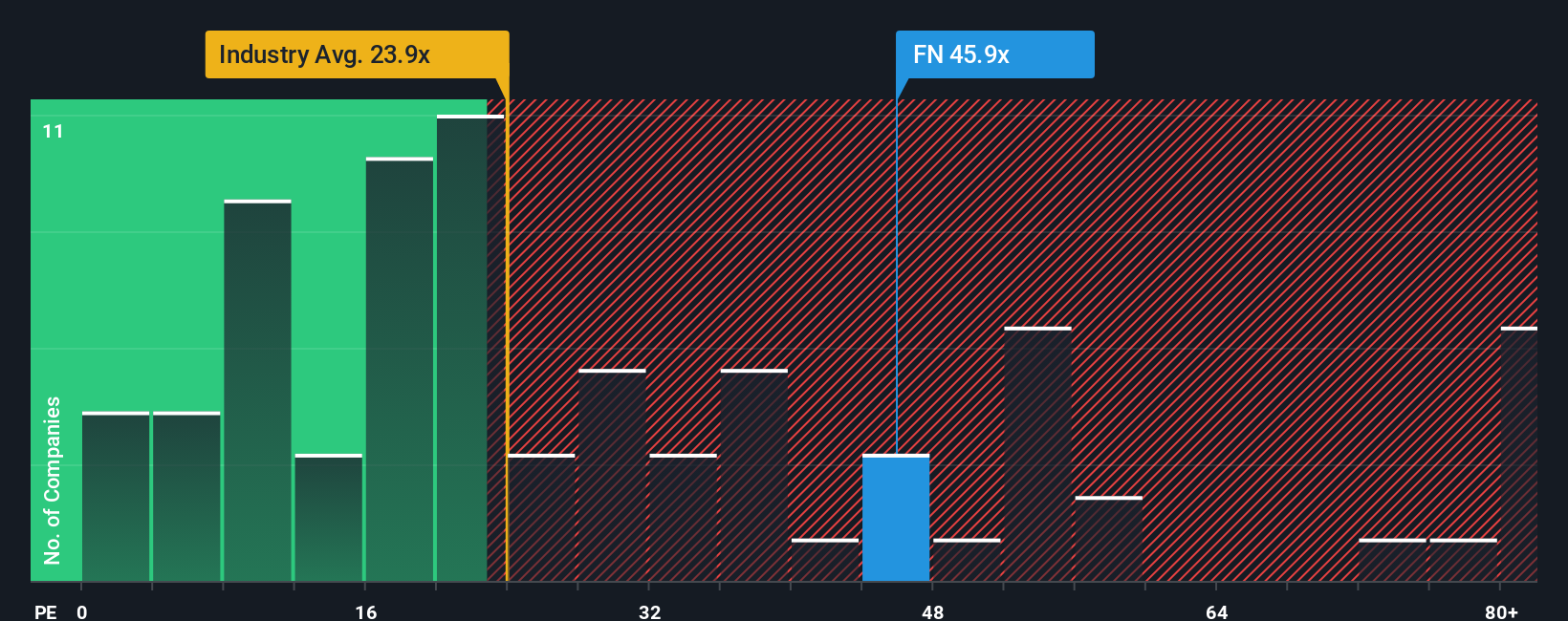

Step away from fair value models, and the plain earnings multiple paints a different picture. Fabrinet trades on a P/E of 48.8 times, well above both peers at 38.7 times and a fair ratio of 34.2 times, suggesting sentiment could be running ahead of fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fabrinet Narrative

If you want to challenge these conclusions or dig into the numbers yourself, you can craft a custom Fabrinet storyline in just minutes using Do it your way.

A great starting point for your Fabrinet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider setting up your next potential opportunities using the Simply Wall Street Screener so you are not relying on just one great story.

- Target reliable income streams by reviewing these 15 dividend stocks with yields > 3% that might strengthen your portfolio’s cash generation and reduce reliance on short term swings.

- Capitalize on potential market mispricing by focusing on these 905 undervalued stocks based on cash flows where future cash flows may be available at a meaningful discount.

- Position yourself thoughtfully by scanning these 26 AI penny stocks that use artificial intelligence to reshape industries and long term growth trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com