Gaming Realms Leads The Charge With 2 Other UK Penny Stocks

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, which has impacted global market sentiment. Despite these challenges, the search for promising investment opportunities continues, particularly in the realm of penny stocks. Although often considered a term from past market eras, penny stocks still offer potential for growth and affordability when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.10 | £467.57M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.07 | £167.23M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.15 | £311.55M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.875 | £13.21M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.04 | £25.89M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.675 | $392.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.486 | £182.98M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.435 | £69.31M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.52 | £44.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.105 | £176.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Gaming Realms (AIM:GMR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gaming Realms plc develops, publishes, and licenses mobile gaming content across various regions including the UK and US, with a market cap of £122.10 million.

Operations: The company's revenue is primarily derived from Licensing, which generated £27.02 million, and Social Publishing (excluding Licensing), contributing £3.86 million.

Market Cap: £122.1M

Gaming Realms plc, with a market cap of £122.10 million, has demonstrated financial stability through its debt-free status and strong asset coverage over liabilities. The company focuses on licensing mobile gaming content, generating significant revenue from this segment (£27.02 million). Recent expansions in licensing agreements with Light & Wonder Inc. highlight strategic growth efforts in North America. Despite a slight decline in net income to £2.66 million for the first half of 2025 compared to the previous year, Gaming Realms maintains high-quality earnings and stable weekly volatility at 5%, positioning itself as a potentially attractive penny stock option for investors seeking exposure to the gaming sector.

- Navigate through the intricacies of Gaming Realms with our comprehensive balance sheet health report here.

- Gain insights into Gaming Realms' future direction by reviewing our growth report.

Strix Group (AIM:KETL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Strix Group Plc designs, manufactures, and supplies kettle safety controls and other components globally with a market cap of £82.66 million.

Operations: The company's revenue is derived from three segments: Controls (£62.08 million), Billi (£44.13 million), and Consumer Goods (£32.16 million).

Market Cap: £82.66M

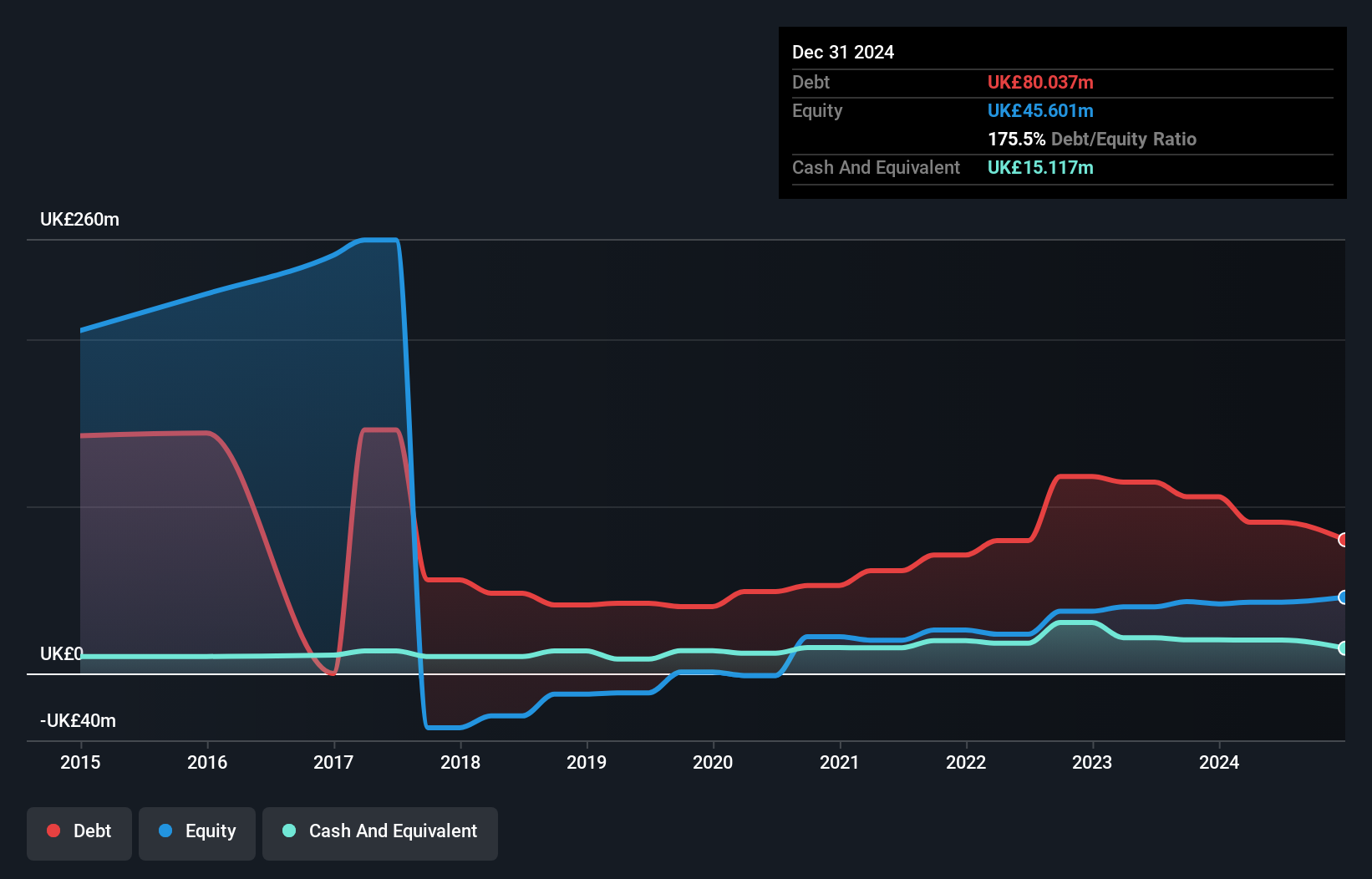

Strix Group Plc, with a market cap of £82.66 million, has shown financial improvement, transitioning from negative to positive shareholder equity over five years. Despite a high net debt to equity ratio of 147%, short-term assets (£67.4M) exceed short-term liabilities (£40.2M), indicating solid liquidity management. Recent earnings reveal sales of £60.5 million and a return to profitability with net income of £1.21 million for H1 2025, compared to a previous loss. However, the company faces leadership changes as CEO Mark Bartlett plans to step down in May 2026, which may impact future strategic direction.

- Click here and access our complete financial health analysis report to understand the dynamics of Strix Group.

- Explore Strix Group's analyst forecasts in our growth report.

Steppe Cement (AIM:STCM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Steppe Cement Ltd. is an investment holding company involved in the production and sale of cement and clinkers in Kazakhstan, with a market cap of £41.61 million.

Operations: The company's revenue is derived entirely from its production and sale of cement, totaling $91.50 million.

Market Cap: £41.61M

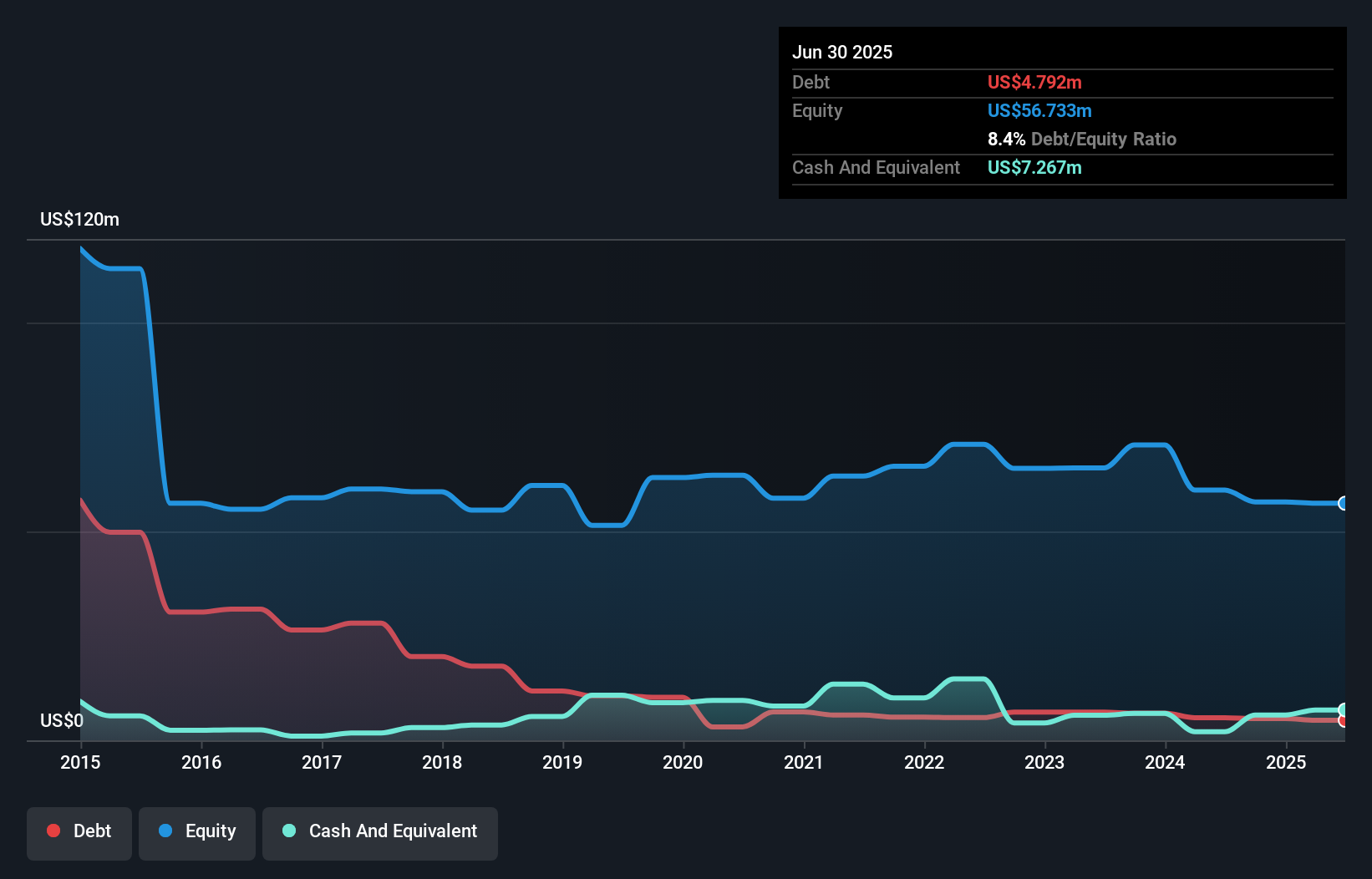

Steppe Cement Ltd. has demonstrated significant earnings growth of 315.2% over the past year, contrasting with a five-year average decline of 28.9% per year, highlighting recent profitability improvements despite historical challenges. The company's financial health is supported by having more cash than total debt and strong coverage of interest payments through EBIT at 5.2 times, while short-term assets comfortably exceed both short- and long-term liabilities. Although trading at a significant discount to estimated fair value, Steppe Cement's low return on equity and increased debt-to-equity ratio indicate areas needing attention for sustainable growth in the penny stock segment.

- Click to explore a detailed breakdown of our findings in Steppe Cement's financial health report.

- Examine Steppe Cement's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Gain an insight into the universe of 306 UK Penny Stocks by clicking here.

- Searching for a Fresh Perspective? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com