A “new main line” under the AI boom! Grid technology stocks lead a new wave of AI infrastructure investment

The Zhitong Finance App learned that with the prosperous expansion of AI data centers and the acceleration of the global electrification process, the stock prices of technology companies that provide services for power grid systems are rapidly soaring, and the top analyst team of Wall Street financial giants such as J.P. Morgan Chase believes that the bull market trend of these companies will continue in the medium to long term in the world's unprecedented AI boom and electrification wave. Although some segments of the energy market seem to be quite “bubbling up” recently, there is one segment that has Wall Street betting that it won't be trapped in a bubble of any sense: the so-called “Grid Tech Stocks” (Grid Tech Stocks).

Regarding the “AI bubble argument” that hit the global stock market hard in November, Wall Street institutional investors have recently refuted this pessimistic stance, stressing that the bubble has not formed or that it is in the earliest stage of the bubble, and that it is still very far from the stage of a sharp bear market where the bubble burst in the 2000 Internet era.

According to Wall Street giants Morgan Stanley, Citi, Loop Capital, and Wedbush, the global AI infrastructure investment wave with AI computing power hardware at the core is far from over and is only at the beginning. Driven by an unprecedented “AI inference computing power demand storm”, the scale of this round of AI infrastructure investment, which will continue until 2030, is expected to reach 3 trillion to 4 trillion US dollars.

Dan Greenhaus (Dan Greenhaus), chief strategist from Wall Street investment agency Solas Alternative Asset Management, recently said that the “AI bubble panic” that briefly appeared in the market in early November may have come to an end. Furthermore, the senior market strategist does not expect major changes in market dynamics as it moves towards a new round of bull market in 2026. He pointed out that the two core pillars of the current market — the fundamentals of the AI investment theme and the Federal Reserve's potential path to cut interest rates — are all operating in a direction beneficial to investors.

Dan Ives (Dan Ives), managing director of the well-known Wall Street investment bank Wedbush Securities (Wedbush Securities) and a well-known technology analyst, said on Monday that the market is in the early stages of the “fourth industrial revolution.” “Big tech companies' huge capital expenses, like building Las Vegas in the desert — are a necessary foundation for the next decade of growth. If the AI bull market party starts at 9 p.m., it's currently only 10:30 p.m., and is expected to continue until 4 a.m.” The senior analyst said.

Grid technology stock frenzy: A power infrastructure investment frenzy born out of the AI investment theme but better than AI

Steve Tusa (Steve Tusa), managing director and senior stock analyst at JPMorgan Chase & Co. (JPMorgan Chase & Co.), said that although the power grid technology sector as a whole has risen by about 30% this year, power grid technology stocks are still an attractive target for investment in the current global stock market.

Specifically, Grid Technology covers a range of well-known hardware manufacturers and software developers, as well as utility-scale battery product installers. Tusa said investors should use the slight correction in stock prices wisely. “At this stage, any pullback is an opportunity to buy on dips.” Tusa from J.P. Morgan Chase said.

Reasonable valuations — J.P. Morgan says many grid tech stocks are not in a bubble

“Power grid technology stocks” do not refer to traditional power utility companies, but rather to a group of “infrastructure technology+equipment manufacturing” companies that provide equipment, software, and engineering services for power grids. They are sellers in the basic power infrastructure field behind AI, data centers, electric vehicles, and renewable energy — not only following the major trends of AI, electrification, and energy transformation, but not entirely dependent on the popular circuit of a single AI.

In the current market narrative, they are viewed as the comprehensive beneficiaries of “soaring electricity consumption in AI data centers + electrification (EVs, heat pumps, industrial electricity) + renewable energy grid-connected + large-scale reconstruction of aging power grids”.

Take liquid cooling technology leader Vertiv Holdings (VRT.US) as an example, which provides microgrids and energy storage solutions for large-scale AI data centers led by Microsoft, Google, and Meta. Tusa said that although the company's stock price has risen by about 60% this year and is trading at a “significant premium” compared to the relative valuation of the S&P 500 index, its strong growth “justifies” this premium.

Other types of grid technology stocks also recorded sharp gains this year, echoing the data center boom. Korean transformer manufacturer Hyosung Heavy Industries Corp. (Hyosung Heavy Industries Corp.) and LS Electric Co. Leading the way in the Korean stock market and power grid technology stocks, surged about 400% and 230% respectively this year. In the US stock market, the stock price of inverter system manufacturer SolarEdge Technologies Inc. (SEDG.US) has doubled, while the stock price of power engineering company Willdan Group Inc. (WLDN.US) is trading near an all-time high, with an increase of nearly 200% since this year.

Schneider Electric, one of the world's largest electrical equipment manufacturers, headquartered in France, can be described as taking advantage of the “AI dividend” when a wave of AI computing power sets off a massive demand for power distribution. In the second quarter, the company achieved a double-digit increase in endogenous revenue closely linked to AI data centers in recent years. The medium voltage/low voltage power distribution, UPS, battery energy storage, HVDC bus, liquid cooling, and DCIM software that Schneider Electric has been deeply involved in for a long time is the core “hydroelectric coal” of large-scale AI data centers such as Meta, Microsoft, Amazon, and Google.

The ever-increasing scale of AI training/inference clusters has made “power+cooling” the core underlying resource that determines the boundaries of computing power, while Schneider is at the most direct benefit point in this wave of super AI infrastructure with “full-link power system solutions with medium voltage to the end of the rack + digital twin of software and hardware + liquid cooling mergers and acquisitions”. Liquid cooling systems that are urgently needed in hyperscale AI data centers can be described as Schneider's key layout area in recent years. In 2024, Schneider acquired Motivair to enter the submersible/direct liquid cooling plate and cooling distribution unit (CDU) market.

“It's not just about AI.” “Overall energy demand is growing rapidly,” said Tim Chan, head of sustainability research in the Asia-Pacific region other than Japan from Morgan Stanley.

Wall Street asset management giant Fidelity International (Fidelity International)'s core view is that “a very long period of structural change” is currently taking place. Gabriel-Wilson Otto (Gabriel-Wilson Otto), head of sustainable investment strategies at Fidelity, said the change was driven by rapid progress in global electrification and the growing demand for electricity in Asian economies, particularly to obtain the country's unique energy security system.

He said that non-AI factors are still “playing a greater role” in driving up energy demand in developing economies, which should support grid technology stocks on a global scale. As climate change creates longer periods of extreme weather, it is urgent for developed and developing countries to upgrade their aging power grids.

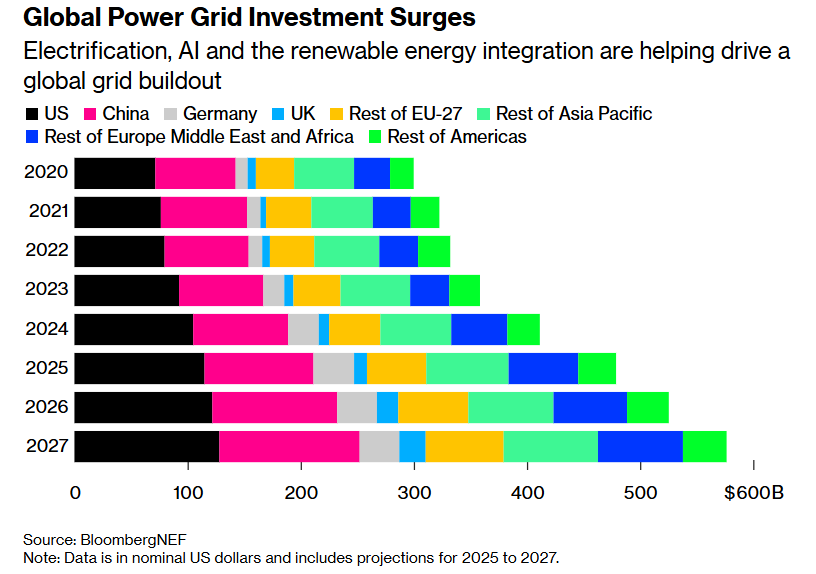

According to a recent study by BloombergNEF, overall spending at the global grid level is expected to rise 16% this year to $479 billion, and is expected to rise to $577 billion in 2027. According to the International Energy Agency (IEA), electricity demand for data centers (including AI data centers and non-AI data centers) will at least double by the end of this decade (that is, the end of 2030), and almost every new large power plant needs to be connected to the grid system.

As shown in the chart above, global grid investment has surged in recent years — in particular, large-scale grid integration of electrification, AI, and renewable energy systems are jointly driving global grid construction.

The NASDAQ OMX Clean Edge Smart Grid Infrastructure Index is the main grid index that tracks companies related to the power grid infrastructure business. It has surged about 30% this year, outperforming other major stock indices in the US stock market. The Nasdaq 100 Index, which includes Nvidia, Apple, and Microsoft, which has the nominal trend of technology stocks, rose about 22% during this period. The above mentioned grid index is currently trading at a forward price-earnings ratio of 21 times, so its valuation is far lower than the Nasdaq 100 Index.

Of course, when the global stock market was severely impacted last month due to fears that the AI bubble was about to burst, grid technology stocks also experienced a significant decline. It highlights that not all investments are convinced that the sector can retreat as potential AI spending or AI monetization paths slow down.

“The investment theme of power grid technology stocks will remain a structural winner until the end of 2026.” Lisa Audet (Lisa Audet), founder and chief investment officer of Tall Trees Capital Management LP, a boutique hedge fund headquartered in the US and focused on energy transformation, said. However, she also pointed out that a lot of positive news has been reflected in this year's strong and sharp rise in stock prices. Investors currently have to be “very picky in terms of valuation and periodicity,” she warned.

Many grid upgrade activities may require deep and long-term collaboration with utility companies, or at least data from these regulated monopolies, which may slow or hinder investment. As customer bills rise, some US states are also stepping up scrutiny, which may hinder deployment in some regions because grid technology is viewed as too risky. Different utilities, state and regional grid operators, and broader regulatory structures across regions will result in differences in the speed of adoption.

Hedge funds that reported positions to US data provider Hazeltree are still net bullish on the Nasdaq Grid Index. According to the data, as of the end of September, 66% of companies in the index's constituent stocks had long bets over bears, up from 59% a month ago. Hazeltree tracks 108 of the 113 constituent stocks of the index, and around 600 investment funds of various sizes voluntarily report their positions to the platform.

It may be a super investment cycle spanning decades

“Grid infrastructure isn't essentially a pure AI story; you can think of it as a stock market narrative of 'the chicken finally returns to the nest'.” Green Alpha Advisors' chief investment officer Garvin Jabusch (Garvin Jabusch) said. The Nasdaq Grid Technology Index has been rising for three consecutive years since 2023, although the previous increase was more moderate. As the AI boom pushes power grid infrastructure into the spotlight of global stock markets, “the market is finally starting to price positive growth that should have been evident a long time ago,” Jabushi said in a report.

This is particularly evident in the US and Europe. Most grid systems in the US and Europe were built decades ago, when electricity was fully generated by fossil-fuel-burning power plants and transported unidirectionally from utility companies to the consumer market. Today, renewable energy is rapidly emerging, and household energy storage batteries paired with rooftop photovoltaics can send huge amounts of electricity back to the grid, all of which require upgrading everything from transformers to transmission lines for the 21st century.

Venture capitalists are also seeing significant opportunities in this area. “We don't need to bet that the data center will be the core growth engine; growth in other areas is also impressive.” Montauk Capital's chief investment officer Evan Caron (Evan Caron) said the company's shareholding supports early-stage energy and grid startups. He said that the global boom in large-scale AI data center construction is “gasoline poured on an already burning fire.”

Alex Darden (Alex Darden), head of infrastructure investment in the Americas at EQT Partners Inc., a global private equity firm, said in an interview that even though there is a certain amount of hype and bubble panic surrounding AI, due to continued and increasing favorable factors, and long-term underinvestment in power grid infrastructure investment from the perspective of historical data, it is creating “major investment opportunities.” “And this isn't just a single-year opportunity in 2026.” In an interview, Darden said, “We are now entering a 'super investment cycle' of power infrastructure that spans many years, and maybe even decades.”

The essence of the global AI competition is an AI computing power infrastructure competition, and the core foundation that drives AI computing power clusters is a stable and huge power supply system. Because of this, the demand for electricity in AI data centers is surging at an unprecedented rate, and AI seems to have become a “power devil.” The core foundation behind high-energy AI data centers, which are expanding exponentially in scale due to intense demand for computing power infrastructure such as AI chips, is inseparable from the core foundation of electricity supply. This is also the origin of the market view that “the end of AI is electricity.”

For global cloud computing and AI infrastructure leaders such as Google, Microsoft, and Amazon, the current demand for AI computing power resources around the world continues to explode, which in turn has prompted these leaders to continue to step up efforts to build power supply systems to drive AI data centers that consume enormous amounts of electricity. This is why the valuations of cloud-based AI computing power leasing leaders such as Fluidstack and CoreWeave have continued to expand since this year. AI computing power resource requirements, which are closely related to AI training/inference, have pushed the capacity that the underlying computing power infrastructure clusters can meet to the limit, and even large-scale AI data centers that have continued to expand recently cannot meet the extremely strong computing power demand on a global scale.

After Google launched the Gemini 3 AI application ecosystem in late November, this cutting-edge AI application immediately became popular all over the world, driving an instant surge in demand for Google's AI computing power. Once released, Gemini3 series products brought huge AI token processing capacity, forcing Google to drastically reduce the amount of free access to Gemini 3 Pro and Nano Banana Pro, and also imposed temporary restrictions on Pro subscribers. Combined with South Korea's recent trade export data, demand for HBM storage systems and enterprise-grade SSDs continues to be strong, further verifying that “the AI boom is still in the early stages of construction where computing power infrastructure is in short supply.”

According to a forecast report from the International Energy Agency (IEA), global data center electricity demand will more than double by 2030, reaching about 945 terawatt-hours (TWh), slightly higher than Japan's current total electricity consumption. Artificial intelligence applications will be the most important driving force for this growth; the IEA expects the overall electricity demand for data centers focusing on artificial intelligence to at least quadruple by 2030.