Does Divesting Industrial Specialties and CTO Refinery Reshape The Bull Case For Ingevity (NGVT)?

- Ingevity has already agreed to sell its industrial specialties product line and North Charleston crude tall oil refinery to Mainstream Pine Products under an Asset Purchase Agreement announced on September 3, 2025, with closing targeted by early 2026 and the assets now classified as discontinued operations.

- This divestiture marks a major shift in Ingevity’s portfolio composition, sharpening its focus on higher-value specialty materials while materially reshaping future operations and financial reporting.

- We’ll now explore how the divestiture of the industrial specialties line and crude tall oil refinery may influence Ingevity’s investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Ingevity Investment Narrative Recap

To own Ingevity today, you need to believe in its shift toward higher value specialty materials, especially in Performance Materials and Advanced Polymer Technologies, while accepting exposure to cyclical industrial and auto demand and tariff uncertainty. The sale of the industrial specialties product line and North Charleston crude tall oil refinery is important for tightening portfolio focus, but it does not remove the near term pressure from weak APT margins and global industrial softness.

Among recent developments, the CHASM license agreement to manufacture NTeC-E conductive additives for EV batteries stands out as most connected to Ingevity’s push toward higher value applications. It ties directly into the core catalyst that many investors are watching: whether innovation in battery and purification materials can offset ongoing APT headwinds and make the post divestiture portfolio more resilient.

Yet behind this portfolio reshaping, the risk that tariff related pressures keep weighing on APT demand is something investors should be aware of...

Read the full narrative on Ingevity (it's free!)

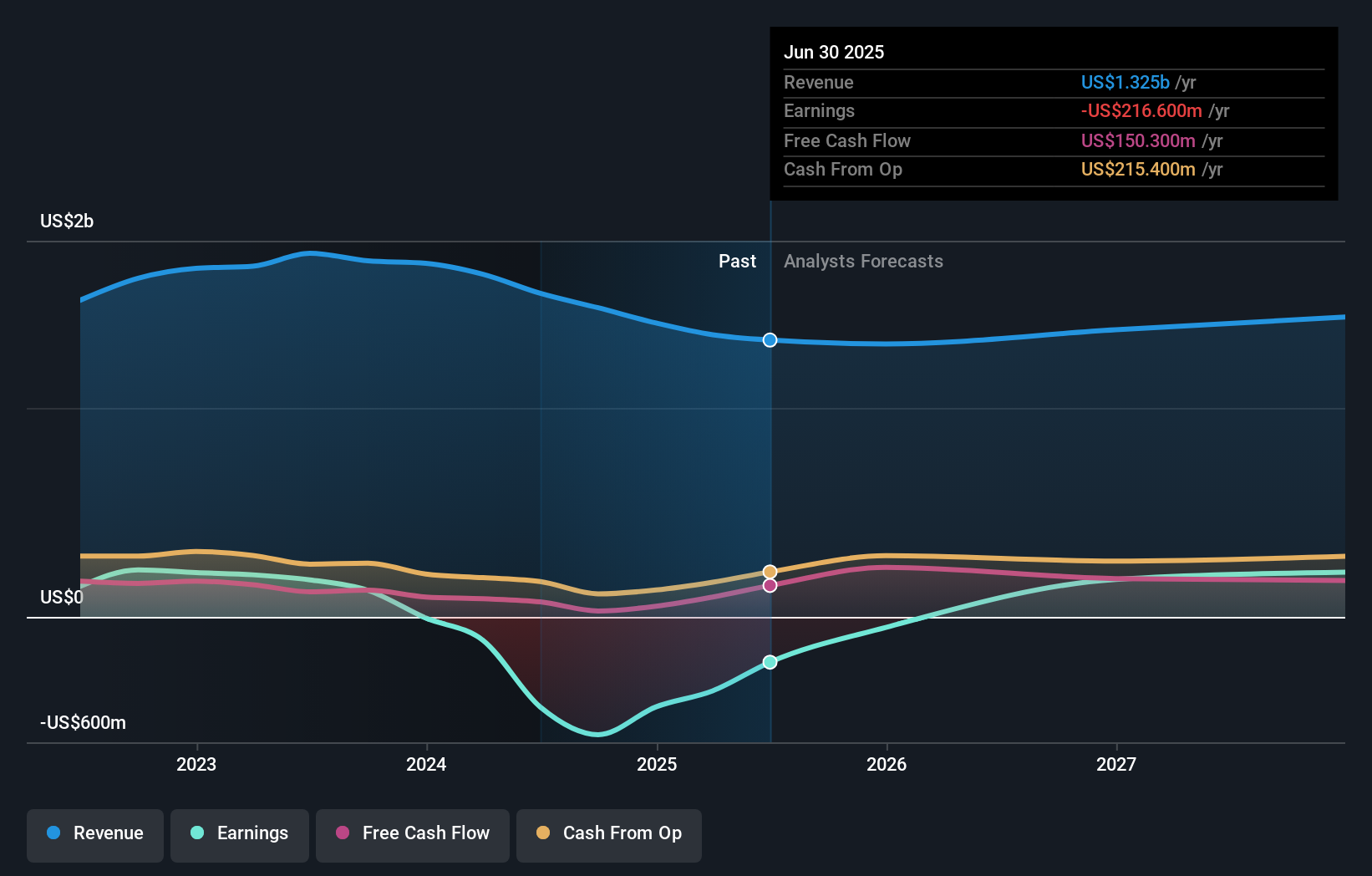

Ingevity’s narrative projects $1.5 billion revenue and $412.8 million earnings by 2028.

Uncover how Ingevity's forecasts yield a $65.25 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members who model Ingevity’s fair value currently cluster at US$65.25 per share from 1 submitted view, showing how individual assessments can be very concentrated. You can weigh that against the risk that ongoing tariff related demand weakness in Advanced Polymer Technologies may continue to pressure margins and earnings, with important implications for how the business performs relative to these expectations.

Explore another fair value estimate on Ingevity - why the stock might be worth just $65.25!

Build Your Own Ingevity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingevity research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ingevity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingevity's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com