Skylark (TSE:3197) Valuation Check After November Sales Strength and Ongoing Share Price Momentum

Skylark Holdings (TSE:3197) just reported higher November sales, a data point investors are watching closely as the restaurant operator leans on its wide mix of brands across Japan and overseas.

See our latest analysis for Skylark Holdings.

Even after a soft patch this week, with a 1 week share price return of minus 4.76 percent, Skylark’s 30 day share price gain of 18.07 percent and 1 year total shareholder return of 43.16 percent suggest momentum is still building behind the latest sales uptick.

If November’s stronger sales have you rethinking consumer names, it might also be a good time to scan for other restaurant and retail operators with resilient demand using fast growing stocks with high insider ownership.

But with shares already up strongly over the past year and now trading above the average analyst target, investors have to ask whether Skylark is still mispriced or if the market has already factored in the next leg of growth.

Price-to-Earnings of 45.7x: Is it justified?

Skylark last closed at ¥3,463, which implies a rich price-to-earnings ratio of 45.7 times that screens as expensive against several valuation anchors.

The price-to-earnings multiple compares the current share price to the company’s earnings per share, making it a quick gauge of how much investors are willing to pay for each unit of profit.

In Skylark’s case, the market is assigning a premium valuation to a business that has shown strong recent earnings growth but only moderate forecast growth. This raises the question of how much future progress is already embedded in the price.

That premium stands out when set against the wider hospitality sector. Skylark’s 45.7 times earnings is roughly double the Japan hospitality industry average of 22.9 times and also well above the estimated fair price-to-earnings ratio of 26.9 times, a level the market could ultimately gravitate toward if sentiment cools.

Explore the SWS fair ratio for Skylark Holdings

Result: Price-to-Earnings of 45.7x (OVERVALUED)

However, risks remain, including a potential pullback toward analyst targets if growth underwhelms, or margin pressure if input costs or wage inflation accelerate.

Find out about the key risks to this Skylark Holdings narrative.

Another Way to Look at Value

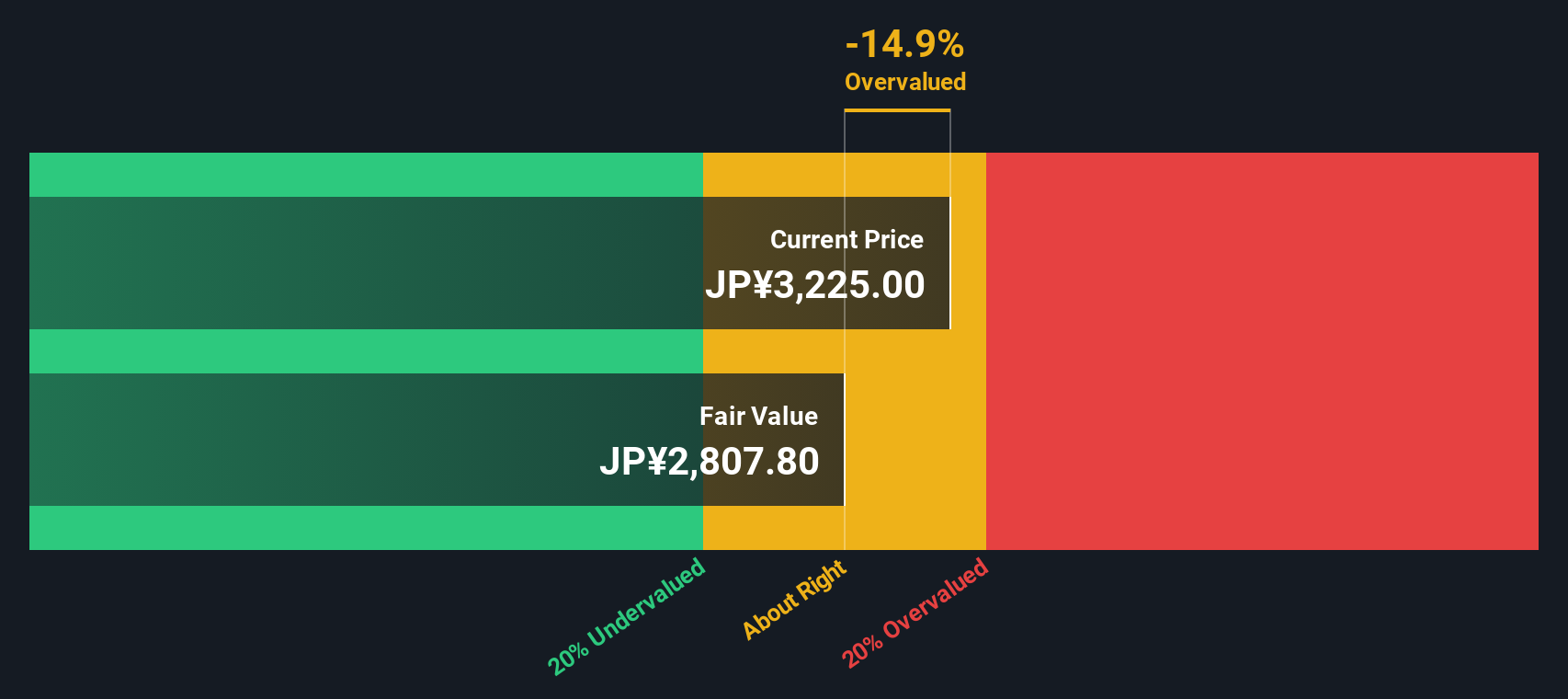

Our DCF model paints a similar picture. With Skylark trading around ¥3,463 versus an estimated fair value near ¥2,926, the shares look overvalued on cash flows too, not just earnings multiples. Is the market overpaying for past growth or correctly betting on a longer runway?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Skylark Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Skylark Holdings Narrative

If you see the numbers differently or want to follow your own process, you can build a personalized view in just a few minutes, starting with Do it your way.

A great starting point for your Skylark Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Skylark might not be the only opportunity on your radar, and using targeted screeners now could surface quality ideas before the crowd catches on.

- Capitalize on mispriced quality by scanning these 905 undervalued stocks based on cash flows that pair strong fundamentals with attractive cash flow yields.

- Ride the structural shift toward automation and data by targeting these 26 AI penny stocks positioned at the heart of intelligent software and infrastructure.

- Strengthen your income stream by filtering for these 15 dividend stocks with yields > 3% that balance yield, payout sustainability, and long term growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com