RH (RH): Evaluating the Stock’s Valuation After New Detroit Gallery and Europe Expansion Push

RH (RH) just opened RH Detroit, a four level, 60,000 square foot gallery that feels as much like a boutique hotel as a furniture store, and investors are watching how this strategy reshapes the stock’s story.

See our latest analysis for RH.

Those splashy openings in Detroit and Europe are RH leaning into its luxury lifestyle pitch, but the share price tells a tougher story. There has been a steep year to date share price decline of around 59% and a similarly weak five year total shareholder return, signalling that investors are still cautious about how quickly this strategy can translate into durable earnings growth.

If RH’s bold gallery push has you rethinking where growth could come from next, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other ambitious stories early.

With the share price far below analyst targets but revenue and profit still growing, has RH been unfairly punished for near term housing and tariff headwinds, or is the market already discounting that next growth chapter?

Most Popular Narrative Narrative: 38.6% Undervalued

With RH last closing at $161.06 against a narrative fair value near $262, the gap reflects bold expectations about how today’s galleries reshape tomorrow’s earnings power.

The company's plans to monetize assets, including real estate with an estimated equity value of approximately $500 million and excess inventory valued at $200 million to $300 million, could boost cash flow and help in reducing debt, potentially improving net margins and lowering interest expenses.

Want to see the full financial playbook behind that valuation gap? The narrative leans on rapid earnings expansion, rising margins, and a lower future earnings multiple. Curious how those pieces fit together into that higher fair value?

Result: Fair Value of $262.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariff uncertainty and a still fragile housing backdrop could easily compress margins and delay the payoff from RH’s ambitious gallery and Europe expansion.

Find out about the key risks to this RH narrative.

Another Lens on Valuation

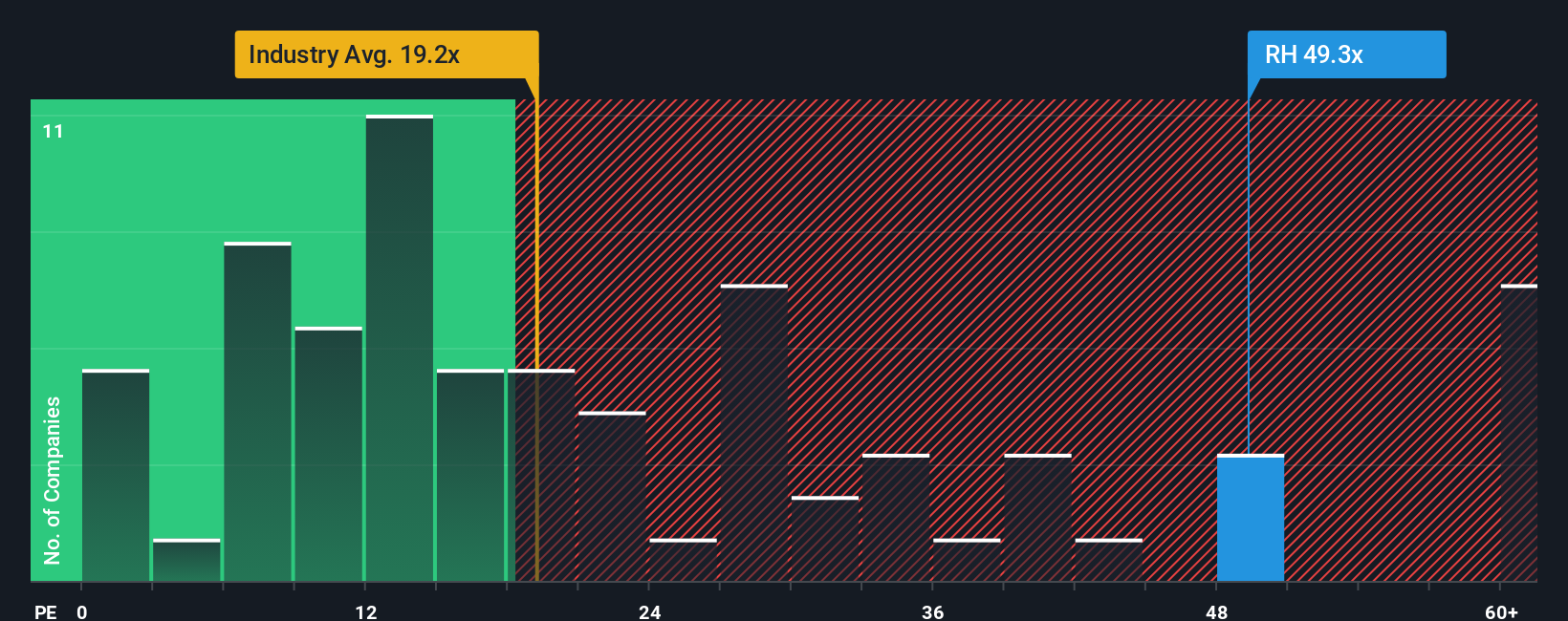

Analysts see RH as undervalued versus their $262.25 target, yet the price to earnings ratio of 28.3 times sits well above both the US Specialty Retail average of 20 times and peer average of 18.2 times, while still below a fair ratio of 34.1 times. Is that gap smart opportunity or extra risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RH Narrative

If this view does not quite match your own thinking, you can dig into the numbers yourself and build a fresh perspective in minutes, Do it your way.

A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about levelling up your portfolio, do not stop at RH. Use the Simply Wall Street Screener to uncover your next standout opportunity.

- Capture powerful long term compounding by targeting reliable income opportunities through these 15 dividend stocks with yields > 3% with yields that can strengthen your portfolio’s foundation.

- Position yourself ahead of the next tech wave by focusing on innovation driven businesses using these 26 AI penny stocks to find potential leaders early.

- Capitalize on market mispricing by pinpointing quality companies trading below intrinsic value through these 902 undervalued stocks based on cash flows, before other investors catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com