Is New Kiena High‑Grade Exploration Data Altering The Investment Case For Wesdome Gold Mines (TSX:WDO)?

- Wesdome Gold Mines Ltd. recently presented at the 121 Dubai Mining Investment Conference and reported promising surface exploration results at its Kiena Mine Complex, including high-grade gold intercepts in the Dubuisson North Zone after nearly 38,000 meters of drilling.

- The discovery of new vein orientations and potential mineralization zones at Kiena is an important development because it supports Wesdome’s efforts to grow its resource base and refine long-term mine planning.

- We’ll now examine how these Kiena exploration results, and the analyst confidence they appear to support, may influence Wesdome’s broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Wesdome Gold Mines Investment Narrative Recap

To own Wesdome, you need to believe that Kiena and Eagle River can keep converting high grade exploration success into sustainable, lower cost production while funding heavy CapEx from internal cash flows. The latest Kiena drill results support that long term resource growth story, but they do not meaningfully change the near term picture where Kiena’s execution issues, cost inflation and dependence on a few mining fronts remain the key catalyst and the biggest operational risk.

Among recent announcements, the November 2025 guidance revision is most relevant here, because it reset expectations around Kiena just weeks before the new drilling update. Management cut Kiena’s 2025 production and raised cost guidance after early year setbacks, which puts more pressure on these exploration results to eventually translate into additional mining horizons and better unit costs, rather than simply adding ounces that are expensive or difficult to extract.

Yet investors should be aware that if Kiena’s required multi year CapEx runs over budget or behind schedule, it could...

Read the full narrative on Wesdome Gold Mines (it's free!)

Wesdome Gold Mines' narrative projects CA$986.3 million revenue and CA$395.3 million earnings by 2028. This requires 10.8% yearly revenue growth and about CA$154.5 million earnings increase from CA$240.8 million today.

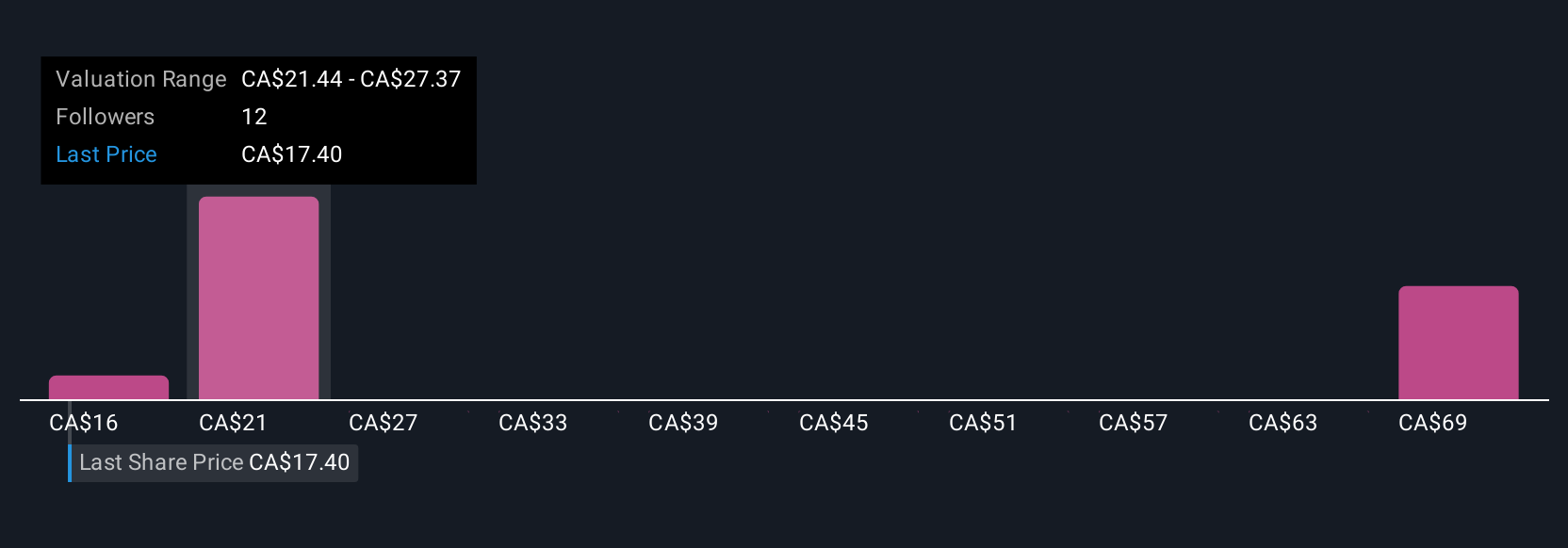

Uncover how Wesdome Gold Mines' forecasts yield a CA$26.61 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community currently see Wesdome’s fair value anywhere between CA$15.50 and CA$73.21, underscoring how far opinions can diverge. Set those views against Kiena’s execution and CapEx risks, and you can see why it pays to examine several angles before deciding how this business might perform over time.

Explore 10 other fair value estimates on Wesdome Gold Mines - why the stock might be worth 28% less than the current price!

Build Your Own Wesdome Gold Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wesdome Gold Mines research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Wesdome Gold Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wesdome Gold Mines' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com