How TransUnion’s Cinema Attribution Deal With National CineMedia Could Shape TRU’s Data Strategy Investors

- In December 2025, National CineMedia announced a partnership with TransUnion to feed NCM’s theatrical exposure data into TransUnion’s cross-platform, multi-touch attribution system built on an identity graph covering 98% of US adults.

- This integration lets advertisers rigorously measure how cinema ads drive incremental lift and cross-channel reach alongside digital, CTV, social, and linear campaigns, reinforcing cinema’s role within performance-focused media plans.

- We’ll now examine how adding cinema exposure data into TransUnion’s attribution engine could influence its investment narrative and data-driven marketing ambitions.

Find companies with promising cash flow potential yet trading below their fair value.

TransUnion Investment Narrative Recap

To own TransUnion, you need to believe it can keep turning its vast identity and credit data into higher value analytics, even as regulation, competition, and tech change intensify. The National CineMedia integration fits this thesis by showing how TransUnion can extend its identity graph into new media channels, but it does not materially change the near term focus on executing product integration and managing rising data privacy and cybersecurity risks.

The recent expansion of TransUnion’s OneTru platform is particularly relevant here, because it underpins how cross platform attribution and partnerships like NCM plug into a unified data and analytics layer. Together, these moves speak to a catalyst around deeper, more scalable monetization of TransUnion’s identity graph, while still leaving execution risk on technology integration and margin discipline squarely in view.

Yet investors should also recognize how growing regulatory scrutiny and data privacy demands could eventually reshape how TransUnion can use the very identity data that powers...

Read the full narrative on TransUnion (it's free!)

TransUnion's narrative projects $5.6 billion revenue and $869.9 million earnings by 2028.

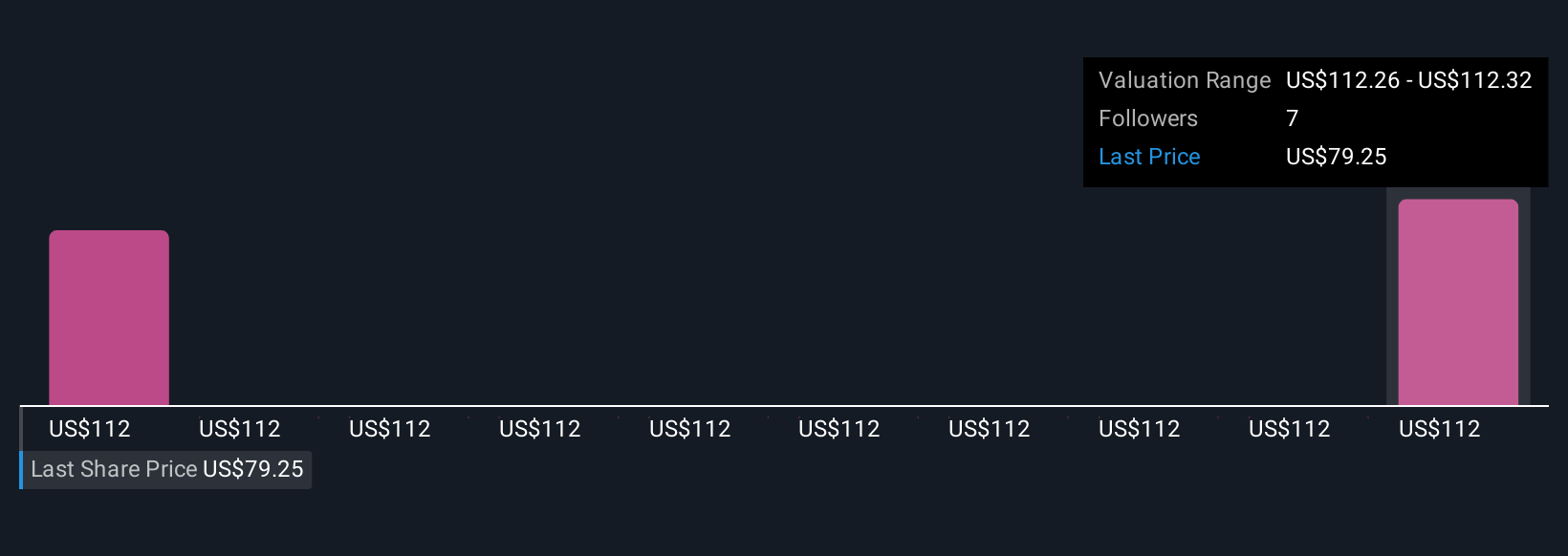

Uncover how TransUnion's forecasts yield a $106.95 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for TransUnion span roughly US$106.95 to US$137.85, showing how far opinions can stretch. You should weigh that spread against execution risks in integrating acquisitions and platforms like OneTru, then explore how different views on those risks might shape very different expectations for the business.

Explore 2 other fair value estimates on TransUnion - why the stock might be worth as much as 63% more than the current price!

Build Your Own TransUnion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TransUnion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransUnion's overall financial health at a glance.

No Opportunity In TransUnion?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com