Yaokun Hydraulics submitted an IPO registration to raise 808.62 million yuan

The Zhitong Finance App learned that on December 8, Jiangsu Yaokun Hydraulic Co., Ltd. (abbreviation: Yaokun Hydraulic) applied for the Shenzhen Stock Exchange motherboard IPO review status to “submit registration”. GF Securities is its sponsor and plans to raise 808.62 million yuan.

According to the prospectus, Yaokun Hydraulic is mainly engaged in R&D, production and sales of hydraulic components and components. The main products are fuel tanks, hard tubes, and metal accessories, which are mainly used in various types of construction machinery mainframe equipment such as excavators. Since its establishment, the company has been focusing on hydraulic components and components. After years of independent innovation, the company has built a complete product system for fuel tanks, hard tubes and metal accessories, providing customers with products with advanced technology, mature technology, excellent quality and stable performance, forming a strong brand advantage and competitive advantage.

The development of the hydraulic industry is inseparable from the huge local market demand and the strong technical research and process accumulation of enterprises. As traditional manufacturing powers, Germany, the US, and Japan also maintain a leading position in the world in the hydraulic industry. Judging from the market share of the global hydraulic industry, the international hydraulic industry currently has obvious market concentration characteristics. The most important hydraulic component manufacturers in the world include Bosch Rexroth in Germany, Parker Hannifin and Eaton in the US, and Kawasaki Heavy Industries and KYB in Japan.

China's hydraulic industry started late, but it is developing rapidly. After more than 60 years of development, it has become an industry with a specialized production system, relatively complete product categories, and basically able to meet the supporting needs of various mainframe industries in China's national economy. According to statistics from the China Hydraulic and Pneumatic Seals Industry Association, there are currently more than 1,000 domestic hydraulic companies. Although there are many local hydraulic companies in China's hydraulic industry, the vast majority of enterprises operate on a relatively small scale, industry concentration is still low, overall competitiveness is not strong, and technology accumulation is relatively weak. There is still a big gap between leading international hydraulic companies in terms of technology accumulation, manufacturing experience, and revenue scale.

Yaokun Hydraulics has long been based in the field of manufacturing hydraulic components and components such as fuel tanks, hard pipes, and metal trims. With deep technology and process accumulation, excellent quality control, and quick delivery response, the company has successfully entered the supply system of the world's major construction machinery manufacturers.

Yaokun Hydraulic has established long-term and stable cooperative relationships with many well-known foreign mainframe manufacturers such as Caterpillar, Komatsu, Volvo, John Deere, Hitachi Construction Machinery, JCB, Epiroc, Kobelco, Terex, Sumitomo Heavy Equipment, JLG, Hyundai Engineering, Bomag, etc., and many leading domestic mainframe manufacturers such as XCMG Group, Liugong Group, China Longgong, Shandong Lingong, China Machinery Heavy Industries, Lingong Group, and Shantui Co., Ltd.

According to the certification issued by the China Construction Machinery Industry Association, from 2022 to 2024, the fuel tank and hydraulic hard tube products produced by Yaokun Hydraulics all ranked in the top three domestic construction machinery market shares in the Chinese construction machinery market. According to the certification issued by the China Hydraulic and Pneumatic Seals Industry Association, the company's comprehensive strength ranks among the top in the hydraulic industry. The company has a large operating scale and is representative of the industry. The operating income of industry products in the period from 2022 to 2024 ranked in the top ten key connected enterprises in the hydraulic industry.

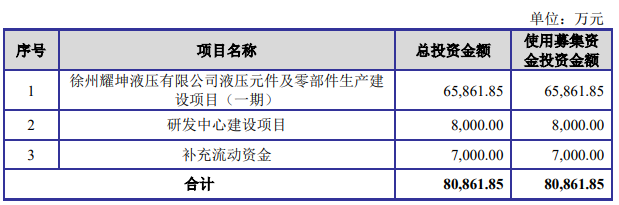

This fund-raising plan invests in the following projects:

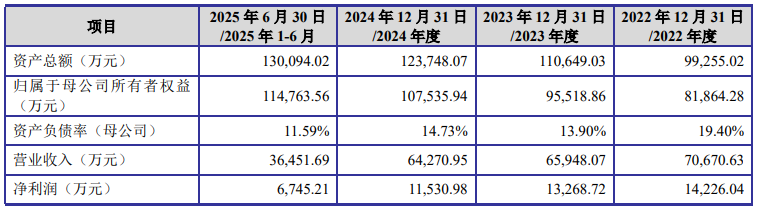

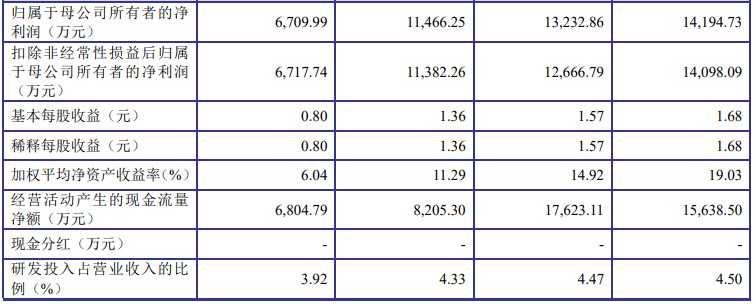

On the financial side, in 2022, 2023, 2024, and June 30, 2025, the company achieved operating income of 707 million yuan, 659 million yuan, 643 million yuan, and 365 million yuan respectively; in the same period, the company achieved net profit of 142 million yuan, 133 million yuan, 115 million yuan and 674.521 million yuan respectively.