Dividend Hike And Streaming Deals Could Be A Game Changer For Royal Gold (RGLD)

- Earlier this month, Royal Gold reported record third-quarter 2025 revenue, announced a 6% increase in its annual dividend to US$1.90 per share, and disclosed that Senior Vice President of Corporate Development Daniel Breeze sold 970 shares on 4 December 2025.

- These updates come alongside the completed Sandstorm Gold and Horizon Copper acquisitions and an extended Mount Milligan mine life to 2045, reshaping Royal Gold’s long-term portfolio mix and cash flow profile.

- Against this backdrop, we’ll explore how the higher dividend and expanded streaming portfolio influence Royal Gold’s existing investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Royal Gold Investment Narrative Recap

To own Royal Gold, you need to believe in the durability of gold demand and the appeal of a low-operating-risk royalty model that converts metal prices into high-margin cash flow. The record Q3 2025 revenue, higher dividend and insider sale do not materially change the near term focus on successfully integrating the Sandstorm Gold and Horizon Copper portfolios while managing the higher leverage that comes with them.

The roughly 6% dividend increase to US$1.90 per share a year is the clearest link between the recent results and Royal Gold’s investment case, because it directly reflects how management views the sustainability of current cash flows. For investors watching the Sandstorm and Horizon acquisitions as the key catalyst, this higher payout raises the stakes: if integration or asset performance disappoints, there is less room for error before debt, growth spending and dividends start to compete for the same cash.

Yet behind the dividend increase, investors still need to be aware of how concentrated Royal Gold remains in gold prices and what happens if...

Read the full narrative on Royal Gold (it's free!)

Royal Gold's narrative projects $1.4 billion revenue and $877.9 million earnings by 2028. This requires 21.4% yearly revenue growth and an earnings increase of about $428 million from $449.5 million today.

Uncover how Royal Gold's forecasts yield a $248.55 fair value, a 23% upside to its current price.

Exploring Other Perspectives

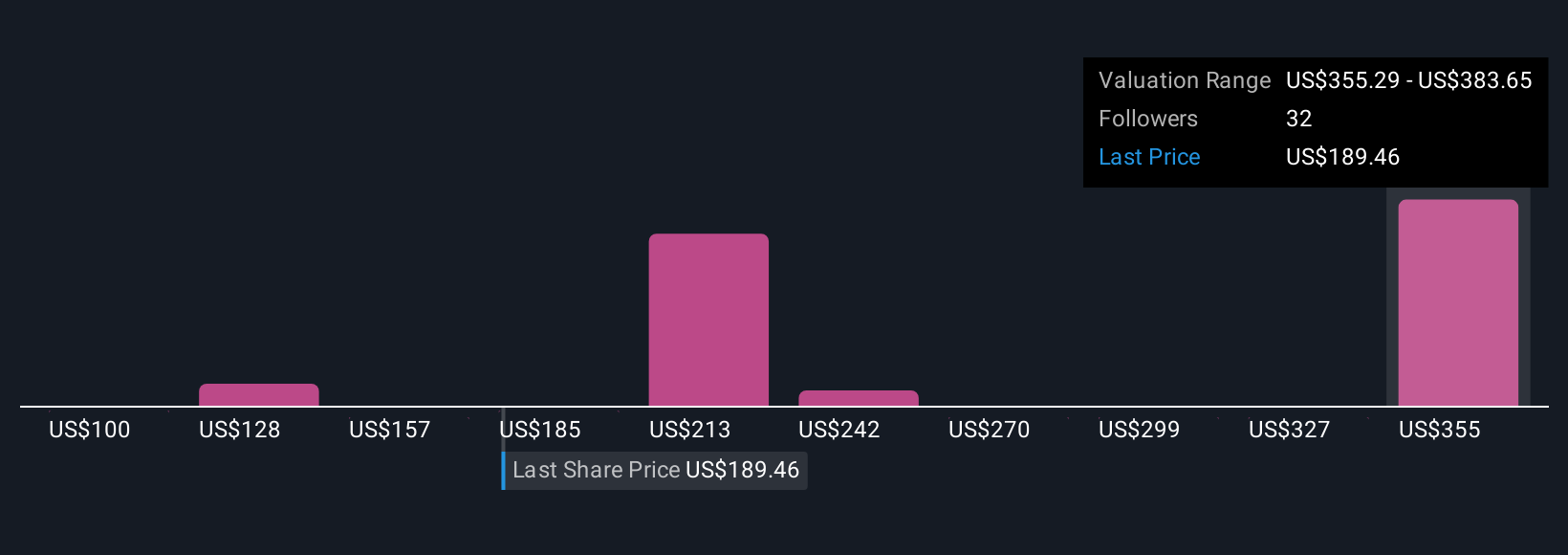

Ten members of the Simply Wall St Community now value Royal Gold between US$143.73 and US$266.61 per share, highlighting a wide spread in expectations. You can weigh those views against the increased balance sheet risk tied to the Sandstorm and Horizon deals and decide what that might mean for the company’s ability to support growth and a rising dividend over time.

Explore 10 other fair value estimates on Royal Gold - why the stock might be worth as much as 32% more than the current price!

Build Your Own Royal Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Royal Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Gold's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com