US stocks have gone from a standout in AI to a “cyclical group dance”! Damo is betting on 2026 to embark on a rolling recovery cycle, and stocks lead the second phase of the bull market

The Zhitong Finance App learned that Wall Street financial giant Morgan Stanley released a research report saying that the OBBBA (the so-called “big and beautiful” bill) passed by the Trump administration in 2025 will strongly promote economic growth effects starting in 2026. Combined with the price increase caused by Trump's tariff policy, it was eventually proven to be a temporary inflationary disturbance until short-term inflation gradually dissipates, and technology giants such as Google are in full swing. They will jointly drive the US economy to show a “golden girl soft landing” in 2026 This is the macroeconomic environment for moderate growth.

Therefore, Damo defines 2026 as a “broad-spectrum stock market bull market under rolling recovery,” arguing that the return of “point-to-point” market risk appetite resonates with multiple cyclical industries to rise.

According to the latest research report released by the Daimo strategist team led by top Wall Street strategist Michael Wilson, they believe that the current stock market is at the beginning of a new profit cycle and a structured bull market. It is expected that in 2026, the core leadership of the US stock market will spread from Nvidia, Google, and Microsoft, which benefit from AI to small to medium capitalization and cyclical core industries. Daimo strategists emphasized that under the main investment line of “soft landing+rolling recovery of the US economy” in 2026, cyclical stocks (especially high-cycle industries, finance, and optional consumption) are expected to fully benefit, and their performance will be significantly better than the average benchmark performance of the past two to three years.

Damo said that the US stock market has come out of a three-year “rolling recession” (rolling recession) and has officially entered the “rolling recovery” (rolling recovery) stage. The continuously compressed cost structure, strong profit revisions, significant improvements in corporate operating leverage, and the release of suppressed demand all together form a “typical early cycle” environment; on the macro side, Damo anticipates that the Federal Reserve's interest rate cut path will begin a new round of capital expenditure cycles, and real interest rates will return to normal, and corporate investment (especially AI and manufacturing) will become a new growth engine.

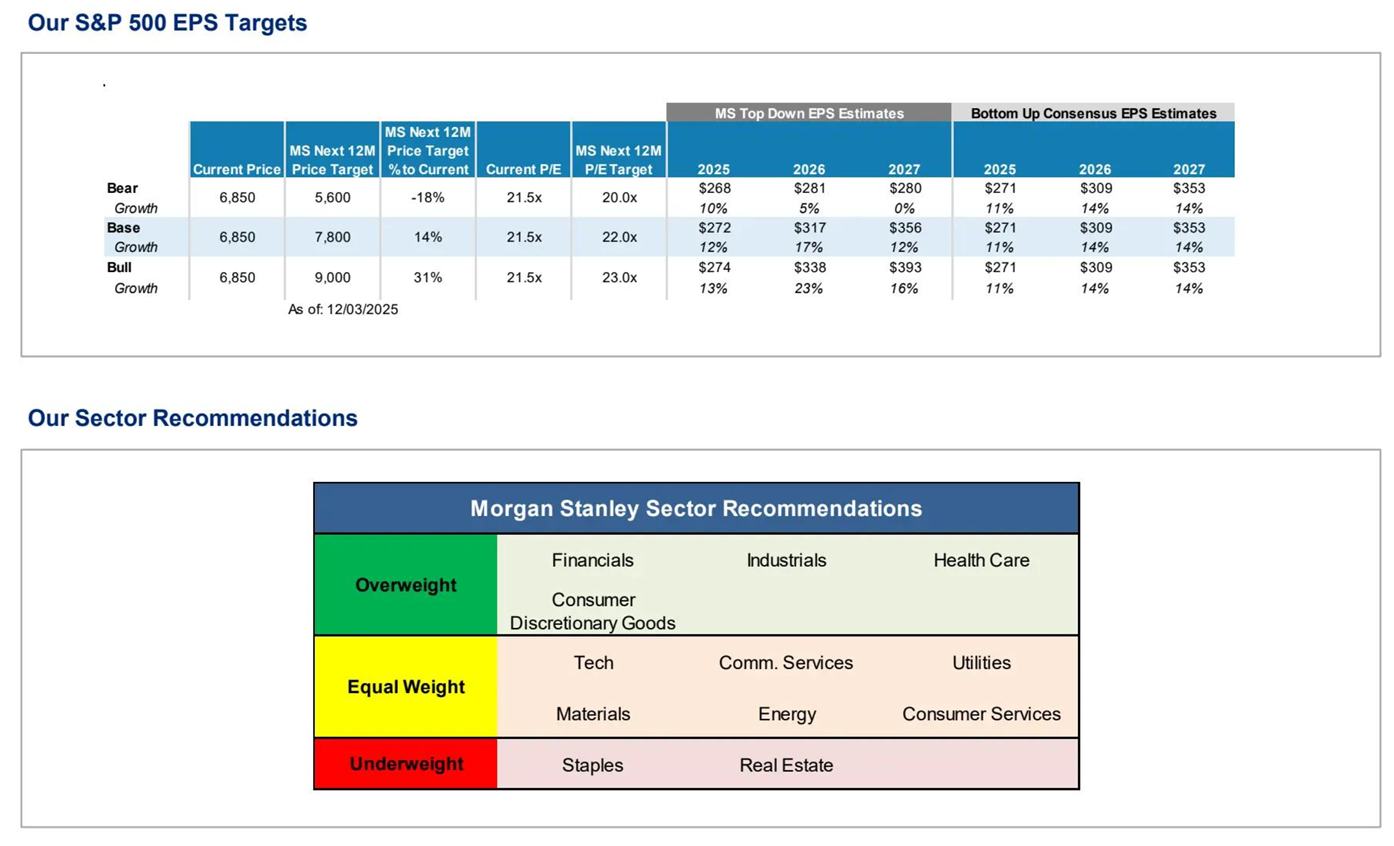

In 2025, the US stock “Big Seven Tech Giants” (Mag 7), which covers tech giants such as Nvidia and Google, will still lead the increase in earnings, but in 2026 it is expected to spread to S&P 493 constituent stocks (in particular, the correction in the industrial and financial sectors is expected to improve). Therefore, Morgan Stanley defines the current situation as a “second-stage bull market under rolling recovery” — dominated by profit expansion and cyclical industry rotation, financial market risk appetite has fully returned, and the market is more extensive and resilient. The Damo Strategy Team advises investors to “overallocate the cycle, underallocate defense” — that is, “overallocate” finance, industry, healthcare, and optional consumption in 2026; “under-allocate” essential consumption and real estate; and “allocate equal weight” to the technology sector and energy sector.

At about the same time, a research report released by Bank of America, another major Wall Street bank, showed that the Trump administration will definitely adopt a “hot” economic policy in order to maintain approval ratings, so increasing commodities in 2026 will be the best trading theme, and all commodity trend charts will eventually show an upward trend like gold. The Bank of America strategist team led by Michael Hartnett, who has the title of Wall Street's most likely strategist, said that this judgment is based on the global economy shifting from a “monetary easing plus fiscal austerity” model after the financial crisis to a new investment paradigm of “fiscal easing plus de-globalization” after the pandemic, and the cyclical investment sector has the best room for relative growth.

The “Golden-Style Soft Landing” is getting closer! Damo bets on “the end of the AI investment-themed solo dance era”

Various economic data for 2025, which were released before the US government shut down, actually showed Golden Girl's prospects. Although the non-farm payrolls market is in a weak state, the combination of economic data from January to August 2025, which is in line with the expected curve and rising GDP, has indeed raised the subjective probability of the “Goldilocks” macro scenario: that is, growth is weak, inflation is too hot, and market expectations are more “biased towards interest rate cuts.”

The so-called “Goldilocks” (Goldilocks) macroeconomic environment in the US refers to the US economy being lukewarm and just right, maintaining moderate “moderate growth” in GDP and consumer spending and a stable long-term “moderate inflation trend”. At the same time, the benchmark interest rate is on a downward trajectory. Overall, Damo expects the US economy to gradually emerge from a state of high uncertainty in 2026 and return to a positive path of “moderate growth.”

Damo said that 2025 is a year of tariff policy, immigration tightening, and intensive implementation of the One Big Beautiful Bill (OBBBA) led by the Trump administration. Analysts expect that from 2026-2027, the general framework of policies to stimulate economic growth will basically settle, and the focus of the US economy will shift from “policy disturbances” to how businesses and households can adjust spending in an environment of “big and beautiful” tax cuts and the Trump administration stimulating a recovery in consumer confidence.

Therefore, Damo anticipates that the OBBBA tax relief bill (the so-called “big and beautiful” bill) passed by the Trump administration in 2025 will have a strong economic growth effect starting in 2026, compounded by the price increase caused by Trump's tariff policy, which will eventually prove to be a temporary inflationary disturbance until short-term inflation gradually dissipates, and that tech giants such as Microsoft and Google are in full swing building AI data centers centered around AI computing power infrastructure. They will jointly drive the US economy to show a “golden girl style soft landing” in 2026.

Regarding the 2026 stock market investment sector outlook, Damo said that since the market focus is shifting from defense to attack, AI is still one of the main lines of investment, but it is no longer the “sole driving force” of the US stock super bull market driven by the 2023 AI frenzy; Damo expects the breadth and depth of profit recovery to be the key to the sustainability of this round of the bull market in 2026-2027, and 2026 is expected to usher in the second phase of the “diffusion of leadership” bull market. Investors should pay close attention to undervalued cyclical sectors and small to medium cap growth stocks.

Recent gains in the market sector show that the strength of the US stock market is no longer limited to large-cap technology stocks. Popular AI technology stocks such as Nvidia, TSMC, and Broadcom that have benefited from the AI boom are no longer outstanding, and other weighted sectors such as healthcare, utilities, and traditional finance have fully blossomed. Benchmark indices such as small-cap stocks and weighted versions of the S&P 500 index are also very close to historical highs, indicating that a wider range of market participation sectors is expected to provide a significant risk buffer against any short-term pullback trend related to AI technology leaders

“We are in a rolling recovery phase where profits are expanding, leadership is broadening, and risk appetite is being reignited.” Wilson led the Daimo strategist team and said. Damo defines 2026 as a “broad-spectrum stock market bull market under rolling recovery,” arguing that the return of “point-to-point” market risk appetite resonates upward with multiple cyclical industries.

In 2026, the S&P 500 is expected to hit 9,000 points! The cyclical sector is expected to become the core driving force of the stock market bull market

Michael Wilson, leading the Daimo strategist team, said that defining 2026 as “The Year of Risk Reboot” (The Year of Risk Reboot), the market focus will shift from the macro level to the micro level. The rare “policy trio” of fiscal stimulus, monetary stimulus, and regulatory easing resonates with the unprecedented AI investment cycle, which will drive strong profit growth in US companies and push the benchmark index of US stocks, the S&P 500 index, to 7,800 points. More importantly, under the so-called “bull market situation,” Damo predicts that the S&P 500 index is expected to hit 9,000 points — mainly based on AI-driven productivity growth exceeding expectations and the full explosion of AI capital expenditure to drive widespread benefits for various industries.

Damo stressed that this combination of fiscal, monetary, and regulatory policies is extremely rare when the economy is not in recession and works in a procyclical manner. The last time a similar situation occurred dates back to the late 1980s. This unique “policy dividend package” will inject strength into risk markets such as stocks, and enable investors to focus more on corporate microfundamentals such as corporate profits and AI investment.

From a longer-term perspective, investors are increasingly confident about the long-term growth prospects of the US economy. Real interest rates have returned to pre-crisis levels, reflecting optimistic expectations of stronger economic growth momentum driven by private investment (including the AI computing power infrastructure process) and the “Big and Beautiful Act” led by the Trump administration. This major shift has made it easier for investors to “take risks” in the stock and bond markets.

Under the combined effects of the pro-growth Trump administration's fiscal portfolio, a moderate interest rate cut cycle, and unprecedented AI capital spending led by US tech giants, Wall Street strategists, including Wilson, currently generally use “soft landing+moderate expansion of the US economy” as the benchmark scenario. In this optimistic environment, the cyclical sector represented by industry, finance, and optional consumption can indeed benefit relatively and surpass the S&P 500 index and the Nasdaq 100 index, which has the title of “global technology stock weather vane.”

As the market shifts from a single AI driver to a broad-spectrum rebound dominated by the cycle, and the performance of small and medium capitalization stocks and equal weighting indices increases, the Damo Strategy Team suggests that investors “overallocate” finance, cyclical industry, healthcare, and popular optional consumption in 2026; “low allocation” essential consumption and real estate; and “equal weight allocation” technology and energy sectors.

Damo is betting that global stock market leadership will expand significantly, and small to medium capitalization stocks (upgrade to overallocation) and cyclical sectors (such as finance, cyclical industry, optional consumption, healthcare) will benefit from profit elasticity; the core supporting logic includes positive operating leverage due to cost structure compression, a historic rebound in the breadth of profit revisions, and a strong stimulus from “high temperature operation” on the policy side. Damo believes that the current environment has typical early cycle characteristics. Although the stock market's valuation is high, it will be digested by strong profit growth synergy during the “rolling recovery” phase.