T1 Energy (TE): Valuation Check After Governance Reforms and New 2026 Offtake Deals

T1 Energy (TE) just pushed through a mix of governance changes and new offtake deals that reshape both how the company is run and how its 2026 revenue base could evolve.

See our latest analysis for T1 Energy.

The governance overhaul and fresh 2026 offtake wins seem to have flipped sentiment, with the share price jumping to $5.83 and delivering a 90 day share price return above 200 percent. However, the five year total shareholder return remains sharply negative, which suggests that momentum is rebuilding from a low base rather than peaking.

If this kind of rapid turnaround catches your eye, it could be worth seeing which other names are gaining traction in the market through fast growing stocks with high insider ownership.

With the share price sprinting ahead of fundamentals, a hefty intrinsic discount and new 2026 contracts colliding with governance risks and fresh dilution capacity, is this a mispriced turnaround, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 16.7% Undervalued

With T1 Energy last closing at $5.83 against a narrative fair value of $7.00, the spread signals meaningful upside if the story plays out.

The expansion of U.S. electricity demand, driven by the AI infrastructure build out, electrification of transportation, and onshoring of advanced manufacturing, positions T1 as a key provider of solar modules and storage solutions for a rapidly growing market, supporting sustained topline revenue growth. Robust government policy tailwinds including stackable, transferable Section 45X tax credits and protectionist trade measures are providing T1 with access to funding, margin boosting incentives, and risk mitigation for its U.S. production pipeline, which should improve both earnings quality and net margins.

Curious how a high growth revenue ramp, rising margins, and a shrinking risk premium combine into that fair value? The narrative leans on bold long term earnings math. Want to see which future multiple really underpins it, and how fast analysts think cash flows have to scale to get there?

Result: Fair Value of $7 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, hefty capital needs and heavy reliance on policy incentives mean that any funding shortfall or regulatory rollback could quickly puncture this bullish narrative.

Find out about the key risks to this T1 Energy narrative.

Another Lens On Valuation

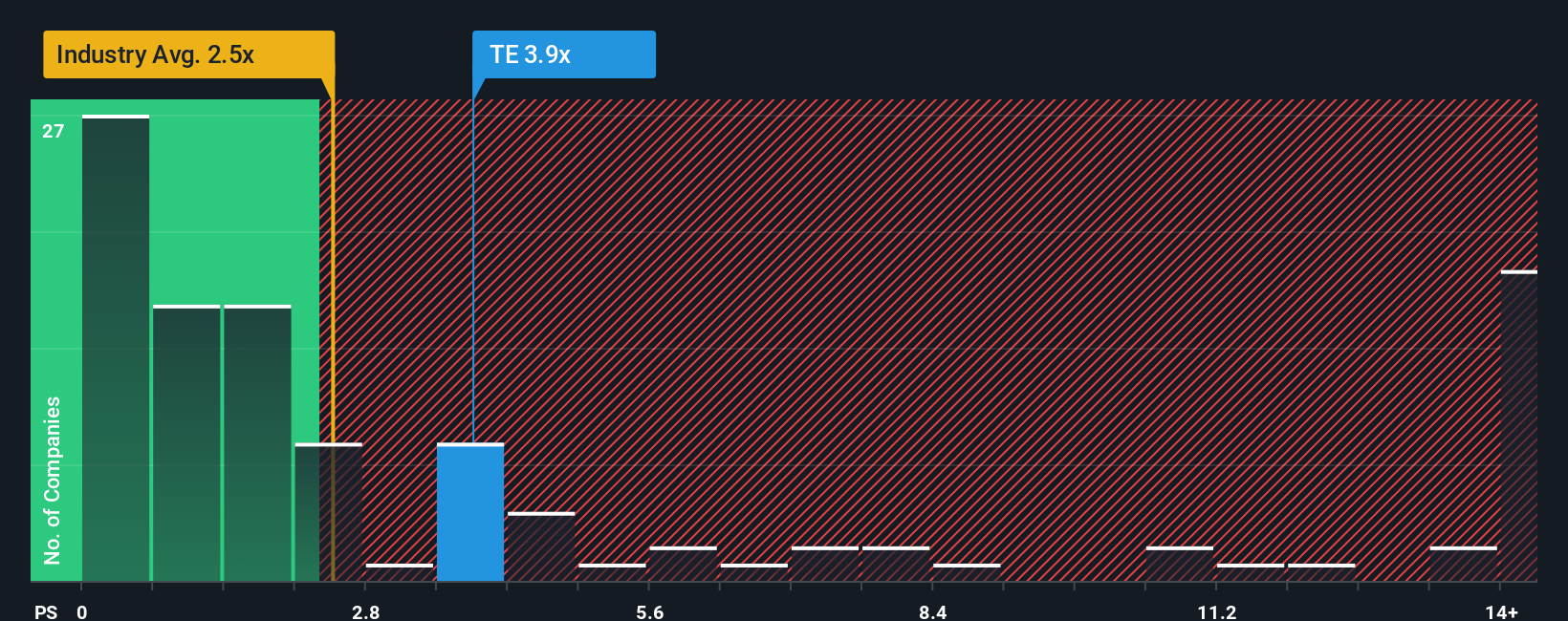

Price to sales tells a mixed story. TE trades on 3.1 times sales compared with a 2.2 times sector norm and a 2.6 times fair ratio, making it look stretched relative to fundamentals. Yet versus peers on 34.5 times, it still screens cheap. Which side of that gap closes first?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T1 Energy Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a fresh view in minutes: Do it your way.

A great starting point for your T1 Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you log off, lock in an edge by scanning fresh opportunities on Simply Wall Street’s Screener so you are not late to the next winner.

- Capture potential bargains early by zeroing in on these 905 undervalued stocks based on cash flows where robust cash flows may not yet be reflected in share prices.

- Ride structural growth in automation and machine learning by targeting these 26 AI penny stocks positioned at the heart of the AI acceleration.

- Strengthen your portfolio’s income engine by focusing on these 15 dividend stocks with yields > 3% that offer attractive yields with the potential for compounding returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com