Evaluating Bright Smart Securities & Commodities Group (SEHK:1428) After Its Profit-Improving Half-Year Results

Bright Smart Securities & Commodities Group (SEHK:1428) just posted its half year results, with revenue broadly flat but net income and earnings per share edging higher, hinting at better cost discipline behind the scenes.

See our latest analysis for Bright Smart Securities & Commodities Group.

The half year earnings tweak the narrative for Bright Smart Securities & Commodities Group, with a 1 year total shareholder return of 247.35 percent still looking strong. At the same time, the 90 day share price return of negative 33.25 percent shows momentum cooling after a huge year to date move, suggesting investors are reassessing how much of that operational improvement is already priced in at HK$7.85.

If this jumpy performance has you thinking about diversification, it could be a good moment to explore fast growing stocks with high insider ownership as a source of other high potential ideas.

With profitability improving faster than revenue and the share price giving back a chunk of its earlier surge, the key question now is whether Bright Smart is trading below its true worth or if the market has already priced in its future growth.

Price-to-Earnings of 21.1x: Is it justified?

On a price-to-earnings ratio of 21.1x versus a last close of HK$7.85, Bright Smart Securities & Commodities Group screens as slightly expensive rather than a bargain against its peers.

The price to earnings multiple compares what investors pay today for each dollar of current earnings, a key yardstick for capital markets businesses where profits can be cyclical and sensitive to leverage. With earnings having only recently accelerated after a period of decline, paying above the wider Hong Kong Capital Markets industry average hints that the market is assigning a premium to the latest upswing in profitability.

That premium, however, is modest, with Bright Smart trading on 21.1x earnings compared to the industry average of 20.5x. This suggests investors are only marginally more optimistic than they are for the broader sector. At the same time, the stock looks cheaper than a narrower peer set where the average multiple is 25.3x. This highlights a tension between the shares appearing relatively expensive for the industry overall yet offering comparatively better value against closer comparables.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 21.1x (OVERVALUED)

However, sustained share price volatility and highly cyclical trading revenue could quickly challenge assumptions that recent earnings strength represents a durable structural reset.

Find out about the key risks to this Bright Smart Securities & Commodities Group narrative.

Another View Using Our DCF Model

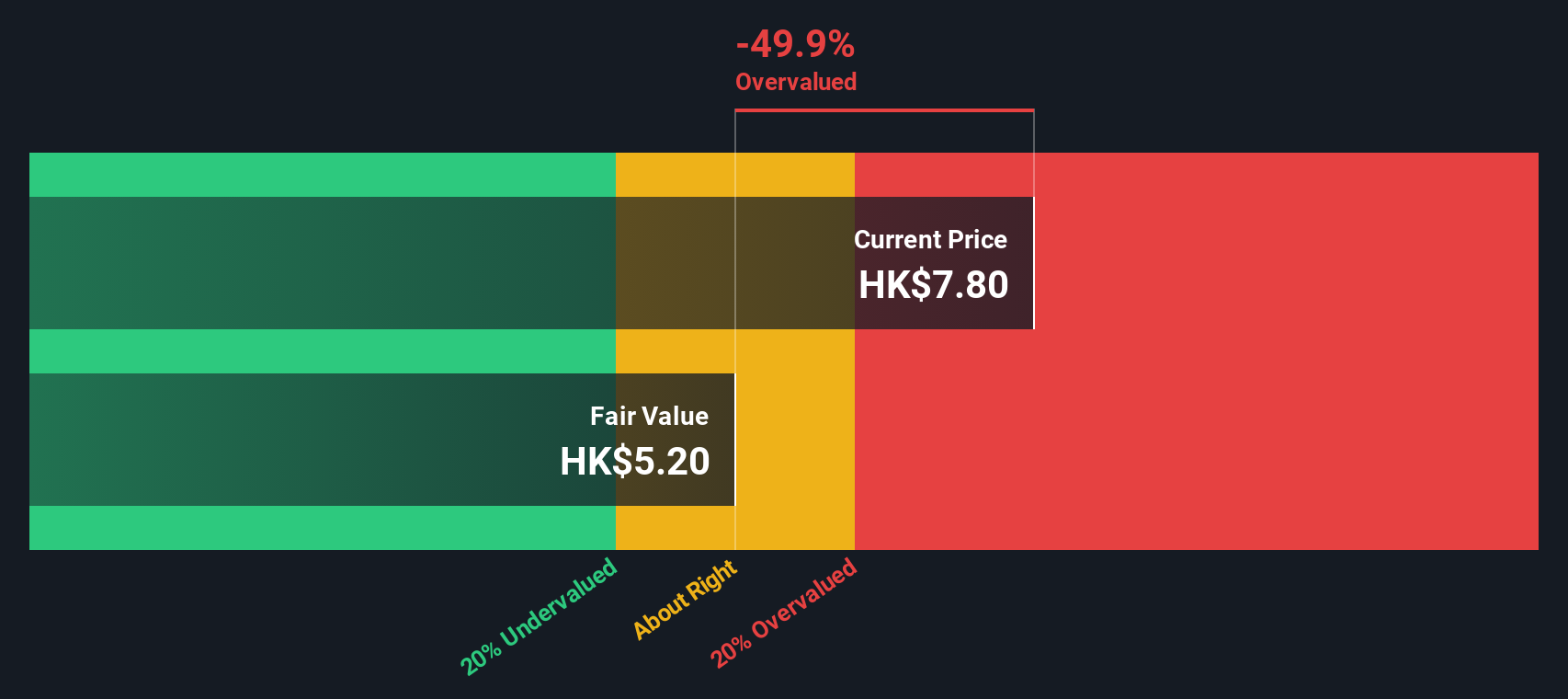

Our DCF model paints a different picture. With a fair value estimate of HK$5.24 versus the current HK$7.85 share price, Bright Smart looks overvalued, not just slightly pricey. If cash flows do not keep pace with expectations, how much downside are investors really carrying here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bright Smart Securities & Commodities Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bright Smart Securities & Commodities Group Narrative

If you are not fully convinced by this view or simply prefer to dig into the numbers yourself, you can quickly craft a personalised outlook in just a few minutes, Do it your way.

A great starting point for your Bright Smart Securities & Commodities Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Bright Smart is only one opportunity, and you may miss additional options if you stop here when you could instead identify more potential investments using targeted stock screeners on Simply Wall St.

- Explore potential mispricings early by reviewing these 905 undervalued stocks based on cash flows that may appear attractive based on discounted cash flow fundamentals.

- Consider the next wave of innovation by scanning these 26 AI penny stocks involved in real world applications in automation, analytics, and intelligent software.

- Assess your income stream by targeting these 15 dividend stocks with yields > 3% that combine dividend payments with financial characteristics that may support ongoing distributions through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com