TSX Value Picks Including Constellation Software That Investors May Be Undervaluing

As we approach the end of 2025, Canadian markets have shown impressive double-digit gains, with investors closely monitoring central bank meetings and employment data to guide their year-end strategies. In this context of market optimism and economic resilience, identifying undervalued stocks becomes crucial for investors seeking opportunities to enhance their portfolios, particularly in sectors that may benefit from stable interest rates and positive labor market trends.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topicus.com (TSXV:TOI) | CA$125.98 | CA$223.31 | 43.6% |

| Savaria (TSX:SIS) | CA$21.67 | CA$35.27 | 38.6% |

| Neo Performance Materials (TSX:NEO) | CA$16.71 | CA$31.42 | 46.8% |

| kneat.com (TSX:KSI) | CA$4.70 | CA$9.29 | 49.4% |

| Haivision Systems (TSX:HAI) | CA$5.29 | CA$8.65 | 38.8% |

| GURU Organic Energy (TSX:GURU) | CA$4.75 | CA$8.91 | 46.7% |

| EQB (TSX:EQB) | CA$96.71 | CA$189.15 | 48.9% |

| Dexterra Group (TSX:DXT) | CA$11.95 | CA$22.90 | 47.8% |

| Decisive Dividend (TSXV:DE) | CA$7.12 | CA$14.19 | 49.8% |

| Constellation Software (TSX:CSU) | CA$3325.82 | CA$5810.60 | 42.8% |

We're going to check out a few of the best picks from our screener tool.

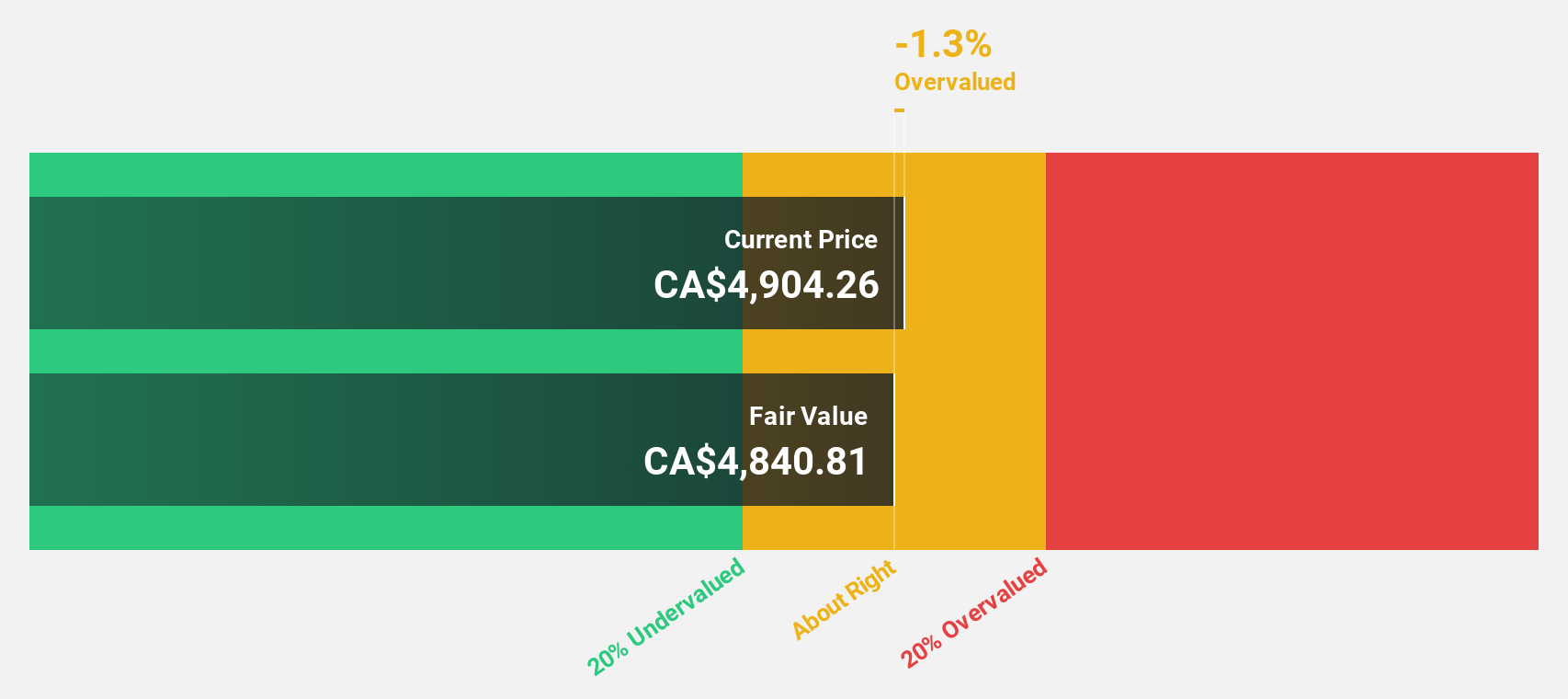

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses to provide mission-critical solutions for public and private sectors, with a market cap of CA$70.48 billion.

Operations: The company's revenue segment is primarily from Software & Programming, amounting to $11.15 billion.

Estimated Discount To Fair Value: 42.8%

Constellation Software is trading at CA$3325.82, significantly below its estimated fair value of CA$5810.6, presenting a potential opportunity based on cash flows. Despite a high level of debt and recent insider selling, earnings are expected to grow substantially at 23.4% annually, outpacing the Canadian market's growth rate. Recent earnings show revenue increased to US$2.95 billion for Q3 2025 from US$2.54 billion the previous year, with net income rising to US$210 million from US$164 million.

- In light of our recent growth report, it seems possible that Constellation Software's financial performance will exceed current levels.

- Get an in-depth perspective on Constellation Software's balance sheet by reading our health report here.

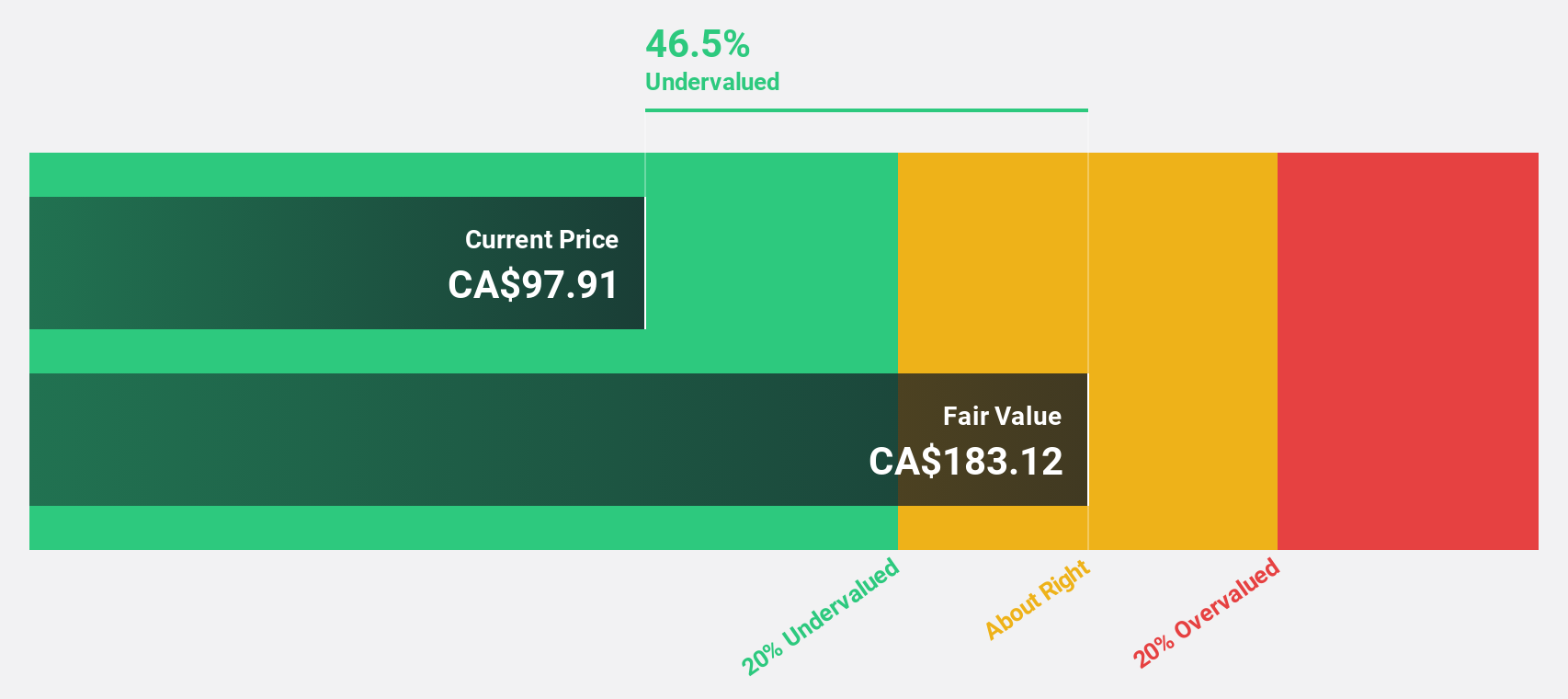

BRP (TSX:DOO)

Overview: BRP Inc., along with its subsidiaries, is engaged in the design, development, manufacturing, and sale of powersports vehicles and marine products across several countries including Mexico, Canada, Austria, the United States, Finland, Australia, and Germany; it has a market cap of CA$7.78 billion.

Operations: BRP Inc.'s revenue segments include the design, development, manufacturing, and sale of powersports vehicles and marine products in regions such as Mexico, Canada, Austria, the United States, Finland, Australia, and Germany.

Estimated Discount To Fair Value: 17.6%

BRP, trading at CA$106.12, is undervalued compared to its fair value of CA$128.85 based on cash flows. Despite a high debt level, earnings are projected to grow significantly at 21.1% annually, surpassing the Canadian market's growth rate. Recent Q3 results show sales increased to CA$2.25 billion from CA$1.97 billion last year, and net income rose sharply to CA$69.1 million from CA$7.1 million a year ago, highlighting robust financial performance amidst strategic debt management initiatives and collaborations in electrification technology.

- Our earnings growth report unveils the potential for significant increases in BRP's future results.

- Delve into the full analysis health report here for a deeper understanding of BRP.

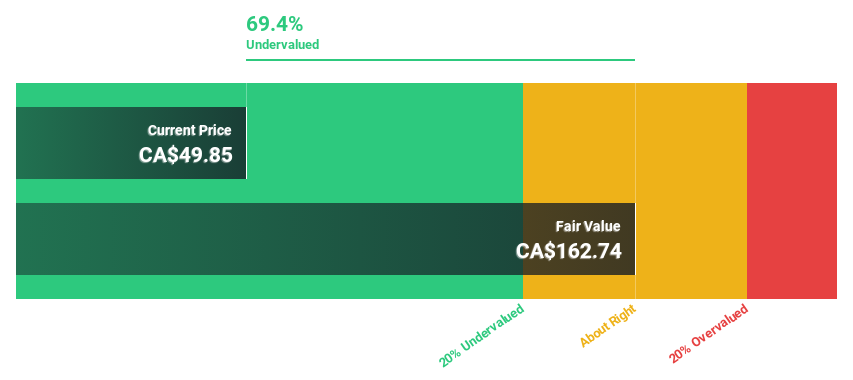

EQB (TSX:EQB)

Overview: EQB Inc., operating through its subsidiary Equitable Bank, offers personal and commercial banking services to retail and commercial clients across Canada, with a market cap of CA$3.63 billion.

Operations: EQB Inc.'s revenue is primarily derived from its banking segment, which generated CA$1.12 billion.

Estimated Discount To Fair Value: 48.9%

EQB, priced at CA$96.71, is significantly undervalued relative to its estimated fair value of CA$189.15 based on discounted cash flow analysis, trading 48.9% below this estimate. Despite a recent quarterly net loss of CA$4.76 million and reduced profit margins from the previous year, EQB's earnings are forecast to grow substantially at 25.1% annually over the next three years, outpacing the Canadian market's growth rate while maintaining a reliable dividend yield of 2.36%.

- Our comprehensive growth report raises the possibility that EQB is poised for substantial financial growth.

- Dive into the specifics of EQB here with our thorough financial health report.

Next Steps

- Get an in-depth perspective on all 28 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com