Exploring Global's Undervalued Small Caps With Insider Buying December 2025

As global markets navigate the final month of 2025, investor sentiment is buoyed by hopes for an interest rate cut from the Federal Reserve, with small-cap stocks like those in the Russell 2000 Index experiencing a modest rise. Despite challenges such as contracting manufacturing activity and fluctuating employment figures, opportunities arise in identifying small-cap companies that demonstrate resilience and potential value through strategic insider investments. In this context, understanding what constitutes a promising stock involves looking at factors such as financial health, market positioning, and insider confidence amidst these dynamic economic conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.3x | 1.0x | 28.69% | ★★★★★★ |

| Senior | 24.7x | 0.8x | 27.59% | ★★★★★☆ |

| Eurocell | 16.4x | 0.3x | 39.81% | ★★★★☆☆ |

| Centurion | 3.7x | 3.1x | -55.33% | ★★★★☆☆ |

| Chinasoft International | 21.7x | 0.7x | -1205.52% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.60% | ★★★★☆☆ |

| Kendrion | 29.3x | 0.7x | 41.90% | ★★★☆☆☆ |

| Nickel Asia | 12.4x | 1.9x | 11.99% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.5x | 0.4x | -424.88% | ★★★☆☆☆ |

| CVS Group | 45.6x | 1.3x | 26.92% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

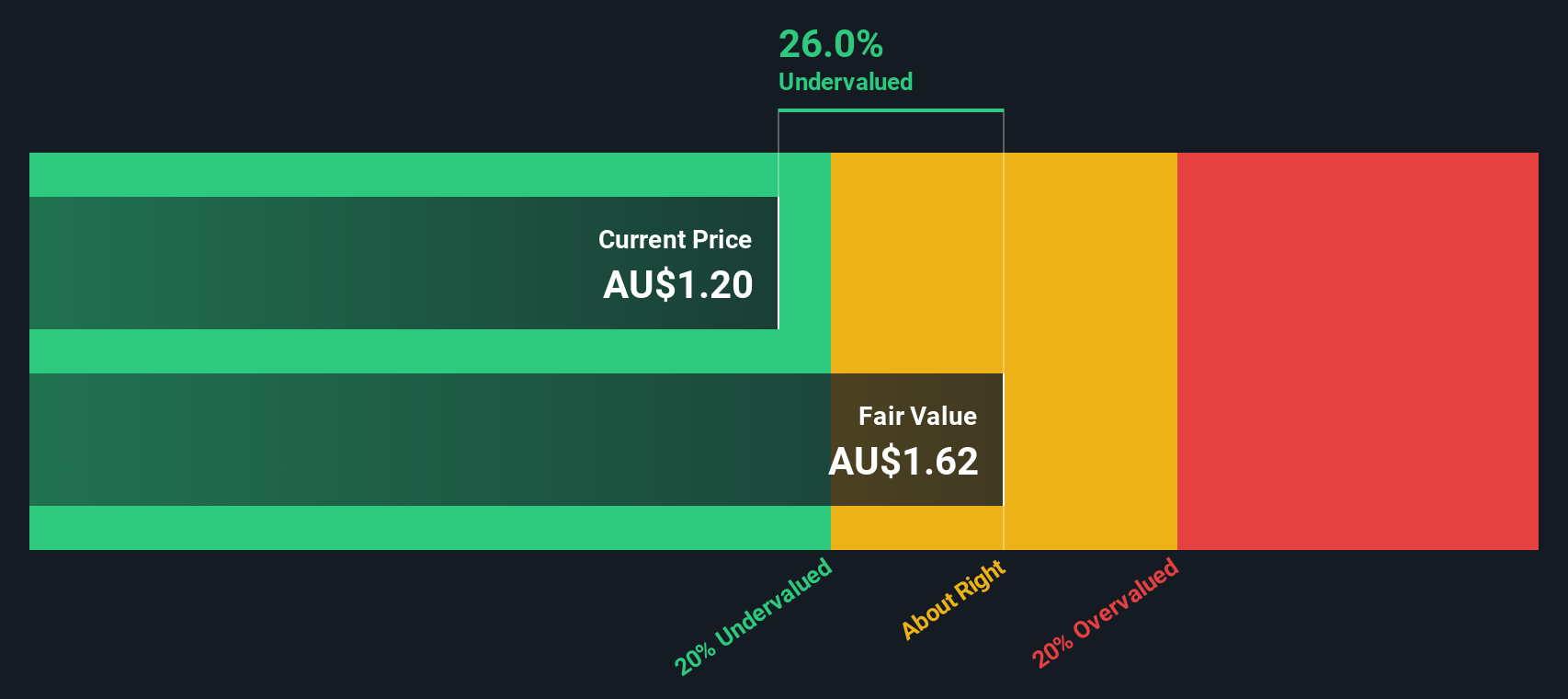

Nufarm (ASX:NUF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nufarm is a company engaged in the production and distribution of crop protection solutions and seed technologies, with operations spanning across APAC, Europe, and North America, and it has a market capitalization of A$2.58 billion.

Operations: Nufarm generates revenue primarily from its Crop Protection segments across APAC, Europe, and North America, as well as its Seed Technologies Global segment. The company's gross profit margin reached 29.49% by September 2023, reflecting a trend of gradual improvement compared to previous periods. Operating expenses are significant and include costs related to sales and marketing, R&D, and general administrative activities.

PE: -4.7x

Nufarm, a company in the agriculture chemicals sector, recently reported sales of A$3.44 billion for the year ending September 2025, with a net loss of A$165.32 million. Despite this financial setback, insider confidence is evident through recent share purchases by executives. The upcoming leadership change with Rico Christensen as CEO from January 2026 brings optimism due to their extensive global experience and strategic vision in driving operational excellence and growth initiatives across various markets.

- Click to explore a detailed breakdown of our findings in Nufarm's valuation report.

Gain insights into Nufarm's historical performance by reviewing our past performance report.

PolyNovo (ASX:PNV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: PolyNovo is a company focused on the development, manufacturing, and commercialization of its NovoSorb technology with a market capitalization of A$1.74 billion.

Operations: PolyNovo generates revenue primarily from the development, manufacturing, and commercialization of its NovoSorb Technology, with recent figures reaching A$128.70 million. The company has seen a notable improvement in its gross profit margin, which was recorded at 89.39% for the latest period. Operating expenses remain significant but are counterbalanced by substantial gross profits as evidenced by their financials over multiple periods.

PE: 62.2x

PolyNovo, a company in the medical device sector, is experiencing insider confidence with David Williams purchasing 61,335 shares for A$85,869. This suggests potential value recognition by insiders. The recent addition of Robert Douglas to the board brings extensive experience in digital health and governance from his tenure at ResMed. Despite relying on higher risk external borrowing for funding, PolyNovo's earnings are projected to grow annually by 27%, indicating promising growth prospects in its industry.

- Unlock comprehensive insights into our analysis of PolyNovo stock in this valuation report.

Gain insights into PolyNovo's past trends and performance with our Past report.

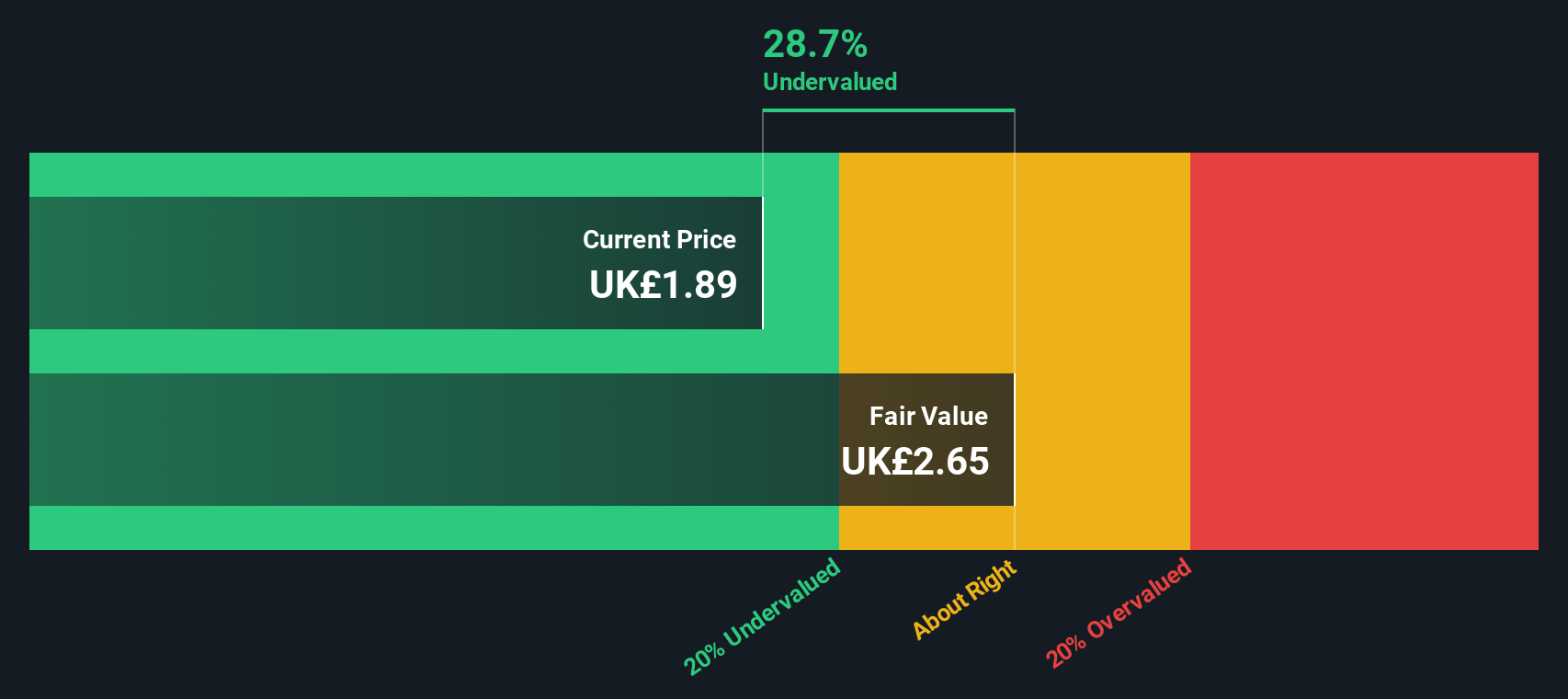

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Baltic Classifieds Group operates as a leading online classifieds platform in the Baltic region, focusing on segments such as auto, real estate, generalist, and jobs & services, with a market capitalization of approximately €1.25 billion.

Operations: The company generates revenue from four main segments: Auto, Generalist, Real Estate, and Jobs & Services. Over the observed periods, its net income margin has shown a notable upward trend, reaching 57.68% by October 2025. The cost of goods sold (COGS) and operating expenses have varied over time but generally contribute to the overall financial performance.

PE: 19.5x

Baltic Classifieds Group, a company with a focus on external borrowing for funding, reported half-year sales of €44.84 million and net income of €26.44 million, showing growth from the previous year. Insider confidence is evident as they increased their holdings recently, signaling potential value in the stock. Despite challenges in the Estonian auto market, revenue is expected to grow into double digits by fiscal 2027. The company announced an interim dividend of €0.013 for early 2026 distribution.

- Click here and access our complete valuation analysis report to understand the dynamics of Baltic Classifieds Group.

Evaluate Baltic Classifieds Group's historical performance by accessing our past performance report.

Taking Advantage

- Investigate our full lineup of 148 Undervalued Global Small Caps With Insider Buying right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com