Discover TSX Penny Stocks: Lion Copper and Gold Leads the Pack

As we approach the end of 2025, Canadian markets have seen substantial gains, with the TSX up by 27% in local currency terms. In this context of market optimism and central bank decisions looming, investors are keenly evaluating opportunities that align with their risk tolerance and financial goals. Penny stocks—often overlooked yet full of potential—represent a unique investment area where smaller or newer companies can offer both affordability and growth prospects when supported by robust financial health.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$54.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.34 | CA$252.72M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.36 | CA$137.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.465 | CA$3.88M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$51.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.22 | CA$811.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.25 | CA$164.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.13 | CA$201.55M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 392 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Lion Copper and Gold (CNSX:LEO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lion Copper and Gold Corp. is a mineral exploration company focused on acquiring, exploring, and developing copper projects in the United States with a market cap of CA$80.58 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$80.58M

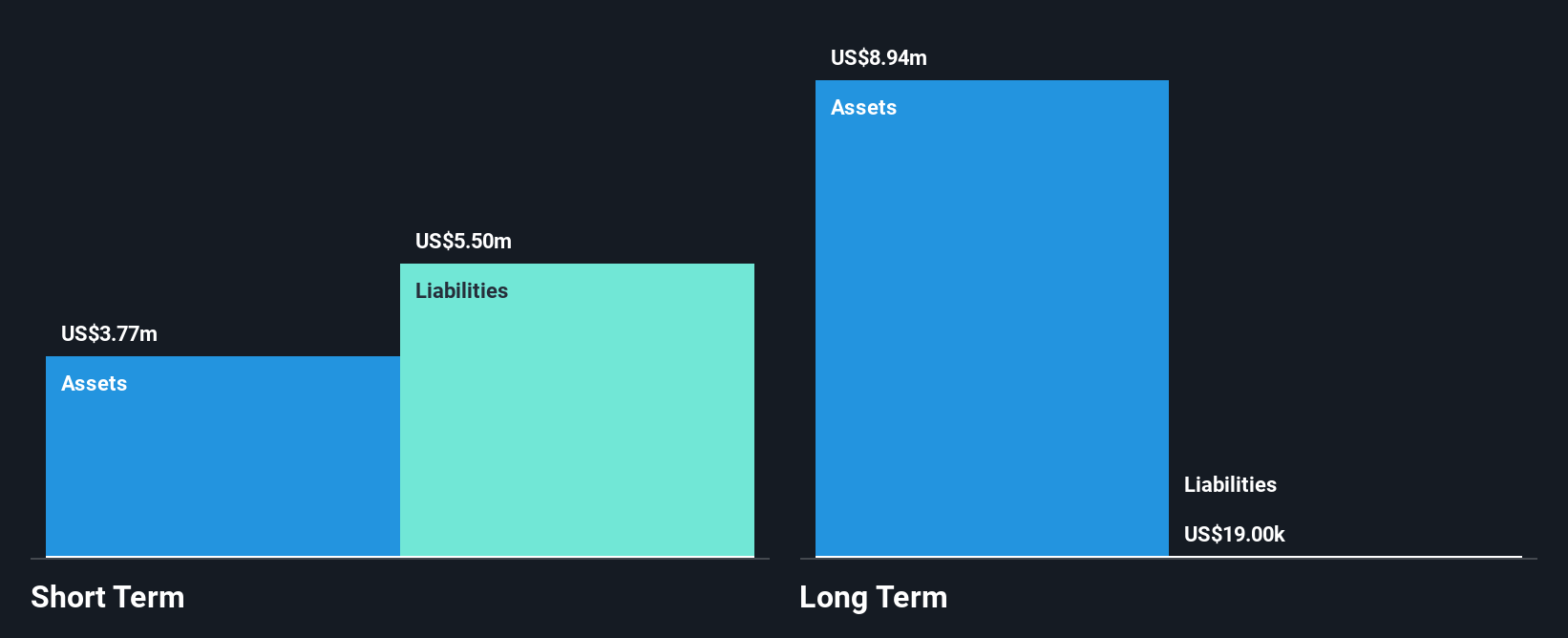

Lion Copper and Gold Corp., with a market cap of CA$80.58 million, remains pre-revenue as it focuses on developing its copper projects in the U.S. Recent financial results show a net loss of US$3.6 million for Q3 2025, reflecting increased losses from the previous year. The company closed private placements raising US$2.7 million to support operations, though this resulted in significant shareholder dilution potential due to convertible debentures and warrants issued at $0.0965 per share. Despite having more cash than debt and sufficient short-term assets, Lion faces high volatility and an inexperienced management team amidst ongoing financial challenges.

- Click here to discover the nuances of Lion Copper and Gold with our detailed analytical financial health report.

- Explore historical data to track Lion Copper and Gold's performance over time in our past results report.

Tantalus Systems Holding (TSX:GRID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tantalus Systems Holding Inc. is a technology company offering smart grid solutions in Canada and the United States, with a market cap of CA$219.68 million.

Operations: The company's revenue is derived from two main segments: Connected Devices and Infrastructure, which generated $33.66 million, and Utility Software Applications and Services, contributing $18.12 million.

Market Cap: CA$219.68M

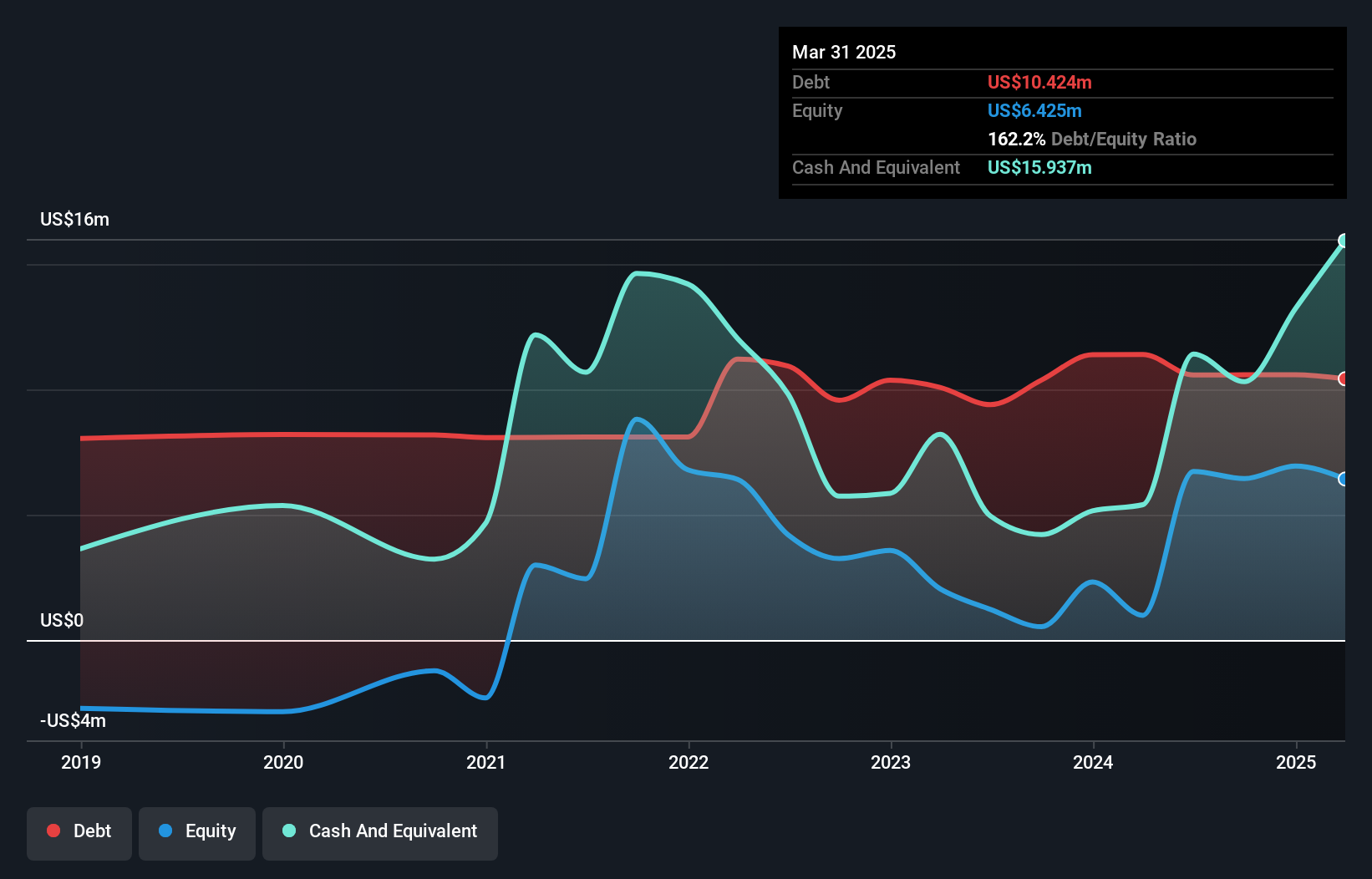

Tantalus Systems Holding Inc., with a market cap of CA$219.68 million, has shown revenue growth in its recent financials, reporting US$14.2 million in sales for Q3 2025, up from US$11.59 million the previous year. Despite being unprofitable, the company maintains a strong cash position with more cash than debt and sufficient short-term assets to cover liabilities. Its management and board are experienced, offering stability amidst volatility. Analysts suggest potential stock price appreciation by 27%. While its return on equity is negative due to current unprofitability, Tantalus has reduced losses over five years and improved shareholder equity from negative values previously.

- Jump into the full analysis health report here for a deeper understanding of Tantalus Systems Holding.

- Examine Tantalus Systems Holding's earnings growth report to understand how analysts expect it to perform.

Oroco Resource (TSXV:OCO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oroco Resource Corp., with a market cap of CA$92.47 million, is an exploration stage company focused on acquiring and exploring mineral properties in Mexico.

Operations: Oroco Resource Corp. does not have any reported revenue segments as it is currently in the exploration stage focused on mineral properties in Mexico.

Market Cap: CA$92.47M

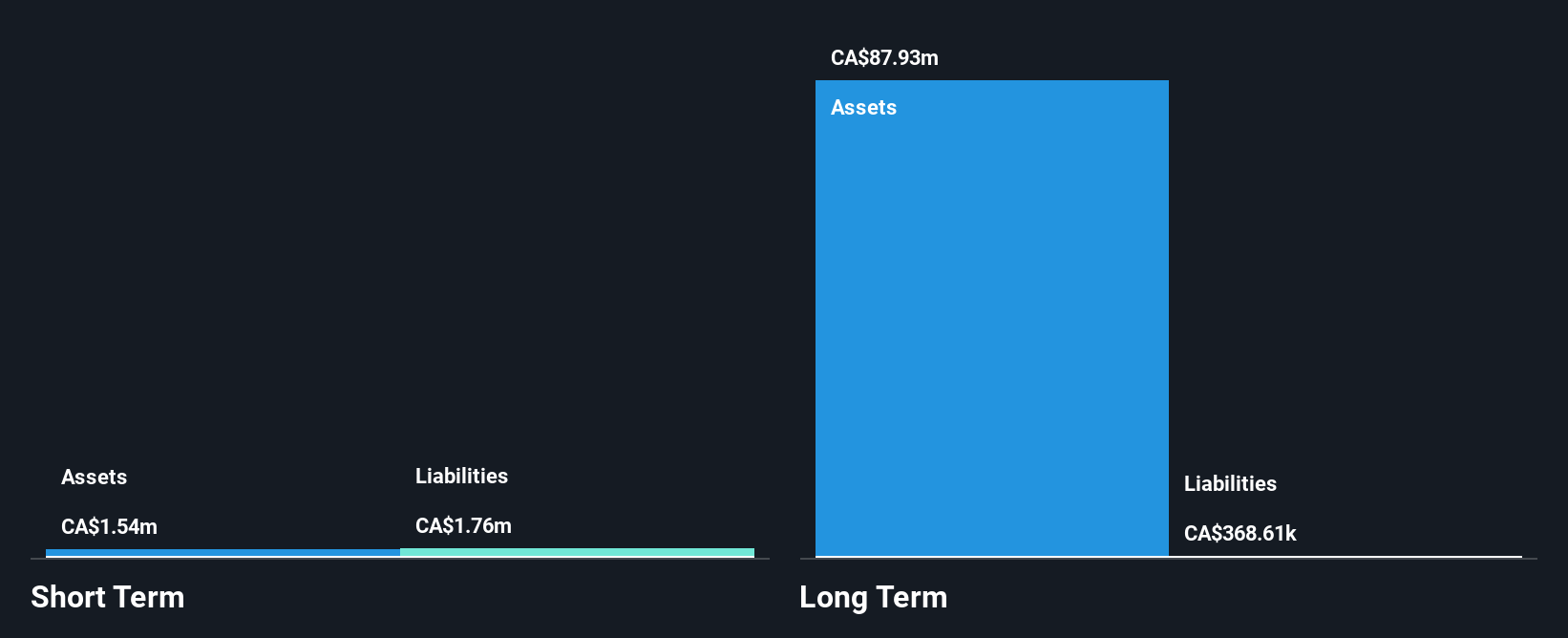

Oroco Resource Corp., with a market cap of CA$92.47 million, is pre-revenue and focused on mineral exploration in Mexico. The company has recently raised capital through private placements, securing CA$500,000 in November 2025 and announcing plans for an additional CA$4.97 million. Despite being debt-free, Oroco faces challenges with short-term liabilities exceeding its assets and auditor concerns about its ability to continue as a going concern. The board is experienced, bolstered by the appointment of Faysal Rodriguez, who brings extensive mining expertise to support the development of the Santo Tomás copper project amidst high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Oroco Resource.

- Assess Oroco Resource's previous results with our detailed historical performance reports.

Next Steps

- Discover the full array of 392 TSX Penny Stocks right here.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com