How Kohl’s CEO Appointment and Raised 2025 Outlook Will Impact Kohl's (KSS) Investors

- Kohl’s Corporation recently reported third-quarter 2025 results showing revenue of US$3,575 million and net income of US$8 million, while also raising full-year 2025 guidance even as it still expects net sales and comparable sales to decline.

- The Board made interim leader Michael J. Bender the permanent CEO, signaling a commitment to his operational playbook at a time when Kohl’s is balancing cost control gains against ongoing pressure on store traffic and sales.

- We’ll now examine how Bender’s appointment as permanent CEO may reshape Kohl’s existing investment narrative and expectations for a turnaround.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kohl's Investment Narrative Recap

To own Kohl’s today, you need to believe that its omnichannel model, brand reinvestment and partnerships can offset persistent traffic and revenue pressure, and that cost discipline can keep earnings positive even as sales contract. The latest quarter supports that tension: revenue and net income both slipped year on year, yet full year 2025 earnings guidance was raised, suggesting the near term catalyst is margin execution, while the biggest risk remains ongoing declines in net and comparable sales.

The most relevant update here is the Board’s decision to make Michael J. Bender the permanent CEO after serving as interim leader since May 2025. That move ties the investment case more tightly to his operating approach at a time when Kohl’s is still guiding to a 3.5% to 4% decline in net sales, underscoring how much the turnaround hinges on execution in stores, digital and merchandising rather than a quick recovery in customer demand.

Yet investors should also be aware that persistent weakness in store traffic and comparable sales could...

Read the full narrative on Kohl's (it's free!)

Kohl's narrative projects $15.2 billion revenue and $199.4 million earnings by 2028. This implies a 1.6% yearly revenue decline and a $9.6 million earnings decrease from $209.0 million today.

Uncover how Kohl's forecasts yield a $21.82 fair value, a 5% downside to its current price.

Exploring Other Perspectives

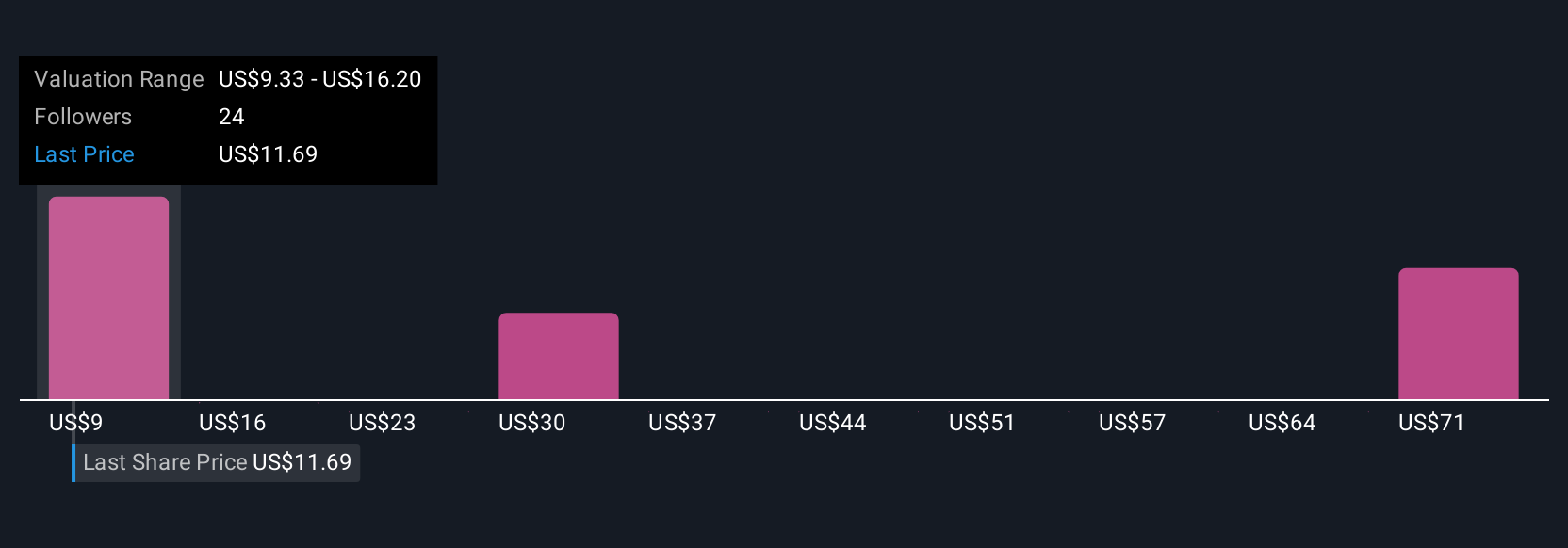

Five members of the Simply Wall St Community currently see Kohl’s fair value anywhere between about US$15 and US$65 per share, underscoring how far apart individual views can be. Set against that wide range, the recent guidance for continued declines in net and comparable sales highlights why it can be helpful to examine several different risk and turnaround scenarios before forming a view on Kohl’s overall performance potential.

Explore 5 other fair value estimates on Kohl's - why the stock might be worth over 2x more than the current price!

Build Your Own Kohl's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Kohl's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kohl's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com